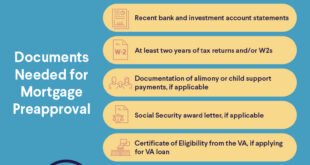

Mortgage Application Meaning: Mortgage Application Process. When you decide to purchase a home, one of the first steps is to understand the mortgage application process. This process is essential for securing financing from a lender, and it can be both exciting and overwhelming. Knowing the meaning of a mortgage application and how it works is crucial to ensuring that you …

Read More »Ramram Adminna

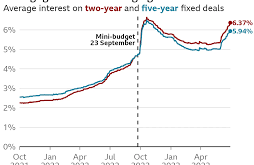

Interest Rates Mortgage: Everything You Need to Know

Interest Rates Mortgage: Everything You Need to Know. Understanding mortgage interest rates is crucial for anyone looking to buy a home. These rates can significantly impact the total cost of a mortgage loan, and being informed can help you make better financial decisions. This article delves into everything you need to know about mortgage interest rates, from how they’re determined …

Read More »Mortgage for First-Time Buyers: Guide to First Home Purchase

Mortgage for First-Time Buyers: Guide to First Home Purchase. Buying your first home is an exciting and rewarding milestone. However, it comes with its own set of challenges, especially when navigating the mortgage process. Whether you’re looking to settle down or invest in property, understanding how mortgages work can help make the journey smoother and less stressful. In this guide, …

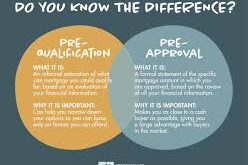

Read More »Mortgage Prequalification Meaning: Understanding the Process

Mortgage Prequalification Meaning: Understanding the Process. The journey to homeownership begins with understanding the mortgage process. One key aspect that can greatly influence your ability to secure a home loan is mortgage prequalification. But what does mortgage prequalification mean, and why is it important? This guide breaks down the concept of mortgage prequalification, its significance, and how it differs from …

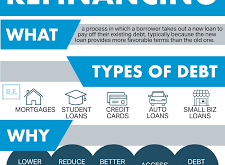

Read More »Mortgage Refinance Meaning: Guide Mortgage Refinancing

Mortgage Refinance Meaning: Guide Mortgage Refinancing. Mortgage refinance meaning refers to the process of replacing an existing mortgage with a new loan, often with better terms such as a lower interest rate, reduced monthly payments, or a shorter loan term. Refinancing can also allow homeowners to access equity in their homes for other financial needs. This comprehensive guide will explain …

Read More »Mortgage Eligibility Criteria: Guide to Qualify for a Home Loan

Mortgage Eligibility Criteria: Guide to Qualify for a Home Loan. Purchasing a home is one of the most significant financial decisions many people make in their lifetime. Securing a mortgage is often necessary to finance this dream. However, not everyone qualifies for a mortgage easily. Lenders have stringent mortgage eligibility criteria that applicants must meet to obtain a home loan. …

Read More »Mortgage Foreclosure Meaning: Guide to Process and Your Rights

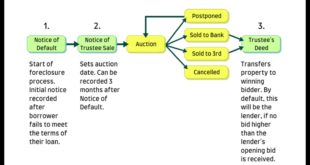

Mortgage Foreclosure Meaning: Guide to Process and Your Rights. Mortgage foreclosure is a term that can strike fear into any homeowner’s heart. But what does mortgage foreclosure really mean? In simple terms, mortgage foreclosure refers to the legal process where a lender takes possession of a property when the borrower fails to meet their mortgage payment obligations. This comprehensive guide …

Read More »Mortgage Closing Process: Guide to Finalizing Home Purchase

Mortgage Closing Process: Guide to Finalizing Home Purchase. The mortgage closing process is the final and most crucial step in purchasing a home. It involves signing essential documents, transferring funds, and officially becoming a homeowner. Understanding each stage of this process can save you from unexpected surprises and ensure a smooth transaction. What is the Mortgage Closing Process? The mortgage …

Read More »Buying a Mortgage: Guide to Making the Right Choice

Buying a Mortgage: Guide to Making the Right Choice. Buying a mortgage is one of the most significant financial decisions a person can make. Whether you are a first-time homebuyer or looking to refinance, understanding how mortgages work is crucial. This guide will provide you with an in-depth understanding of the mortgage process, factors to consider, and tips for securing …

Read More »Mortgage Loan Officer: Your Ultimate Guide to Home Financing

Mortgage Loan Officer: Your Ultimate Guide to Home Financing. Buying a home is one of the biggest financial decisions in life, and having the right mortgage loan officer can make all the difference. Whether you’re a first-time homebuyer or refinancing an existing mortgage, a mortgage loan officer helps navigate the complexities of home loans, ensuring you get the best rates …

Read More » mortgage.kbk.news

mortgage.kbk.news