Mortgage Banks for Refinancing: Choose the Right One for You. Refinancing your mortgage is a significant financial decision, and finding the right mortgage bank for refinancing is crucial to ensuring you get the best deal. In this article, we’ll explore what mortgage banks for refinancing offer, how to choose the right bank, and tips to make the process smoother. Whether …

Read More »Ramram Adminna

Large Mortgage Banks List: Guide for Homebuyers and Investors

Large Mortgage Banks List: Guide for Homebuyers and Investors. In the ever-evolving real estate market, understanding mortgage banking is critical for both homebuyers and investors. With so many options available, identifying the largest mortgage banks can help you secure the best financial support tailored to your needs. This guide offers a comprehensive list of large mortgage banks, along with insights …

Read More »Affordable Mortgage Loan Banks: Guide to Finding the Best Deals

Affordable Mortgage Loan Banks: Guide to Finding the Best Deals. In today’s dynamic real estate market, securing a home loan can be overwhelming, especially if you’re navigating it for the first time. Fortunately, affordable mortgage loan banks make it possible to achieve homeownership without breaking the bank. This comprehensive guide will walk you through everything you need to know about …

Read More »Affordable Mortgage Loan Banks: Finding the Best Options

Affordable Mortgage Loan Banks: Finding the Best Options. Affordable mortgage loans are essential for anyone looking to purchase a home without stretching their finances too thin. Finding the right bank that offers affordable options can be a daunting task, but with the right information and approach, it’s achievable. This comprehensive guide covers everything you need to know about affordable mortgage …

Read More »Online Mortgage Banks 2024: Guide to Modern Home Financing

Online Mortgage Banks 2024: Guide to Modern Home Financing. The rise of online mortgage banks has transformed how people secure home loans, making the process faster, more transparent, and accessible. In 2024, these digital platforms continue to dominate the mortgage industry, offering streamlined services, competitive rates, and user-friendly tools. Here’s everything you need to know about online mortgage banks and …

Read More »Mortgage Banks for Refinancing: Saving on Your Mortgage

Mortgage Banks for Refinancing: Saving on Your Mortgage. Refinancing your mortgage can be a game-changer for your financial health. By choosing the right mortgage bank for refinancing, you could lower your interest rate, reduce monthly payments, or shorten the term of your loan. This guide provides everything you need to know about refinancing with mortgage banks to make an informed …

Read More »Large Mortgage Banks List: Top Institutions for Home Financing

Large Mortgage Banks List: Top Institutions for Home Financing. When looking for a reliable institution to finance your dream home, large mortgage banks often provide the resources, stability, and competitive rates you need. In this comprehensive guide, we explore the leading large mortgage banks, their benefits, and what sets them apart from smaller lenders. Discover why these institutions dominate the …

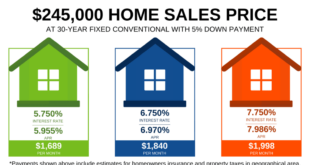

Read More »Compare Mortgage Bank Rates: Guide to Securing the Best Deal

Compare Mortgage Bank Rates: Guide to Securing the Best Deal. When looking for a mortgage, comparing bank rates can make a significant difference in how much you pay over the life of your loan. With so many banks offering competitive rates, knowing how to evaluate and compare them is crucial for finding the best deal that fits your financial goals. …

Read More »Easy Approval Mortgage Banks: Hassle-Free Home Financing

Easy Approval Mortgage Banks: Hassle-Free Home Financing. When it comes to purchasing a home, finding a mortgage bank that offers easy approval can make all the difference. Whether you’re a first-time homebuyer or looking to refinance, understanding what to look for and how to apply can streamline the process. This comprehensive guide dives deep into the world of easy approval …

Read More »Mortgage Banks with Cashback: Unlocking Financial Benefits

Mortgage Banks with Cashback: Unlocking Financial Benefits. In today’s competitive mortgage market, “Mortgage Banks with Cashback” have become an attractive option for homebuyers and refinancers. Offering additional financial perks beyond traditional lending, cashback mortgage banks help customers save money and enhance the value of their investment. This article dives deep into how cashback works, the benefits, eligibility, and tips to …

Read More » mortgage.kbk.news

mortgage.kbk.news