What Does Mortgage Mean? A Comprehensive Guide. A mortgag e is a financial tool that allows individuals to purchase real estate by borrowing money from a lender, typically a bank. This loan is secured against the property, meaning the borrower agrees to repay the loan over time, with interest, or risk losing the property through foreclosure if payments are not made. Mortgages are essential for most homebuyers, as few people can afford to pay for a home outright. In this article, we will explore what a mortgage means, how it works, the different types available, and how to choose the right one for your needs.

What Does Mortgage Mean?

A mortgage is essentially a loan used to buy a home or other real estate. The property itself acts as collateral for the loan. The borrower agrees to make monthly payments over a specified period, often 15 to 30 years. These payments typically include both the principal (the amount borrowed) and the interest (the cost of borrowing the money). If the borrower fails to make payments, the lender has the legal right to take possession of the property through a process called foreclosure.

How a Mortgage Works

When you apply for a mortgage, a lender evaluates your financial situation to determine how much money they are willing to lend you. Factors like your income, credit score, and down payment amount will affect the terms of your mortgage, including the interest rate and loan length.

Once approved, you’ll make monthly payments to the lender. Each payment is divided into principal and interest. Early in the loan, most of your payment will go toward interest, but over time, more of your payment will be applied to the principal. This process is called amortization.

Types of Mortgages

There are several types of mortgages, each with its advantages and disadvantages. The most common types include:

- Fixed-Rate Mortgage: With a fixed-rate mortgage, your interest rate remains the same throughout the loan term, providing predictable monthly payments.

- Adjustable-Rate Mortgage (ARM): ARMs have interest rates that change periodically based on market conditions. They often start with lower rates, but those rates can increase over time.

- FHA Loan: These are government-backed loans from the Federal Housing Administration that are popular with first-time homebuyers due to lower down payment requirements and more lenient credit standards.

- VA Loan: Available to veterans and active-duty service members, VA loans often require no down payment and have favorable interest rates.

- Jumbo Loan: These are used for properties that exceed the conventional loan limits. They tend to have stricter credit requirements and higher interest rates.

The Role of Down Payments in Mortgages

A down payment is a portion of the home’s purchase price that you pay upfront. The size of your down payment affects your mortgage terms. For example, larger down payments usually result in better interest rates, and putting down at least 20% can help you avoid private mortgage insurance (PMI), which is an additional cost that protects the lender if you default on the loan.

Mortgage Interest Rates: Fixed vs. Adjustable

Mortgage interest rates determine the cost of borrowing money for your home. With a fixed-rate mortgage, your interest rate is locked in for the life of the loan, so your monthly payments remain the same. This is ideal for buyers who prefer stability and predictability.

On the other hand, adjustable-rate mortgages (ARMs) start with lower interest rates that adjust periodically. This can be a good option if you plan to sell or refinance your home before the rate adjusts, but it comes with the risk of rising rates in the future.

The Application Process for a Mortgage

The mortgage application process involves several key steps:

- Prequalification: This gives you an estimate of how much you can afford based on your financial situation.

- Preapproval: Once you submit financial documents (tax returns, pay stubs, bank statements), the lender provides a more accurate loan amount and interest rate.

- House Hunting: After preapproval, you can start looking for homes within your price range.

- Loan Application: After finding a home, you complete a mortgage application with your lender.

- Underwriting: The lender verifies your information and assesses the risk of lending to you.

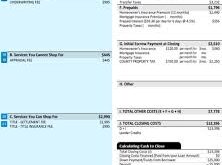

- Approval and Closing: Once approved, you’ll close the loan by signing final documents and paying any closing costs. You then take possession of the home.

Mortgage Insurance: What Is PMI?

Private mortgage insurance (PMI) is often required if you put down less than 20% on a home. This insurance protects the lender if you default on the loan, but it adds to your monthly payment. Once you reach 20% equity in the home, you can usually cancel PMI, reducing your mortgage costs.

Refinancing a Mortgage

Refinancing is the process of replacing your current mortgage with a new one, often to secure a lower interest rate, reduce monthly payments, or change the loan term. Homeowners typically refinance when interest rates drop or when they want to tap into their home’s equity.

The Costs Associated with Mortgages

There are several costs associated with obtaining a mortgage, including:

- Origination Fees: Lenders charge fees for processing your mortgage application.

- Appraisal Fees: The lender requires an appraisal to determine the value of the property.

- Closing Costs: These include various fees, such as title insurance, attorney fees, and taxes, and typically range from 2% to 5% of the loan amount.

Common Mistakes to Avoid When Getting a Mortgage

- Not Shopping Around: Different lenders offer different rates and terms, so it’s essential to compare offers.

- Overborrowing: Just because you qualify for a large loan doesn’t mean you should take it. Borrow only what you can comfortably repay.

- Ignoring the Fine Print: Understand all the terms and conditions of your loan to avoid surprises later.

- Not Checking Your Credit: A low credit score can lead to higher interest rates, so improve your credit before applying for a mortgage.

10 Tips for Getting a Mortgage

- Improve your credit score before applying to get better terms.

- Save for a larger down payment to reduce your monthly payments.

- Get preapproved to understand how much home you can afford.

- Compare multiple lenders to find the best rates and terms.

- Avoid large purchases or taking on new debt before closing on a home.

- Understand the total cost of the mortgage, including interest, taxes, and insurance.

- Choose the right type of mortgage for your financial situation.

- Be aware of PMI and how it impacts your monthly payments.

- Factor in all homeownership costs, such as maintenance, utilities, and repairs.

- Work with a trusted real estate agent to guide you through the process.

10 FAQs About Mortgages

- What is a mortgage?

- A mortgage is a loan used to buy a home, with the property acting as collateral.

- How does a mortgage work?

- You borrow money from a lender and repay it over time, with interest. If you default, the lender can take the property.

- What types of mortgages are available?

- Common types include fixed-rate, adjustable-rate, FHA, VA, and jumbo loans.

- What is the difference between a fixed-rate and an adjustable-rate mortgage?

- A fixed-rate mortgage has the same interest rate for the life of the loan, while an adjustable-rate mortgage’s rate can change.

- What is PMI?

- Private mortgage insurance protects the lender if you default on the loan, often required if your down payment is less than 20%.

- How do I qualify for a mortgage?

- Lenders look at your credit score, income, employment history, and debt-to-income ratio.

- What are closing costs?

- Closing costs include fees for loan processing, appraisals, insurance, and taxes, typically 2% to 5% of the loan amount.

- What is a down payment?

- A down payment is the portion of the home’s price you pay upfront, with the rest financed through a mortgage.

- Can I refinance my mortgage?

- Yes, refinancing allows you to replace your current mortgage with a new one, often to lower your interest rate or payments.

- How long does the mortgage process take?

- The mortgage process typically takes 30 to 45 days from application to closing.

Conclusion

A mortgage is a key financial tool that enables individuals to purchase a home by borrowing money from a lender. Understanding the different types of mortgages, how they work, and the associated costs can help you make informed decisions throughout the home-buying process. Whether you’re a first-time homebuyer or looking to refinance, choosing the right mortgage can save you money and help you achieve long-term financial success.

In conclusion, understanding the full scope of what a mortgage means is crucial for making sound financial decisions. From the types of loans available to the intricacies of the application process, being well-informed will help ensure that your home-buying journey is smooth and financially secure.

mortgage.kbk.news

mortgage.kbk.news