Mortgage Fraud Statistics: Risks and How to Protect Yourself. Mortgage fraud is a growing concern in the real estate and financial sectors. Fraudulent mortgage activities not only cause financial losses to individuals and institutions but also weaken the stability of the housing market. Understanding mortgage fraud statistics can help individuals and businesses identify risks and take preventative measures. What is …

Read More »Ramram Adminna

Mortgage Fraud Cases: Prevention and Legal Consequences

Mortgage Fraud Cases: Prevention and Legal Consequences. Mortgage fraud cases have become a growing concern in the real estate and financial sectors. With increasing home loan applications, fraudulent activities related to mortgages have surged, leading to severe financial losses and legal consequences. In this article, we will explore what mortgage fraud is, the types of mortgage fraud cases, legal consequences, …

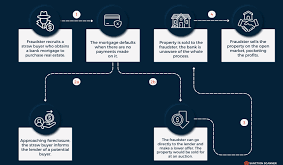

Read More »Mortgage Fraud Schemes: Identify, Prevent, and Protect Yourself

Mortgage Fraud Schemes: Identify, Prevent, and Protect Yourself. Mortgage fraud schemes have become a significant concern in the real estate and financial industries. These fraudulent activities deceive lenders, homeowners, and investors, leading to substantial financial losses. Understanding how mortgage fraud works and recognizing the red flags can help individuals and businesses avoid becoming victims. This article will provide a comprehensive …

Read More »Mortgage Fraud Detection: Identify and Prevent Mortgage Scams

Mortgage Fraud Detection: Identify and Prevent Mortgage Scams. Mortgage fraud is a serious issue that affects lenders, borrowers, and financial institutions worldwide. Scammers manipulate loan processes to obtain property, money, or services under false pretenses. Understanding how to detect mortgage fraud can help individuals and organizations protect themselves from financial losses and legal consequences. This guide will explore common types …

Read More »Mortgage Fraud Penalties: Consequences and Avoid Them

Mortgage Fraud Penalties: Consequences and Avoid Them. Mortgage fraud is a serious crime with severe legal and financial repercussions. Whether committed by individuals, mortgage brokers, or financial institutions, mortgage fraud carries penalties that can include hefty fines, imprisonment, and a damaged financial future. This article provides an in-depth exploration of mortgage fraud penalties, legal consequences, and preventive measures to avoid …

Read More »Mortgage Fraud Prevention: Shield from Scams and Deception

Mortgage Fraud Prevention: Shield from Scams and Deception. Mortgage fraud is a serious issue that can have devastating financial and legal consequences for borrowers, lenders, and financial institutions. Whether you are buying a home, refinancing a mortgage, or working as a mortgage professional, understanding the risks and knowing how to prevent fraud is essential. In this article, we will explore …

Read More »Principal Reduction Alternatives: How to Lower Mortgage Debt

Principal Reduction Alternatives: How to Lower Mortgage Debt. Buying a home is one of the biggest financial commitments most people will ever make. However, high mortgage payments can become a financial burden over time. Principal reduction alternatives provide homeowners with ways to lower their mortgage debt, reduce interest costs, and achieve financial freedom faster. In this article, we’ll explore various …

Read More »Making Home Affordable: Saving and Reducing Mortgage Costs

Making Home Affordable: Saving and Reducing Mortgage Costs. Owning a home is a significant milestone, but financial hardships can make it challenging to keep up with mortgage payments. The Making Home Affordable (MHA) program was introduced by the U.S. government to provide struggling homeowners with relief options. Whether you’re facing foreclosure, seeking lower monthly payments, or refinancing your loan, this …

Read More »Home Affordable Refinance: Lowering Your Mortgage Payments

Home Affordable Refinance: Lowering Your Mortgage Payments. Homeownership comes with many financial responsibilities, and mortgage payments can be one of the biggest monthly expenses. If you’re struggling to keep up with payments or simply want to reduce your interest rate, Home Affordable Refinance might be the right solution for you. This guide will explain what Home Affordable Refinance is, its …

Read More »HARP Refinance Program: Learn to Save Money on Your Mortgage

HARP Refinance Program: Learn to Save Money on Your Mortgage. The HARP Refinance Program (Home Affordable Refinance Program) was a federal initiative designed to help homeowners refinance their mortgages even if they had little or no equity. This program allowed borrowers with underwater mortgages to take advantage of lower interest rates, reducing monthly payments and stabilizing financial situations. Although HARP …

Read More » mortgage.kbk.news

mortgage.kbk.news