Predicting Future Interest Rates: A Guide for Financial Success. Interest rates play a critical role in shaping the global economy, influencing everything from personal savings to corporate investments. Predicting future interest rates is a skill that can benefit investors, policymakers, and everyday consumers alike. In this article, we delve deep into the art and science of interest rate forecasting, providing …

Read More »Ramram Adminna

Impact of Federal Reserve Decisions on the Economy: A Guide

Impact of Federal Reserve Decisions on the Economy: A Guide. The Federal Reserve’s decisions significantly influence the economic landscape of the United States and beyond. Whether it’s adjusting interest rates or modifying monetary policies, these actions ripple through financial markets, consumer behaviors, and business operations. This article explores how the Federal Reserve’s decisions impact various sectors, providing valuable insights for …

Read More »How Mortgage Rates Are Set: A Comprehensive Guide

How Mortgage Rates Are Set: A Comprehensive Guide. Mortgage rates play a pivotal role in determining the cost of homeownership. Understanding how these rates are set can help you make informed decisions when shopping for a loan. In this article, we will explore the factors influencing mortgage rates, how they are determined, and how you can secure the best rate …

Read More »Technology in Mortgage Lending: Transforming the Industry

Technology in Mortgage Lending: Transforming the Industry. In recent years, the integration of technology in mortgage lending has revolutionized the way loans are processed, approved, and managed. This transformation has streamlined the process for borrowers and lenders alike, making it faster, more efficient, and user-friendly. Here’s an in-depth look at how technology is reshaping the mortgage industry. The Evolution of …

Read More »Interest Rates vs. Inflation: Dynamic Relationship

Interest Rates vs. Inflation: Dynamic Relationship. The relationship between interest rates and inflation is one of the most critical aspects of economic policy and personal finance. Both factors influence each other and have significant implications for savings, investments, and economic growth. In this article, we delve into the interplay between interest rates and inflation, their impact on the economy, and …

Read More »Home Loan Tax Benefits: Maximize Your Savings Today

Home Loan Tax Benefits: Maximize Your Savings Today. Purchasing a home is a significant financial decision, and understanding the rate benefits associated with a home loan can help you save substantial amounts of money. This article explores the various tax deductions and benefits available for home loan borrowers, providing actionable insights to optimize your savings. What Are Home Loan Tax …

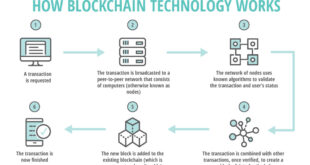

Read More »Blockchain in Mortgages: Real Estate Industry

Blockchain in Mortgages: Real Estate Industry. Blockchain technology has been a game-changer across various industries, and the mortgage sector is no exception. With its ability to enhance transparency, improve efficiency, and ensure data security, blockchain is paving the way for a more streamlined mortgage process. This article explores how blockchain is transforming the mortgage industry, offering insights, tips, and answers …

Read More »Cheapest FHA Lenders: Affordable Options for Your Home Loan

Cheapest FHA Lenders: Affordable Options for Your Home Loan. Purchasing a home can be one of the most significant financial decisions in your life. For many first-time buyers, FHA loans offer an affordable path to homeownership. However, finding the cheapest FHA lenders is essential to minimize costs and ensure you’re getting the best deal. This article explores top tips, frequently …

Read More »Top Mortgage Apps 2024: Simplify Your Home Buying Journey

Top Mortgage Apps 2024: Simplify Your Home Buying Journey. The world of mortgage financing has been transformed by technology, offering a variety of apps that simplify the home-buying process. Whether you’re a first-time buyer or looking to refinance, top mortgage apps in 2024 can help you save time, money, and effort. Let’s dive into the best apps available and explore …

Read More »Fastest Mortgage Approvals: Guide to Speedy Home Financing

Fastest Mortgage Approvals: Guide to Speedy Home Financing. In today’s competitive housing market, obtaining the fastest mortgage approvals can make the difference between securing your dream home or losing it to another buyer. With proper preparation and the right approach, you can significantly accelerate the approval process. This comprehensive guide will walk you through actionable tips, common questions, and expert …

Read More » mortgage.kbk.news

mortgage.kbk.news