Top Banks Offering Mortgage Insurance: A Complete Guide. When it comes to securing a home loan, one crucial aspect that often gets overlooked is mortgage insurance. Mortgage insurance is designed to protect lenders in case a borrower defaults on their loan. For homebuyers with a down payment less than 20%, mortgage insurance becomes a requirement. Choosing the right mortgage insurance …

Read More »Ramram Adminna

Top Mortgage Banks for Doctors: Lenders for Home Loan Needs

Top Mortgage Banks for Doctors: Lenders for Home Loan Needs. Doctors often face unique financial challenges and benefits when it comes to securing a mortgage. Whether it’s managing student loan debt, looking for competitive rates, or navigating loan programs designed for medical professionals, selecting the right mortgage bank is crucial. In this article, we explore the best mortgage banks for …

Read More »Best Mortgage Banks for Seniors: Lenders Offering Services

Best Mortgage Banks for Seniors: Lenders Offering Services. For many seniors, securing a mortgage can be a crucial step toward achieving financial stability in their retirement years. Whether you’re looking to purchase a new home, refinance an existing one, or secure a reverse mortgage, finding the right lender is key. However, the options can feel overwhelming. Understanding which banks and …

Read More »Zero-Down Mortgage Banks USA: Homeownership

Zero-Down Mortgage Banks USA: Homeownership. In the United States, buying a home can be an exciting yet daunting process, especially when it comes to the down payment. The good news is that there are options available for prospective homeowners who may not have significant savings for a down payment. Zero-down mortgages are becoming increasingly popular for many individuals who dream …

Read More »Credit-Friendly Mortgage Banks: Lenders for Your Home Loan

Credit-Friendly Mortgage Banks: Lenders for Your Home Loan. When it comes to securing a mortgage, your credit score can have a significant impact on the terms and conditions offered by lenders. For those with less-than-perfect credit, finding a credit-friendly mortgage bank is key to ensuring better interest rates, lower down payments, and a higher likelihood of loan approval. In this …

Read More »High-LTV Mortgage Bank Offers: Guide for Homebuyers

High-LTV Mortgage Bank Offers: Guide for Homebuyers. When it comes to purchasing a home, securing a mortgage can often feel like navigating a maze. One of the key factors that influences the loan process is the loan-to-value ratio (LTV). Specifically, high-LTV mortgage bank offers are a hot topic for first-time homebuyers or anyone looking to secure a mortgage with a …

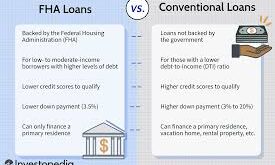

Read More »Conventional Loan Mortgage Banks: Financing Your Home

Conventional Loan Mortgage Banks: Financing Your Home. A conventional loan is one of the most common types of mortgages, and it is often sought by those looking to purchase or refinance their homes. With many conventional loan mortgage banks offering competitive interest rates, understanding how these loans work is essential for making informed decisions. In this article, we’ll dive deep …

Read More »New Construction Mortgage Banks: Financing Your Dream Home

New Construction Mortgage Banks: Financing Your Dream Home. Building a new home is a dream for many people, but the process of financing this venture can be daunting. New construction mortgages offer a solution for homebuyers and builders alike, allowing them to secure funding for a property that is still in the construction phase. This guide will walk you through …

Read More »Best Banks for Home Loans: Right Lender for Your Mortgage

Best Banks for Home Loans: Right Lender for Your Mortgage. Finding the right bank for a home loan is one of the most important decisions you’ll make during the home-buying process. With countless options available, it can be overwhelming to choose the best one for your needs. In this article, we will explore the best banks for home loans, highlighting …

Read More »Mortgage Banks for Vacation Homes: Financing Dream Getaway

Mortgage Banks for Vacation Homes: Financing Dream Getaway. Owning a vacation home is a dream for many, offering a retreat from the everyday hustle and bustle. However, financing a vacation property can be a bit more complex than securing a loan for a primary residence. Mortgage banks for vacation homes offer specialized options that cater to these unique needs. In …

Read More » mortgage.kbk.news

mortgage.kbk.news