Conventional House Mortgage: Guide to Traditional Home Loans A conventional house mortgage is a popular choice among homebuyers due to its straightforward structure and potential financial benefits. Unlike government-backed loans, conventional mortgages are offered by private lenders and are not insured or guaranteed by any government agency. Understanding the key aspects of conventional mortgages, including their benefits, requirements, and application …

Read More »Insantcy Picona

House Mortgage Comparison: Best Loan for Your Needs

House Mortgage Comparison: Best Loan for Your Needs When purchasing a home, selecting the right mortgage is one of the most crucial decisions you will make. With various loan types available, it’s essential to understand the key differences between them to determine which one best suits your financial needs. A house mortgage comparison allows you to evaluate different mortgage options, …

Read More »House Mortgage for Veterans: Securing Your VA Loan Benefits

House Mortgage for Veterans: A Complete Guide to Securing Your VA Loan Benefits Veterans have access to a unique mortgage option, the VA loan, which offers a range of benefits such as no down payment, competitive interest rates, and the absence of private mortgage insurance (PMI). For many veterans and active-duty military members, understanding the VA loan process and maximizing …

Read More »House Mortgage Points: Know to Save on Your Home Loan

House Mortgage Points: Know to Save on Your Home Loan House mortgage points, often referred to as discount points, are a type of prepaid interest that homeowners can pay upfront to reduce their mortgage interest rate. By paying points, homeowners can secure a lower monthly payment and reduce the total interest paid over the life of the loan. Understanding how …

Read More »House Mortgage Loan Types: Choosing the Right Loan

House Mortgage Loan Types: Choosing the Right Loan When it comes to buying a home, understanding the various house mortgage loan types is crucial for making the right decision. The right loan can save you thousands over the course of your mortgage, while the wrong one can make homeownership more expensive. In this guide, we will explore the different types …

Read More »House Mortgage Payment Calculator: Estimate Your Home

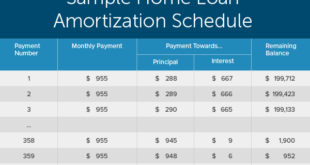

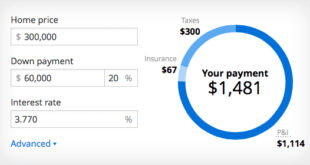

House Mortgage Payment Calculator: Estimate Your Home Loan Payments Understanding the financial commitments of homeownership is essential, and one of the most useful tools available is a house mortgage payment calculator. This calculator helps homebuyers and homeowners determine what their monthly mortgage payments will be, considering various factors like loan amount, interest rate, and loan term. In this article, we’ll …

Read More »House Mortgage with Bad Credit: Improve Your Chances

House Mortgage with Bad Credit: Improve Your Chances Securing a house mortgage with bad credit can feel like a daunting challenge, but it is not impossible. Lenders may be more hesitant to offer loans, but there are several options and strategies that can help you obtain a mortgage, even with less-than-perfect credit. In this article, we’ll break down everything you …

Read More »House Mortgage Interest Deduction: Maximizing Tax Savings

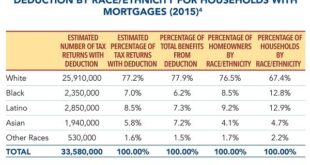

House Mortgage Interest Deduction: Maximizing Tax Savings The house mortgage interest deduction is a powerful tax benefit available to homeowners. This deduction allows you to reduce your taxable income by deducting the interest you pay on your mortgage. It has been a key incentive for homeownership for years, providing significant financial relief to millions of taxpayers. In this article, we’ll …

Read More »House Mortgage Qualification Calculator: Eligibility for a Home Loan

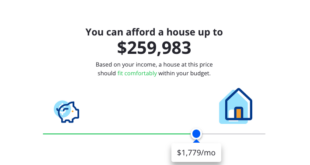

House Mortgage Qualification Calculator: Eligibility for a Home Loan Purchasing a home is one of the biggest financial commitments you’ll ever make, and ensuring that you qualify for a mortgage is a crucial first step. A house mortgage qualification calculator is an essential tool that helps you understand how much home you can afford and whether you meet the criteria …

Read More »House Mortgage Insurance: Protect Your Home and Finances

House Mortgage Insurance: Protect Your Home and Finances House mortgage insurance is an essential aspect of purchasing a home that many buyers may not fully understand. It’s designed to protect lenders, but it also provides benefits to homeowners by allowing them to obtain financing with a lower down payment. In this article, we will explore house mortgage insurance in depth, …

Read More » mortgage.kbk.news

mortgage.kbk.news