Adjustable-Rate Mortgage Details: Everything You Need to Know. An Adjustable-Rate Mortgage (ARM) is a home loan with an interest rate that adjusts periodically based on market conditions. Unlike fixed-rate mortgages, which maintain the same interest rate throughout the loan term, ARMs can fluctuate, potentially offering lower initial rates but higher risks in the long run. This article provides comprehensive details …

Read More »Ramram Adminna

Fixed-Rate Mortgage Options: Best Plans for Homebuyers in 2024

Fixed-Rate Mortgage Options: Best Plans for Homebuyers in 2024. A fixed-rate mortgage is a type of home loan where the interest rate remains constant throughout the loan term. This means your monthly principal and interest payments remain predictable, making it a popular choice for homebuyers who prefer financial stability. How Fixed-Rate Mortgages Work When you take out a fixed-rate mortgage, …

Read More »Mortgage Pre-Approval Process: Securing Your Home Loan

Mortgage Pre-Approval Process: Securing Your Home Loan. Buying a home is a significant financial decision, and the mortgage pre-approval process is an essential step in securing a home loan. Understanding this process can help you streamline your home-buying journey and improve your chances of getting approved for a loan with favorable terms. In this comprehensive guide, we will walk you …

Read More »First-Time Homebuyer Programs: Your First Home Purchase

First-Time Homebuyer Programs: Your First Home Purchase. Buying your first home is a significant milestone, but it can also feel overwhelming. Fortunately, various first-time homebuyer programs are available to help ease the financial burden and make homeownership more accessible. This guide will walk you through the best programs, eligibility requirements, and how to take advantage of them. What Are First-Time …

Read More »Home Loan Calculator: Estimate Your Mortgage Payments

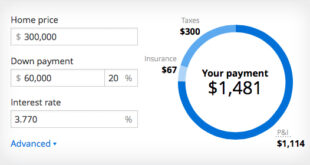

Home Loan Calculator: Estimate Your Mortgage Payments. A home loan calculator is a powerful tool that helps potential homebuyers estimate their monthly mortgage payments. It simplifies complex calculations by considering factors like loan amount, interest rate, loan term, and additional costs such as taxes and insurance. Why Use a Home Loan Calculator? Using a home loan calculator provides quick and …

Read More »Mortgage Interest Rates: Everything You Need to Know in 2024

Mortgage Interest Rates: Everything You Need to Know in 2024. Mortgage interest rates play a crucial role in home financing. Whether you are buying a home or refinancing an existing mortgage, the rate you secure will impact your monthly payments and the overall cost of your loan. In this guide, we will break down everything you need to know about …

Read More »Mortgage Loan Estimate: Things Need to Know Before Applying

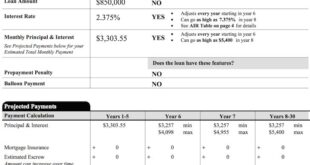

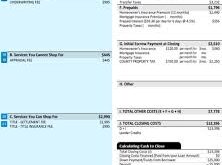

Mortgage Loan Estimate: Things Need to Know Before Applying. A mortgage loan estimate is a crucial document that helps borrowers understand the costs associated with a mortgage. Whether you are a first-time homebuyer or refinancing an existing loan, understanding the details of your mortgage loan estimate can save you money and help you make an informed decision. This comprehensive guide …

Read More »Mortgage Process Explained: Guide to Home Financing

Mortgage Process Explained: Guide to Home Financing. Buying a home is an exciting journey, but the mortgage process can often seem complicated and overwhelming. Understanding each step of the mortgage process helps you make informed decisions, ensuring a smoother home-buying experience. In this guide, we will explain the mortgage process in detail, from application to closing, along with essential tips …

Read More »Mortgage Closing Procedure: Guide to a Smooth Home Purchase

Mortgage Closing Procedure: Guide to a Smooth Home Purchase. Buying a home is an exciting journey, but the mortgage closing procedure can be complex. Understanding the steps involved ensures a hassle-free experience. This guide will walk you through the mortgage closing process, helping you prepare and avoid common pitfalls. What Is Mortgage Closing? Mortgage closing, also known as settlement, is …

Read More »Mortgage Payment Calculator: Estimate Your Home Loan Costs

Mortgage Payment Calculator: Estimate Your Home Loan Costs. Buying a home is one of the biggest financial decisions you’ll make. Understanding your monthly mortgage payment is crucial for budgeting and financial planning. A mortgage payment calculator can help you estimate your costs, ensuring that you make informed decisions about your home loan. This article will explain how a mortgage payment …

Read More » mortgage.kbk.news

mortgage.kbk.news