Mortgage Payment Structure: Works and Optimizing Payments. Buying a home is a significant financial commitment, and understanding the mortgage payment structure is crucial to making informed decisions. A mortgage payment consists of several components that impact how much you pay monthly and how quickly you can pay off your loan. This guide will explain the structure of mortgage payments, how …

Read More »Ramram Adminna

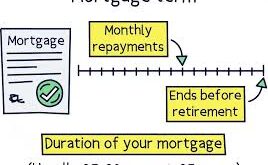

Mortgage Term Length: Best Option for Your Financial Goals

Mortgage Term Length: Best Option for Your Financial Goals. When it comes to buying a home, one of the most critical decisions you’ll face is selecting the right mortgage term length. This choice can significantly impact your monthly payments, total interest costs, and overall financial well-being. Understanding the different mortgage term lengths available and their implications will help you make …

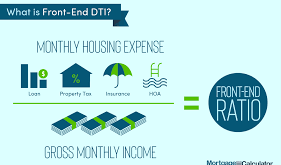

Read More »Mortgage Debt Ratio: Calculation and Best Practices

Mortgage Debt Ratio: Calculation and Best Practices. The mortgage debt ratio is a crucial financial metric used by lenders to determine a borrower’s ability to repay a home loan. It compares a borrower’s monthly housing expenses to their gross monthly income. Mortgage lenders use this ratio to assess financial risk and decide loan approval terms. There are two primary types …

Read More »Mortgage Industry Definition: the Key Aspects of Home Financing

Mortgage Industry Definition: the Key Aspects of Home Financing. The mortgage industry refers to the network of financial institutions, lenders, brokers, and regulatory bodies involved in providing loans for home purchases and refinancing. It plays a crucial role in the real estate market by enabling individuals and businesses to secure funding for property acquisition. The industry comprises mortgage lenders, banks, …

Read More »Mortgage Documentation Meaning: Guide to Essential Paperwork

Mortgage Documentation Meaning: Guide to Essential Paperwork. Mortgage documentation plays a crucial role in securing a home loan. Understanding the meaning of mortgage documentation and its importance helps borrowers prepare for a smooth mortgage approval process. Whether you are a first-time homebuyer or refinancing your property, knowing what documents are required and why they matter can save time and prevent …

Read More »Mortgage Refinancing Options: Saving on Your Home Loan

Mortgage Refinancing Options: Saving on Your Home Loan. Mortgage refinancing can be a great financial strategy for homeowners looking to lower their monthly payments, secure a better interest rate, or tap into home equity. Understanding the different mortgage refinancing options available will help you make the best choice for your financial situation. In this guide, we will explore various refinancing …

Read More »Mortgage Loan Options: Choosing the Best Option for You

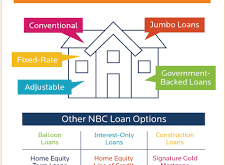

Mortgage Loan Options: Choosing the Best Option for You. When you’re in the market for a home loan, it’s essential to understand the variety of mortgage loan options available to you. Whether you’re a first-time homebuyer or looking to refinance, selecting the right mortgage can significantly impact your financial future. In this article, we’ll explore the different types of mortgage …

Read More »Current Mortgage Rates: What You Need to Know in 2025

Current Mortgage Rates: What You Need to Know in 2025. In today’s world, staying informed about the current mortgage rates is essential for anyone considering buying a home, refinancing, or making long-term financial plans. The mortgage market is dynamic, with rates fluctuating based on several factors like inflation, the economy, and central bank policies. Understanding how mortgage rates work, and …

Read More »Mortgage Monthly Payments: Guide to Managing Your Payments

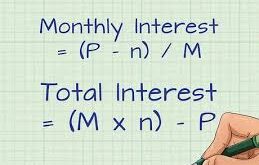

Mortgage Monthly Payments: Guide to Managing Your Payments. Understanding your mortgage monthly payments is a crucial aspect of homeownership. Whether you’re a first-time buyer or refinancing your current mortgage, knowing how your payments are structured can help you manage your finances better. This guide will take you through everything you need to know, from what makes up your mortgage payment …

Read More »Mortgage Interest Calculator: Save Money on Your Home Loan

Mortgage Interest Calculator: Save Money on Your Home Loan. When it comes to purchasing a home, one of the most important factors to consider is the mortgage interest rate. Whether you’re a first-time homebuyer or looking to refinance, understanding how much interest you’ll pay over the life of your loan can have a significant impact on your finances. A mortgage …

Read More » mortgage.kbk.news

mortgage.kbk.news