Mortgage Basics: Understanding the Fundamentals of Home Financing. Understanding mortgages is crucial for anyone looking to buy a home. Whether you’re a first-time homebuyer or just looking to brush up on your knowledge, grasping the basics of mortgages can make a significant difference in navigating the home financing process. In this article, we’ll cover the essential aspects of mortgages, including what they are, how they work, and key considerations when choosing the right mortgage for you.

What is a Mortgage?

A mortgage is a loan specifically used to purchase real estate, where the property itself serves as collateral. When you take out a mortgage, you’re borrowing money from a lender to buy a home or other property, and you’ll repay the loan over a set period with interest.

Key Components of a Mortgage

- Principal: The amount of money borrowed from the lender.

- Interest: The cost of borrowing the money, expressed as a percentage of the principal.

- Term: The length of time over which you agree to repay the loan, typically 15, 20, or 30 years.

- Monthly Payment: The amount paid each month, including both principal and interest.

- Down Payment: The initial amount paid upfront, usually a percentage of the property’s purchase price.

Types of Mortgages

Understanding different types of mortgages can help you choose the one that best suits your needs:

- Fixed-Rate Mortgages: These mortgages have a fixed interest rate for the entire term of the loan, providing predictable monthly payments.

- Adjustable-Rate Mortgages (ARMs): These mortgages have interest rates that can fluctuate based on market conditions, leading to varying monthly payments.

- Interest-Only Mortgages: For a set period, you only pay interest on the loan. After the initial period, you’ll start paying both principal and interest.

- FHA Loans: Backed by the Federal Housing Administration, these loans are designed for low-to-moderate-income borrowers and often require a lower down payment.

- VA Loans: Offered to veterans and active-duty service members, these loans are backed by the Department of Veterans Affairs and typically require no down payment.

- USDA Loans: These loans are backed by the U.S. Department of Agriculture and are available for rural and suburban homebuyers, often with no down payment required.

How to Apply for a Mortgage

Applying for a mortgage involves several steps:

- Pre-Approval: Before house hunting, get pre-approved by a lender to understand how much you can borrow and to strengthen your offer.

- Gather Documentation: Lenders will require various documents, including proof of income, credit history, and personal identification.

- Choose a Lender: Compare rates and terms from different lenders to find the best mortgage for your situation.

- Submit an Application: Fill out a mortgage application with your chosen lender, providing all necessary documentation.

- Loan Processing: The lender will review your application, verify information, and process your loan.

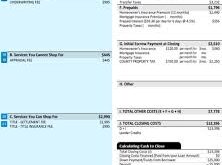

- Closing: If approved, you’ll close on the loan, sign the necessary paperwork, and pay any closing costs.

Understanding Mortgage Terms

Familiarize yourself with key mortgage terms to better understand your loan:

- Amortization: The process of paying off a loan through regular payments that cover both principal and interest.

- Escrow: An account where funds are held for property taxes and insurance, paid along with your mortgage payment.

- Private Mortgage Insurance (PMI): Insurance required if your down payment is less than 20% of the home’s purchase price.

- Points: Fees paid upfront to lower your mortgage interest rate.

Factors Affecting Mortgage Rates

Several factors influence mortgage rates:

- Credit Score: Higher credit scores generally lead to lower interest rates.

- Down Payment: Larger down payments can result in better rates.

- Loan Term: Shorter loan terms often have lower rates.

- Market Conditions: Economic factors and market trends can impact rates.

- Type of Loan: Different loan types have varying rates.

Pros and Cons of Different Mortgage Types

Each type of mortgage has its advantages and disadvantages:

- Fixed-Rate Mortgages

- Pros: Predictable payments, stable interest rate.

- Cons: Typically higher initial rates compared to ARMs.

- Adjustable-Rate Mortgages

- Pros: Lower initial rates, potential for savings.

- Cons: Payment variability, risk of higher rates in the future.

- Interest-Only Mortgages

- Pros: Lower initial payments, potential cash flow benefits.

- Cons: No equity buildup during the interest-only period, higher payments later.

Tips for Managing Your Mortgage

- Make Extra Payments: Paying extra each month can reduce your loan balance and shorten the term.

- Refinance When Possible: Consider refinancing to take advantage of lower rates or better terms.

- Keep Track of Your Payments: Monitor your payments to ensure you’re staying on track and avoid late fees.

- Build an Emergency Fund: Having savings set aside can help manage unexpected expenses.

- Review Your Budget: Ensure your mortgage payments fit comfortably within your overall budget.

- Understand Your Loan Terms: Be clear about the details and terms of your mortgage agreement.

- Seek Professional Advice: Consult with financial advisors or mortgage experts for guidance.

- Stay Informed: Keep up-to-date with interest rate trends and market conditions.

- Check for Prepayment Penalties: Some loans have penalties for paying off early.

- Plan for Homeownership Costs: Budget for property taxes, insurance, and maintenance.

FAQs About Mortgage Basics

- What is a mortgage?

- A mortgage is a loan used to purchase real estate, where the property itself serves as collateral.

- How do fixed-rate mortgages work?

- Fixed-rate mortgages have a constant interest rate and monthly payments throughout the loan term.

- What is an adjustable-rate mortgage?

- An ARM has an interest rate that changes periodically based on market conditions, affecting monthly payments.

- What is a down payment?

- A down payment is an initial amount of money paid upfront when purchasing a home, usually expressed as a percentage of the purchase price.

- What is private mortgage insurance (PMI)?

- PMI is insurance required if your down payment is less than 20% of the home’s purchase price, protecting the lender in case of default.

- What is loan amortization?

- Amortization is the process of gradually paying off a loan through regular payments that cover both principal and interest.

- How does a mortgage affect my credit score?

- Timely mortgage payments can positively impact your credit score, while missed payments can have a negative effect.

- What is a mortgage point?

- Points are fees paid upfront to reduce the interest rate on a mortgage, with one point equal to 1% of the loan amount.

- When should I consider refinancing my mortgage?

- Refinancing is ideal when interest rates drop, you want to change loan terms, or you need to access home equity.

- What are closing costs?

- Closing costs are fees paid at the end of the home-buying process, including charges for appraisal, inspection, and title insurance.

Conclusion

Understanding mortgage basics is essential for making informed decisions about home financing. From grasping the components of a mortgage to knowing the different types available, having a clear understanding of these fundamentals can help you navigate the home-buying process more effectively. By educating yourself on key terms, types of loans, and application procedures, you can make choices that align with your financial goals and ensure a smoother path to homeownership.

In summary, mastering mortgage basics empowers you to handle one of the most significant financial commitments you’ll make. With the right knowledge, you can secure a mortgage that fits your needs and helps you achieve your homeownership dreams.

mortgage.kbk.news

mortgage.kbk.news