Low Down Payment Mortgage Banks: Affordable Home Financing. Securing a home loan can be challenging, especially for first-time buyers. Traditional mortgages often require a hefty down payment, making homeownership seem out of reach. However, low down payment mortgage banks offer a viable solution for those who don’t have large sums saved up. This article will explore the benefits of low …

Read More »Ramram Adminna

Home Refinance Mortgage Banks: Best Bank for Your Needs

Home Refinance Mortgage Banks: Best Bank for Your Needs. Refinancing your home mortgage can be a smart financial move if done correctly. Whether you’re looking to lower your monthly payments, shorten your loan term, or cash out on your home’s equity, refinancing through a home refinance mortgage bank offers several potential benefits. However, navigating the complex world of mortgage refinancing …

Read More »Mortgage Bank Loan Pre-Approval: Securing Your Home Loan

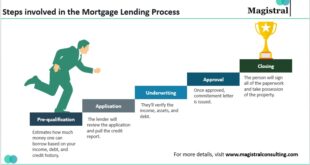

Mortgage Bank Loan Pre-Approval: Securing Your Home Loan. In today’s competitive housing market, getting a mortgage pre-approval is an essential first step in your journey to homeownership. This process not only demonstrates your seriousness as a buyer but also gives you a clear understanding of how much you can borrow, making the home-buying process smoother and more efficient. This guide …

Read More »Mortgage Banks with Loyalty Rewards: Benefits and Boost Savings

Mortgage Banks with Loyalty Rewards: Benefits and Boost Savings. When it comes to securing a mortgage, many homebuyers and homeowners overlook the potential rewards they can earn from their lender. Mortgage banks with loyalty rewards programs offer a unique opportunity to save money, earn perks, and enjoy long-term benefits. This article will explore what mortgage banks with loyalty rewards are, …

Read More »High-Tech Mortgage Banks USA: Home Loan Experience

High-Tech Mortgage Banks USA: Home Loan Experience. In today’s fast-paced world, where technology is integrated into nearly every aspect of our lives, the mortgage industry has not been left behind. High-tech mortgage banks in the USA are now transforming how people apply for and manage home loans. These innovative institutions use advanced digital tools to streamline the entire process, offering …

Read More »Banks with Streamlined Mortgage Process: Home Loans

Banks with Streamlined Mortgage Process: Home Loans. Finding a mortgage lender that offers a streamlined process can be a game changer, especially for homebuyers looking for a hassle-free loan experience. Traditional mortgage processes can be lengthy and filled with paperwork, causing unnecessary stress. However, banks with streamlined mortgage processes aim to make securing a home loan as smooth and quick …

Read More »Mortgage Banks with Low Closing Costs: Home Financing

Mortgage Banks with Low Closing Costs: Home Financing. When looking for a mortgage, one of the crucial factors to consider is the closing cost. Closing costs can significantly impact the affordability of your home loan, but with the right mortgage bank, you can minimize these fees. This article will explore mortgage banks with low closing costs, how to find them, …

Read More »Mortgage Banks Offering Discounts: Saving on Your Mortgage

Mortgage Banks Offering Discounts: Saving on Your Mortgage. When you’re looking to buy a home or refinance your mortgage, finding the best deal is crucial. One of the ways to get a better deal is by taking advantage of mortgage banks offering discounts. These discounts can range from reduced interest rates to waived fees, all designed to make homeownership more …

Read More »Top Mortgage Banks for Teachers: Best Financing Options

Top Mortgage Banks for Teachers: Best Financing Options. Teachers play a vital role in shaping future generations, and their dedication often goes unnoticed, especially when it comes to financial matters. For many teachers, purchasing a home can be a challenging endeavor due to their unique financial circumstances. However, several mortgage banks offer specialized programs and benefits tailored to educators to …

Read More »Adjustable Loan Mortgage Banks: Choosing the Right Lender

Adjustable Loan Mortgage Banks: Choosing the Right Lender. When considering a mortgage, one of the most critical decisions you’ll face is choosing between a fixed-rate mortgage and an adjustable-rate mortgage (ARM). Adjustable-rate mortgages, offered by various adjustable loan mortgage banks, provide a way to secure lower interest rates in the initial years, which can be appealing for many borrowers. However, …

Read More » mortgage.kbk.news

mortgage.kbk.news