House Mortgage vs Rent Comparison: Option is Best for You? When it comes to deciding whether to rent or buy a home, many factors come into play. A detailed house mortgage vs rent comparison can help you make an informed decision based on your financial situation, lifestyle preferences, and long-term goals. While both renting and buying have their advantages, the …

Read More »Insantcy Picona

House Mortgage Payoff Calculator: Early Mortgage Repayment

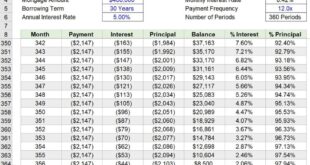

House Mortgage Payoff Calculator: Early Mortgage Repayment A house mortgage payoff calculator is a powerful tool for homeowners who want to explore the benefits of paying off their mortgage early. Whether you’re looking to save on interest, shorten the loan term, or achieve financial freedom sooner, this calculator can help you visualize different payment strategies. In this guide, we will …

Read More »House Mortgage Amortization Schedule: Your Loan Repayment

House Mortgage Amortization Schedule: Your Loan Repayment Breakdown When buying a home, the mortgage amortization schedule is a crucial tool that helps borrowers understand how their loan will be repaid over time. This schedule provides a detailed breakdown of each payment made during the mortgage term, showing how much goes toward interest and principal. In this comprehensive guide, we’ll explore …

Read More »House Mortgage with Co-Signer: Home Loan with Extra Support

House Mortgage with Co-Signer: Home Loan with Extra Support Securing a house mortgage can be a challenge, especially if your credit score or income isn’t strong enough to qualify for the loan amount you need. In such cases, having a co-signer can be a great option to boost your chances of approval. This article delves into the details of securing …

Read More »House Mortgage Credit Score Requirements:You Need to Know

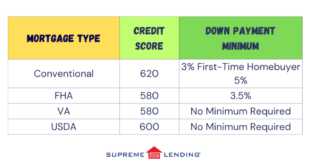

House Mortgage Credit Score Requirements:You Need to Know Your credit score plays a crucial role in determining your eligibility for a house mortgage. It reflects your financial responsibility and helps lenders assess your ability to repay the loan. Different types of loans have varying credit score requirements, and understanding these can help you better prepare for the home-buying process. This …

Read More »House Mortgage for Rental Properties:Guide for Investors

House Mortgage for Rental Properties:Guide for Investors Investing in rental properties can be a lucrative venture, but securing a house mortgage for rental properties is different from obtaining one for a primary residence. Lenders apply different criteria when financing properties meant for investment, which often means stricter credit requirements, higher down payments, and different loan options. This article will provide …

Read More »Investment Property House Mortgage: Financing Your Real Estate

Investment Property House Mortgage: Financing Your Real Estate Investments Investing in property is a popular way to build wealth and secure financial stability. However, acquiring an investment property requires significant financial planning, including securing the right mortgage. Investment property house mortgages differ from traditional home loans in terms of rates, down payment requirements, and eligibility criteria. This article explores the …

Read More »Second House Mortgage:Need to Know Before Buying

Second House Mortgage:Need to Know Before Buying Buying a second home can be an exciting investment opportunity or a personal milestone. However, securing a mortgage for a second house involves different considerations compared to purchasing your primary residence. This comprehensive guide will walk you through the essential aspects of obtaining a second house mortgage, from eligibility and financing options to …

Read More »House Mortgage for Self-Employed: When You’re Your Own Boss

House Mortgage for Self-Employed: When You’re Your Own Boss Obtaining a house mortgage as a self-employed individual can be a challenging process due to unique financial circumstances. Unlike traditional employees, self-employed individuals may face difficulties with income verification and documentation. However, with the right preparation and knowledge, securing a mortgage is entirely possible. This comprehensive guide will explore the essentials …

Read More »House Mortgage Without Down Payment:100% Financing Options

House Mortgage Without Down Payment:100% Financing Options Navigating the home buying process can be challenging, especially when it comes to saving for a down payment. Fortunately, there are mortgage options available that allow you to purchase a home without making a down payment. This comprehensive guide will explore these options, their benefits, and how to determine if they’re right for …

Read More » mortgage.kbk.news

mortgage.kbk.news