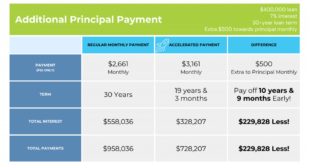

House Mortgage with Extra Payments: Savings and Paying Off Early When it comes to homeownership, one of the most significant financial commitments you’ll make is securing a house mortgage. While mortgages are typically structured over long terms, many homeowners seek ways to reduce the total interest paid and pay off their loan faster. One effective strategy is making extra payments …

Read More »Insantcy Picona

House Mortgage with No Credit: A Complete Guide

House Mortgage with No Credit: A Complete Guide For many, buying a house is one of the biggest financial milestones. However, securing a mortgage can be challenging, especially if you have no established credit history. Traditional lenders often rely on credit scores to assess risk, but there are ways to obtain a house mortgage without credit. This article will explore …

Read More »Online House Mortgage Application: Applying for a Mortgage Online

Online House Mortgage Application: Applying for a Mortgage Online In the digital age, applying for a house mortgage online has become more common and accessible than ever before. The convenience, speed, and efficiency of the online process attract many homebuyers, especially those who prefer to avoid the traditional paperwork and in-person meetings. This article will guide you through the steps …

Read More »House Mortgage Prequalification: Guide to Getting Started

House Mortgage Prequalification: Guide to Getting Started If you’re thinking about buying a home, one of the first steps you should take is getting prequalified for a mortgage. House mortgage prequalification is an important process that gives you a realistic understanding of how much you can borrow and what your financial limits are. It not only helps streamline your home …

Read More »Best House Mortgage Companies: Finding the Right Lender

Best House Mortgage Companies: Finding the Right Lender Finding the best house mortgage company is crucial when you’re on the path to homeownership. With so many lenders available, each offering different loan options, rates, and customer services, choosing the right one can be overwhelming. The best mortgage lenders provide competitive rates, clear terms, and great customer service, helping you navigate …

Read More »FHA vs Conventional House Mortgage: Which is Right for You?

FHA vs Conventional House Mortgage: Which is Right for You? When purchasing a home, one of the most critical decisions you will make is selecting the right mortgage. Two of the most popular mortgage options available are FHA (Federal Housing Administration) loans and conventional loans. Each type comes with its own set of benefits, requirements, and considerations that could impact …

Read More »House Mortgage for New Construction: A Complete Guide

House Mortgage for New Construction: A Complete Guide Purchasing a home is a significant milestone, but when it comes to building your own home, the process is even more intricate. A house mortgage for new construction provides a financing option that allows you to construct your dream home from the ground up. This guide will walk you through everything you …

Read More »House Mortgage for Low Income: Your Path to Affordable Homeownership

House Mortgage for Low Income: Your Path to Affordable Homeownership A house mortgage for low-income families can make homeownership a reality, even when finances are tight. With various loan programs and assistance options available, individuals and families with limited income have pathways to purchase their own homes. This comprehensive guide will cover essential information on house mortgages designed for low-income …

Read More »USDA House Mortgage: Guide to Rural Home Financing

USDA House Mortgage: Guide to Rural Home Financing A USDA house mortgage is a specialized loan program designed by the U.S. Department of Agriculture (USDA) to assist individuals and families in purchasing homes located in eligible rural and suburban areas. This program offers several benefits, including no down payment and competitive interest rates, making it an attractive option for many …

Read More »House Mortgage for Retirees: Home Loans in Retirement

House Mortgage for Retirees: Home Loans in Retirement For retirees, navigating the process of securing a house mortgage can seem daunting. With income sources shifting from salaries to pensions, Social Security, or savings, retirees may face unique challenges in the mortgage application process. However, with the right knowledge and approach, retirees can still achieve their homeownership goals. This guide offers …

Read More » mortgage.kbk.news

mortgage.kbk.news