Mortgage Definition: Understanding the Basics and How It Works. A mortgage is a fundamental financial tool used by individuals to purchase homes or other properties. In essence, a mortgage is a loan that is secured by the property being purchased. Homebuyers borrow money from a lender—typically a bank or financial institution—and agree to repay the loan over a set period, usually …

Read More »Picona More

Meaning of Mortgage Loan: Understanding How It Works

Meaning of Mortgage Loan: Understanding How It Works. A mortgage loan is a fundamental concept in the world of finance, often used by individuals to purchase homes or properties. This type of loan provides buyers the necessary funds to purchase real estate while using the property itself as collateral. For anyone looking to own a home, understanding the intricacies of …

Read More »What is a Mortgage? Understanding Home Financing

What is a Mortgage? Understanding Home Financing and How it Works. A mortgage is a financial product used by individuals and businesses to purchase real estate, usually a home or property, by borrowing money from a lender. In exchange for the loan, the borrower agrees to pay back the principal amount plus interest over a set period. Mortgages are essential …

Read More »Bank Mortgage Rates by State: A Guide for Homebuyers

Bank Mortgage Rates by State: A Guide for Homebuyers. When shopping for a mortgage, the interest rate offered by your lender can significantly impact the overall cost of your home loan. These rates can vary widely depending on where you live, as economic factors, housing market conditions, and state regulations all influence mortgage rates by state. Understanding how these factors affect …

Read More »Bank Mortgage Loan Programs for Teachers: Special Home Financing Options

Bank Mortgage Loan Programs for Teachers: Special Home Financing Options. Teachers, as community builders and vital professionals, often have access to specialized mortgage programs. Many banks and financial institutions offer tailored loan programs specifically designed to make homeownership more accessible for teachers. These programs come with benefits like lower interest rates, down payment assistance, and more flexible credit requirements. In …

Read More »Bank Mortgage for Retirees: A Comprehensive Guide

Bank Mortgage for Retirees: A Comprehensive Guide. As retirees transition into a new phase of life, managing finances becomes even more crucial. Bank mortgages tailored for retirees offer a viable solution for those seeking to purchase a new home or refinance their existing one. This guide will provide an in-depth look at how retirees can benefit from these mortgage options, …

Read More »Bank Mortgage Loan Terms: A Comprehensive Guide for Homebuyers

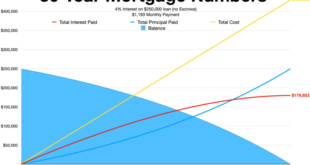

Bank Mortgage Loan Terms: A Comprehensive Guide for Homebuyers. Navigating the world of bank mortgage loans can be overwhelming, especially with the variety of terms and conditions that come into play. Understanding these terms is crucial for making informed decisions about your home loan. This guide aims to demystify bank mortgage loan terms, offering a thorough overview of key concepts, how …

Read More »Bank Mortgage Loan with Low Credit: How to Secure Financing Despite a Low Credit Score

Bank Mortgage Loan with Low Credit: How to Secure Financing Despite a Low Credit Score. Securing a mortgage with a low credit score can seem daunting, but it is possible with the right strategies and understanding of available options. This article will guide you through the process of obtaining a bank mortgage loan even with less-than-perfect credit. We’ll cover various loan …

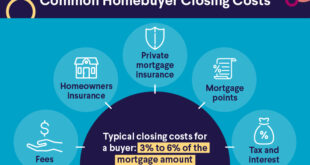

Read More »Bank Mortgage Insurance Programs: A Guide to Protecting Your Home Investment

Bank Mortgage Insurance Programs: A Guide to Protecting Your Home Investment. Bank mortgage insurance programs are crucial for many homebuyers and property owners, especially those who are unable to provide a substantial down payment. These programs offer financial protection to lenders, thereby making it easier for borrowers to secure mortgages. This article explores the various bank mortgage insurance programs available, their …

Read More »Private Mortgage Banks: Your Guide to a Customized Home Loan Experience

Private Mortgage Banks: Your Guide to a Customized Home Loan Experience. Private mortgage banks offer a unique alternative to traditional lending institutions, providing a tailored approach to mortgage financing. These specialized banks focus on individual needs, often offering more flexibility than conventional banks. Whether you’re a first-time homebuyer, looking to refinance, or need a jumbo loan, understanding how private mortgage banks …

Read More » mortgage.kbk.news

mortgage.kbk.news