Refinance Without Equity: Unlocking Financial Opportunities. Refinancing your home has traditionally required a certain level of equity, but modern financial solutions now offer opportunities for homeowners to refinance without equity. This guide explores how to achieve this, the benefits, challenges, and steps involved, providing practical tips and answers to frequently asked questions. What Does It Mean to Refinance Without Equity? …

Read More »Ramram Adminna

Tax Implications of Refinancing: What You Need to Know

Tax Implications of Refinancing: What You Need to Know. Refinancing a loan, especially a mortgage, can bring significant financial advantages, such as lower interest rates or reduced monthly payments. However, it’s crucial to understand the tax implications of refinancing to avoid unexpected financial surprises. This guide explores the key aspects of refinancing and its impact on your taxes, providing actionable …

Read More »Local vs. National Lenders: Which One is Right for You?

Local vs. National Lenders: Which One is Right for You? When it comes to securing a mortgage or a loan, one of the most important decisions is choosing between local and national lenders. The choice can significantly impact your financial future, with differences in customer service, rates, and loan products. Understanding the distinctions and the benefits of each option is …

Read More »Mortgage Rate Analysis Tools: Homebuyers and Investors

Mortgage Rate Analysis Tools: Homebuyers and Investors. Understanding mortgage rates and how they fluctuate is critical for anyone considering a home loan or refinancing. In today’s market, there are a wide variety of mortgage rate analysis tools that can help borrowers make informed decisions. This article provides an in-depth exploration of these tools, explaining what they are, how they work, …

Read More »How to Improve Loan Approval: Essential Tips and Strategies

How to Improve Loan Approval: Essential Tips and Strategies. Obtaining a loan can be a daunting process, especially if you’re unsure about the steps to improve your chances of approval. Whether you’re applying for a personal loan, mortgage, or business loan, understanding what lenders look for can make all the difference. In this article, we’ll explore actionable strategies to enhance …

Read More »Benefits of Higher Down Payments: Financial Advantages

Benefits of Higher Down Payments: Financial Advantages. In the journey toward homeownership, a higher down payment can be a game-changer. It not only impacts the affordability of your mortgage but also influences your long-term financial well-being. Let’s explore the benefits of higher down payments, offering a clear roadmap for buyers looking to maximize their investment. The Financial Benefits of Higher …

Read More »Loan Comparison Calculators: Guide to Smarter Borrowing

Loan Comparison Calculators: Guide to Smarter Borrowing. Loan comparison calculators have become essential tools for anyone looking to secure the best possible loan terms. They provide clarity by comparing different loan options, helping borrowers make informed financial decisions. In this article, we will delve into the features, benefits, and usage of loan comparison calculators, along with actionable tips and frequently …

Read More »Comparing APR vs. Interest Rate: The Key Differences

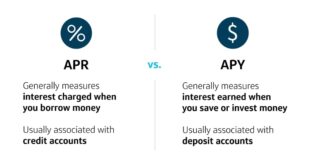

Comparing APR vs. Interest Rate: The Key Differences. When exploring financial products such as loans or mortgages, two terms you will often encounter are APR (Annual Percentage Rate) and interest rate. Both are critical in determining the cost of borrowing, but they represent different aspects of a loan. Understanding the distinction between APR and interest rate can help you make …

Read More »Mortgage Insurance Explained: Everything You Need to Know

Mortgage Insurance Explained: Everything You Need to Know. Mortgage allowance is a crucial element for many homeowners, especially those entering the housing market with limited upfront capital. Understanding how it works, its costs, and its benefits can save you money and provide peace of mind. This comprehensive guide delves into mortgage allowance, explaining its significance, types, costs, and how to …

Read More »ARM vs. Fixed Rates: Which Mortgage Option is Right for You?

ARM vs. Fixed Rates: Which Mortgage Option is Right for You? When it comes to choosing a mortgage, one of the most critical decisions you’ll face is whether to opt for an Adjustable-Rate Mortgage (ARM) or a Fixed-Rate Mortgage. Both options have their advantages and drawbacks, making the choice highly dependent on your financial situation, goals, and tolerance for risk. …

Read More » mortgage.kbk.news

mortgage.kbk.news