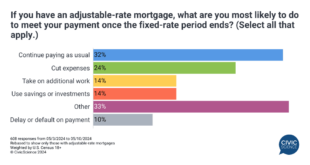

Adjustable Mortgage Rates: Everything You Need to Know. Adjustable mortgage rates (ARMs) offer a flexible home financing option that can be attractive to many borrowers. Unlike fixed-rate mortgages, ARMs have interest rates that change over time. This can result in lower initial payments, but it also introduces uncertainty as rates can increase in the future. In this article, we’ll explore how …

Read More »Picona More

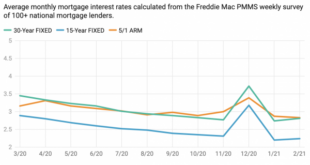

Current Mortgage Rates: A Guide to Understanding Today’s Mortgage Trends

Current Mortgage Rates: A Guide to Understanding Today’s Mortgage Trends. The mortgage market is an ever-changing landscape, and staying updated on current mortgage rates is essential whether you’re a first-time homebuyer, looking to refinance, or simply curious about where the housing market is heading. In this guide, we’ll break down everything you need to know about mortgage rates, the factors …

Read More »Best Mortgage Rates: Your Guide to Securing the Lowest Rates

Best Mortgage Rates: Your Comprehensive Guide to Securing the Lowest Rates. When it comes to financing your dream home, securing the best mortgage rates can make a significant difference in how much you ultimately pay. Mortgage rates can vary based on multiple factors such as your credit score, loan type, and even the lender you choose. Understanding how to find …

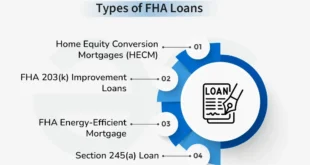

Read More »FHA Mortgage Meaning: Understanding Federal Housing Administration Loans

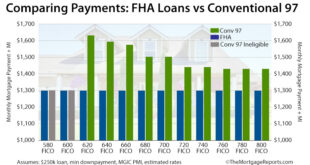

FHA Mortgage Meaning: Understanding Federal Housing Administration Loans. The Federal Housing Administration (FHA) mortgage is a popular home loan option for many prospective homeowners. Designed to make homeownership more accessible, FHA loans offer several benefits, especially for first-time buyers and those with lower credit scores. This article will provide a comprehensive overview of FHA mortgages, their advantages, eligibility requirements, and how …

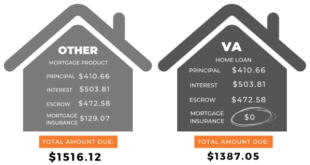

Read More »VA Mortgage Meaning: Understanding VA Loans

VA Mortgage Meaning: Understanding VA Loans. VA mortgages, or VA loans, are a popular financing option for eligible veterans, active-duty service members, and certain members of the National Guard and Reserves. These loans, backed by the U.S. Department of Veterans Affairs (VA), offer several benefits that make homeownership more accessible. In this article, we’ll explore what a VA mortgage is, …

Read More »Second Mortgage Meaning: Understanding the Benefits and Risks

Second Mortgage Meaning: Understanding the Benefits and Risks. A second mortgage is a type of loan that allows homeowners to borrow against the equity in their home, in addition to their primary mortgage. This financial tool can provide significant benefits but also comes with its own set of risks. Understanding what a second mortgage entails, its advantages, and potential pitfalls is …

Read More »Conventional Mortgage Meaning: A Comprehensive Guide

Conventional Mortgage Meaning: A Comprehensive Guide. A conventional mortgage is one of the most common types of home loans available today. Unlike government-backed loans, such as FHA or VA loans, conventional mortgages are not insured or guaranteed by a government agency. Instead, they are offered by private lenders and adhere to guidelines set by Fannie Mae and Freddie Mac. Understanding what …

Read More »Primary Mortgage Meaning: Understanding the Core Concepts

Primary Mortgage Meaning: Understanding the Core Concepts. A primary mortgage is a fundamental component of the home buying process. It represents the loan that the borrower uses to purchase a property, and it plays a crucial role in the real estate market. Understanding the meaning and implications of a primary mortgage is essential for anyone involved in buying or financing a …

Read More »Mortgage Lien Meaning: A Guide to Understanding Lien Types and Their Implications

Mortgage Lien Meaning: A Guide to Understanding Lien Types and Their Implications. A mortgage lien is a crucial concept in real estate and finance, influencing how property transactions are conducted and how lenders secure their interests. Understanding the meaning of a mortgage lien, its types, and its implications can help homeowners, buyers, and investors make informed decisions. This article provides a …

Read More »Collateral Mortgage Meaning: A Comprehensive Guide

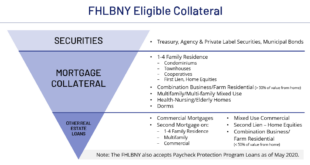

Collateral Mortgage Meaning: A Comprehensive Guide. A collateral mortgage is a type of mortgage where the loan is secured by a property or asset, and this concept can be critical for understanding various financial and lending practices. This article delves into the intricacies of collateral mortgages, exploring their definition, benefits, and risks. It aims to provide a clear and detailed overview …

Read More » mortgage.kbk.news

mortgage.kbk.news