Ramram Adminna

March 20, 2025 House Mortgage

Mortgage Fraud Statistics: Risks and How to Protect Yourself. Mortgage fraud is a growing concern in the real estate and financial sectors. Fraudulent mortgage activities not only cause financial losses to individuals and institutions but also weaken the stability of the housing market. Understanding mortgage fraud statistics can help individuals and businesses identify risks and take preventative measures. What is …

Read More »

Ramram Adminna

March 19, 2025 House Mortgage

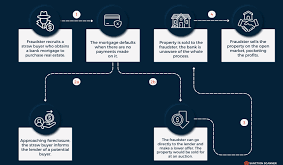

Mortgage Fraud Cases: Prevention and Legal Consequences. Mortgage fraud cases have become a growing concern in the real estate and financial sectors. With increasing home loan applications, fraudulent activities related to mortgages have surged, leading to severe financial losses and legal consequences. In this article, we will explore what mortgage fraud is, the types of mortgage fraud cases, legal consequences, …

Read More »

Ramram Adminna

March 19, 2025 House Mortgage

Mortgage Fraud Schemes: Identify, Prevent, and Protect Yourself. Mortgage fraud schemes have become a significant concern in the real estate and financial industries. These fraudulent activities deceive lenders, homeowners, and investors, leading to substantial financial losses. Understanding how mortgage fraud works and recognizing the red flags can help individuals and businesses avoid becoming victims. This article will provide a comprehensive …

Read More »

Ramram Adminna

March 19, 2025 House Mortgage

Mortgage Fraud Detection: Identify and Prevent Mortgage Scams. Mortgage fraud is a serious issue that affects lenders, borrowers, and financial institutions worldwide. Scammers manipulate loan processes to obtain property, money, or services under false pretenses. Understanding how to detect mortgage fraud can help individuals and organizations protect themselves from financial losses and legal consequences. This guide will explore common types …

Read More »

Ramram Adminna

March 19, 2025 House Mortgage

Mortgage Fraud Penalties: Consequences and Avoid Them. Mortgage fraud is a serious crime with severe legal and financial repercussions. Whether committed by individuals, mortgage brokers, or financial institutions, mortgage fraud carries penalties that can include hefty fines, imprisonment, and a damaged financial future. This article provides an in-depth exploration of mortgage fraud penalties, legal consequences, and preventive measures to avoid …

Read More »

Ramram Adminna

March 18, 2025 House Mortgage

Mortgage Fraud Prevention: Shield from Scams and Deception. Mortgage fraud is a serious issue that can have devastating financial and legal consequences for borrowers, lenders, and financial institutions. Whether you are buying a home, refinancing a mortgage, or working as a mortgage professional, understanding the risks and knowing how to prevent fraud is essential. In this article, we will explore …

Read More »

Ramram Adminna

March 18, 2025 House Mortgage

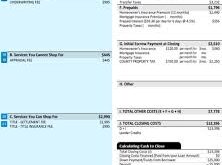

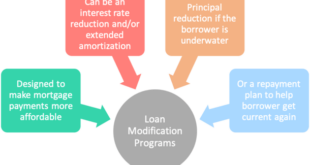

Principal Reduction Alternatives: How to Lower Mortgage Debt. Buying a home is one of the biggest financial commitments most people will ever make. However, high mortgage payments can become a financial burden over time. Principal reduction alternatives provide homeowners with ways to lower their mortgage debt, reduce interest costs, and achieve financial freedom faster. In this article, we’ll explore various …

Read More »

Ramram Adminna

March 18, 2025 House Mortgage

Making Home Affordable: Saving and Reducing Mortgage Costs. Owning a home is a significant milestone, but financial hardships can make it challenging to keep up with mortgage payments. The Making Home Affordable (MHA) program was introduced by the U.S. government to provide struggling homeowners with relief options. Whether you’re facing foreclosure, seeking lower monthly payments, or refinancing your loan, this …

Read More »

Ramram Adminna

March 18, 2025 House Mortgage

Home Affordable Refinance: Lowering Your Mortgage Payments. Homeownership comes with many financial responsibilities, and mortgage payments can be one of the biggest monthly expenses. If you’re struggling to keep up with payments or simply want to reduce your interest rate, Home Affordable Refinance might be the right solution for you. This guide will explain what Home Affordable Refinance is, its …

Read More »

Ramram Adminna

March 17, 2025 House Mortgage

HARP Refinance Program: Learn to Save Money on Your Mortgage. The HARP Refinance Program (Home Affordable Refinance Program) was a federal initiative designed to help homeowners refinance their mortgages even if they had little or no equity. This program allowed borrowers with underwater mortgages to take advantage of lower interest rates, reducing monthly payments and stabilizing financial situations. Although HARP …

Read More »

Ramram Adminna

March 17, 2025 House Mortgage

Mortgage Relief Options: A Complete Guide to Saving Your Home. Owning a home is a significant milestone, but financial challenges can make mortgage payments difficult. If you’re struggling to keep up with payments, understanding mortgage relief options can help you avoid foreclosure and regain financial stability. In this comprehensive guide, we’ll explore various mortgage relief options, eligibility criteria, and actionable …

Read More »

Ramram Adminna

March 17, 2025 House Mortgage

Loan Modification Programs: Save Home and Reduce Payments. Facing financial hardship can be overwhelming, especially when it puts your home at risk. Loan modification programs provide a lifeline for homeowners struggling with mortgage payments by adjusting the terms to make them more manageable. This guide will cover everything you need to know about loan modifications, including eligibility, benefits, application steps, …

Read More »

Ramram Adminna

March 17, 2025 House Mortgage

Short Sale Process: Selling Your Home in Financial Distress. The short sale process is a financial strategy that allows homeowners to sell their property for less than the outstanding mortgage balance. This method is often used as an alternative to foreclosure, offering a way for homeowners to minimize damage to their credit and for buyers to purchase properties at a …

Read More »

Ramram Adminna

March 16, 2025 House Mortgage

Foreclosure Prevention Strategies: Ways to Save Your Home. Foreclosure is a distressing experience for homeowners, often resulting from financial hardships or unexpected circumstances. Fortunately, there are numerous foreclosure prevention strategies that can help homeowners retain their properties. In this article, we will explore effective methods to prevent foreclosure, provide actionable tips, answer frequently asked questions, and offer a comprehensive conclusion. …

Read More »

Ramram Adminna

March 16, 2025 House Mortgage

Mortgage Default Consequences: When Stop Paying Mortgage? Falling behind on mortgage payments can be a stressful and overwhelming experience. However, understanding the potential consequences of mortgage default can help homeowners make informed decisions and explore possible solutions. This article will discuss the key impacts of mortgage default, legal repercussions, effects on credit scores, and available options to avoid foreclosure. 1. …

Read More »

mortgage.kbk.news

mortgage.kbk.news