Mortgage Term Rates: Learning Before Choosing a Loan. Mortgage term rates play a critical role in determining the overall cost of your home loan. Whether you are a first-time homebuyer or refinancing an existing mortgage, understanding mortgage term rates can help you make informed financial decisions. This guide will explain how mortgage term rates work, factors that affect them, and how to choose the best mortgage term for your needs.

What Are Mortgage Term Rates?

Mortgage term rates refer to the interest rates assigned to different mortgage loan terms. These rates vary depending on the length of the loan term, lender policies, and market conditions. The term of a mortgage represents the period over which you agree to pay back the loan, typically ranging from 5 to 30 years.

Common Mortgage Terms and Their Rates

- Short-term mortgages (5-10 years): These loans generally have lower interest rates but higher monthly payments.

- Medium-term mortgages (15-20 years): They balance affordability and interest savings.

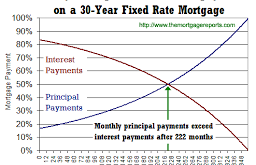

- Long-term mortgages (25-30 years): These loans have higher interest rates but lower monthly payments, making them attractive for first-time buyers.

Factors That Affect Mortgage Term Rates

Several factors influence mortgage term rates, including:

- Economic Conditions – Interest rates fluctuate based on inflation, employment rates, and Federal Reserve policies.

- Credit Score – Borrowers with higher credit scores usually qualify for lower rates.

- Loan Type – Fixed-rate and adjustable-rate mortgages (ARMs) have different pricing structures.

- Down Payment – A larger down payment often leads to a lower interest rate.

- Lender Policies – Different lenders may offer different rates based on their risk assessment.

Fixed-Rate vs. Adjustable-Rate Mortgages

Fixed-Rate Mortgages (FRM)

- The interest rate remains the same throughout the loan term.

- Ideal for borrowers who prefer predictable monthly payments.

- Typically available in 15-year and 30-year terms.

Adjustable-Rate Mortgages (ARM)

- Interest rates fluctuate based on market conditions.

- Usually have lower initial rates, which can increase over time.

- Best for borrowers who plan to move or refinance before the rate adjustment period.

How to Choose the Right Mortgage Term Rate

Selecting the best mortgage term rate depends on your financial goals and budget. Consider the following:

- Monthly Payment Affordability: Choose a term that aligns with your budget.

- Long-Term Financial Goals: If you plan to pay off the loan faster, a shorter term with a lower rate is preferable.

- Market Conditions: Compare current interest rates to determine the best deal.

- Loan Features: Some mortgages allow extra payments without penalties, reducing interest costs over time.

Pros and Cons of Different Mortgage Terms

Short-Term Mortgages (5-15 Years)

Pros:

- Lower interest rates

- Less overall interest paid

- Builds home equity faster

Cons:

- Higher monthly payments

- Requires stable income

Long-Term Mortgages (20-30 Years)

Pros:

- Lower monthly payments

- More accessible for first-time homebuyers

Cons:

- Higher interest rates

- More total interest paid over the loan’s life

10 Tips for Securing the Best Mortgage Term Rate

- Improve your credit score before applying for a loan.

- Shop around and compare lenders to find the best rates.

- Consider a larger down payment to secure a lower interest rate.

- Choose a loan term that fits your financial situation.

- Understand the differences between fixed-rate and adjustable-rate mortgages.

- Lock in your mortgage rate when market conditions are favorable.

- Reduce your debt-to-income ratio to improve loan eligibility.

- Consider refinancing if interest rates drop significantly.

- Work with a mortgage broker to explore multiple loan options.

- Read the fine print to avoid hidden fees and penalties.

10 Frequently Asked Questions (FAQs)

1. What is the best mortgage term length?

The best mortgage term depends on your financial goals. A shorter term saves interest but has higher payments, while a longer term offers lower payments but more interest over time.

2. How do mortgage rates change over time?

Mortgage rates fluctuate based on market conditions, Federal Reserve policies, and lender competition.

3. Can I switch from an adjustable-rate mortgage to a fixed-rate mortgage?

Yes, you can refinance your mortgage to switch from an ARM to a fixed-rate loan when interest rates are favorable.

4. How does my credit score affect my mortgage term rate?

A higher credit score qualifies you for lower interest rates, reducing the overall loan cost.

5. Is a 15-year mortgage better than a 30-year mortgage?

A 15-year mortgage saves on interest but has higher payments, while a 30-year mortgage offers affordability with more total interest.

6. What is a mortgage rate lock?

A rate lock guarantees a specific interest rate for a set period, protecting you from market fluctuations.

7. Can I negotiate mortgage rates with lenders?

Yes, you can negotiate with lenders or work with a mortgage broker to find better rates.

8. What happens if I pay off my mortgage early?

Some loans have prepayment penalties, but paying off early can save interest.

9. How often do adjustable-rate mortgages change?

ARMs typically adjust annually after an initial fixed period, depending on the loan terms.

10. Should I refinance if interest rates drop?

Refinancing can lower your interest rate and monthly payments but consider closing costs before deciding.

Conclusion

Mortgage term rates are a crucial factor in determining your home loan’s affordability and total cost. Understanding how different mortgage terms affect interest rates, monthly payments, and overall financial stability can help you make informed decisions. Whether you opt for a short-term or long-term mortgage, comparing lenders, improving your credit score, and understanding market conditions are key to securing the best deal. By following the tips and insights shared in this guide, you can confidently choose the right mortgage term that aligns with your financial goals.

mortgage.kbk.news

mortgage.kbk.news