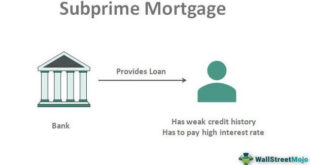

Subprime Mortgage Meaning: the Risks and Benefits. A subprime mortgage is a type of home loan offered to borrowers with low credit scores or a limited credit history. These loans typically come with higher interest rates and less favorable terms to compensate lenders for the increased risk of default. Unlike prime mortgages, which require high credit scores and strong financial …

Read More »Ramram Adminna

Mortgage Tax Credit: Save Money on Your Home Loan

Mortgage Tax Credit: Save Money on Your Home Loan. Owning a home is a dream for many, but the costs associated with a mortgage can be overwhelming. Fortunately, the mortgage tax credit can help homeowners save money by reducing their tax liability. Understanding how this credit works can make a significant difference in your financial planning. This article provides a …

Read More »Mortgage Refinance Rates: Guide to Saving on Your Home Loan

Mortgage Refinance Rates: Guide to Saving on Your Home Loan. Refinancing a mortgage is a strategic financial move that can help homeowners lower their monthly payments, secure a better interest rate, or tap into their home equity. However, understanding mortgage refinance rates is essential to maximizing savings and avoiding costly mistakes. In this comprehensive guide, we will explore everything you …

Read More »Mortgage Pre-Approval Meaning: What It Is and Why It Matters

Mortgage Pre-Approval Meaning: What It Is and Why It Matters. Mortgage pre-approval is a process where a lender evaluates your financial background, including income, credit score, debt, and assets, to determine how much you can borrow for a home loan. A pre-approval letter shows sellers that you are a serious buyer and helps streamline the home-buying process. How Mortgage Pre-Approval …

Read More »Reverse Mortgage Meaning: Guide for Homeowners

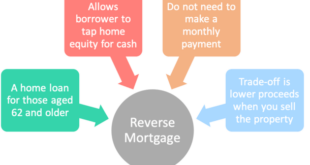

Reverse Mortgage Meaning: Guide for Homeowners. A reverse mortgage is a type of loan available to homeowners aged 62 and older, allowing them to convert a portion of their home equity into cash. Unlike a traditional mortgage, where the borrower makes monthly payments to a lender, a reverse mortgage allows the homeowner to receive payments from the lender, turning their …

Read More »Mortgage Terms Definition: Guide to Understanding Home Loans

Mortgage Terms Definition: Guide to Understanding Home Loans. Buying a home is a significant financial decision, and understanding mortgage terms is essential to making informed choices. Whether you are a first-time homebuyer or refinancing an existing loan, knowing the key definitions can help you navigate the mortgage process effectively. This guide provides a comprehensive breakdown of essential mortgage terms, helping …

Read More »Mortgage Debt Explained: Guide to Managing Your Home Loan

Mortgage Debt Explained: Guide to Managing Your Home Loan. Mortgage debt is a loan secured by real estate, typically used to purchase a home. Borrowers agree to repay the loan amount plus interest over a specified period. If they fail to make payments, the lender has the right to foreclose on the property. How Mortgage Debt Works When you take …

Read More »Interest-Only Mortgage: Guide to Flexible Home Financing

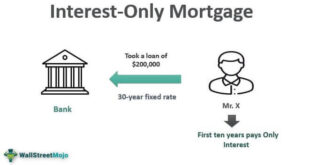

Interest-Only Mortgage: Guide to Flexible Home Financing. An interest-only mortgage is a type of home loan where borrowers are only required to pay the interest portion of the loan for a set period, usually between five to ten years. During this time, the principal balance remains unchanged, resulting in lower initial monthly payments compared to traditional mortgages. How Interest-Only Mortgages …

Read More »Mortgage for Bad Credit: Home Loan with Low Credit Score

Mortgage for Bad Credit: Home Loan with Low Credit Score. Securing a mortgage for bad credit can be challenging, but it is not impossible. Many lenders offer options for borrowers with less-than-perfect credit scores. Understanding the process, requirements, and available loan types can help you make informed decisions and achieve homeownership despite financial setbacks. In this comprehensive guide, we will …

Read More »Mortgage Insurance Explained: Everything You Need to Know

Mortgage Insurance Explained: Everything You Need to Know. Mortgage insurance is an essential financial tool that helps homebuyers secure a mortgage with a lower down payment. While it adds to the overall cost of homeownership, it provides significant benefits, particularly for those who might not have enough savings for a 20% down payment. This article will explain everything about mortgage …

Read More » mortgage.kbk.news

mortgage.kbk.news