Mortgage Credit Score: How It Works and Ways to Improve It. A mortgage credit score is a numerical representation of a borrower’s creditworthiness, specifically in relation to obtaining a mortgage. Lenders use this score to determine the risk of lending money and to set interest rates. The score is derived from a person’s credit history, outstanding debts, payment history, and other financial factors.

Why is Your Mortgage Credit Score Important?

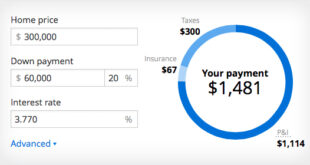

Your mortgage credit score significantly impacts your ability to qualify for a mortgage and affects the interest rate you receive. A high score can lead to lower interest rates, saving thousands of dollars over the loan’s lifespan. On the other hand, a low score may result in higher interest rates or even mortgage denial.

Factors That Affect Your Mortgage Credit Score

Lenders assess multiple factors when calculating your mortgage credit score, including:

- Payment History (35%) – Late payments, delinquencies, or defaults can negatively impact your score.

- Credit Utilization (30%) – The ratio of credit used versus available credit.

- Length of Credit History (15%) – Longer credit histories tend to improve scores.

- Credit Mix (10%) – A diverse mix of credit accounts (credit cards, auto loans, mortgages) can boost your score.

- New Credit Inquiries (10%) – Too many recent credit applications can lower your score.

Minimum Credit Score Requirements for Mortgages

Different loan types require different minimum credit scores:

- Conventional Loans – Typically require a 620+ credit score.

- FHA Loans – Require a 580+ score (500 with a larger down payment).

- VA Loans – No strict minimum, but 620+ is preferred.

- USDA Loans – Usually need 640+.

How to Improve Your Mortgage Credit Score

If your mortgage credit score is low, here are strategies to boost it:

- Pay Bills on Time – Set up automatic payments or reminders to avoid late payments.

- Reduce Credit Utilization – Keep credit card balances below 30% of your credit limit.

- Avoid Opening Too Many New Accounts – Each hard inquiry can lower your score.

- Check Your Credit Reports for Errors – Dispute any inaccuracies.

- Avoid Closing Old Credit Accounts – Older accounts help build credit history.

- Pay Off Outstanding Debts – Reducing overall debt lowers your risk.

- Use a Secured Credit Card – This helps rebuild credit if you have a low score.

- Limit Hard Credit Inquiries – Space out new applications to minimize negative impact.

- Become an Authorized User – A responsible family member can add you to their credit card.

- Increase Credit Limits – This can lower credit utilization if managed wisely.

10 Essential Tips to Maintain a High Mortgage Credit Score

- Always pay mortgage and other bills on time.

- Keep old credit accounts open to maintain a long credit history.

- Monitor your credit report regularly for errors.

- Avoid maxing out your credit cards.

- Reduce your overall debt-to-income ratio.

- Keep credit utilization below 30% of your total credit limit.

- Refrain from making major financial changes before applying for a mortgage.

- Diversify your credit mix with responsible usage.

- Consider a mortgage lender that allows alternative credit scoring.

- Work with a credit counselor if struggling with debt.

10 Frequently Asked Questions (FAQs) About Mortgage Credit Scores

- What is a good mortgage credit score?

- A score above 700 is considered good, while 750+ is excellent.

- Can I get a mortgage with bad credit?

- Yes, but it may come with higher interest rates or require a larger down payment.

- How long does it take to improve my mortgage credit score?

- It depends on the severity of credit issues, but improvements can be seen in 3-6 months with consistent efforts.

- Do mortgage pre-approvals affect my credit score?

- Yes, but only slightly. Multiple inquiries within 45 days are usually counted as one.

- Can I get a mortgage with no credit history?

- Yes, but lenders may require alternative forms of credit verification, such as rent payments.

- Does renting help build my mortgage credit score?

- Only if reported to credit bureaus. Some services allow rent payments to count towards your credit score.

- What is the fastest way to improve a mortgage credit score?

- Paying off high balances and removing errors from credit reports.

- Can closing a credit card lower my credit score?

- Yes, because it reduces your credit history length and available credit.

- How does bankruptcy affect my ability to get a mortgage?

- Bankruptcy stays on credit reports for 7-10 years, but FHA loans may be available after 2-3 years.

- Will paying off my mortgage improve my stock score?

- It may not increase your score significantly but will improve your overall financial health.

Conclusion

Your mortgage stock score plays a crucial role in securing a home loan with favorable terms. A high credit score can save you money on interest rates and improve your chances of loan approval. To maintain a strong score, practice responsible financial habits such as timely bill payments, low credit utilization, and regular credit monitoring.

If your score needs improvement, take proactive steps like reducing debts, checking credit reports for errors, and avoiding unnecessary credit inquiries. By maintaining a solid credit profile, you can unlock better mortgage opportunities and achieve long-term financial stability.

mortgage.kbk.news

mortgage.kbk.news