Mortgage Relief Options: A Complete Guide to Saving Your Home. Owning a home is a significant milestone, but financial challenges can make mortgage payments difficult. If you’re struggling to keep up with payments, understanding mortgage relief options can help you avoid foreclosure and regain financial stability. In this comprehensive guide, we’ll explore various mortgage relief options, eligibility criteria, and actionable …

Read More »House Mortgage

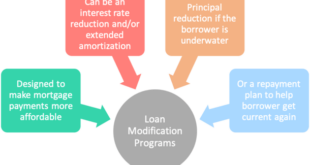

Loan Modification Programs: Save Home and Reduce Payments

Loan Modification Programs: Save Home and Reduce Payments. Facing financial hardship can be overwhelming, especially when it puts your home at risk. Loan modification programs provide a lifeline for homeowners struggling with mortgage payments by adjusting the terms to make them more manageable. This guide will cover everything you need to know about loan modifications, including eligibility, benefits, application steps, …

Read More »Short Sale Process: Selling Your Home in Financial Distress

Short Sale Process: Selling Your Home in Financial Distress. The short sale process is a financial strategy that allows homeowners to sell their property for less than the outstanding mortgage balance. This method is often used as an alternative to foreclosure, offering a way for homeowners to minimize damage to their credit and for buyers to purchase properties at a …

Read More »Foreclosure Prevention Strategies: Ways to Save Your Home

Foreclosure Prevention Strategies: Ways to Save Your Home. Foreclosure is a distressing experience for homeowners, often resulting from financial hardships or unexpected circumstances. Fortunately, there are numerous foreclosure prevention strategies that can help homeowners retain their properties. In this article, we will explore effective methods to prevent foreclosure, provide actionable tips, answer frequently asked questions, and offer a comprehensive conclusion. …

Read More »Mortgage Default Consequences: When Stop Paying Mortgage

Mortgage Default Consequences: When Stop Paying Mortgage? Falling behind on mortgage payments can be a stressful and overwhelming experience. However, understanding the potential consequences of mortgage default can help homeowners make informed decisions and explore possible solutions. This article will discuss the key impacts of mortgage default, legal repercussions, effects on credit scores, and available options to avoid foreclosure. 1. …

Read More »Predatory Lending Practices: Avoiding and Protecting Yourself

Predatory Lending Practices: Avoiding and Protecting Yourself. Predatory lending practices have become a widespread issue, affecting countless individuals who seek financial assistance. These unethical practices involve deceptive, unfair, and often abusive loan terms that put borrowers at a disadvantage. Understanding how predatory lending works, its warning signs, and how to protect yourself is crucial in avoiding financial traps that can …

Read More »Mortgage Origination Fees: Learning Before Getting a Loan

Mortgage Origination Fees: Learning Before Getting a Loan. When applying for a mortgage, borrowers encounter various fees, one of the most significant being mortgage origination fees. Understanding these costs is essential to making informed decisions and ensuring you get the best possible deal. This comprehensive guide will explain mortgage origination fees, their purpose, how they are calculated, ways to reduce …

Read More »Subprime Mortgage Crisis: Causes, Effects, and Lessons Learned

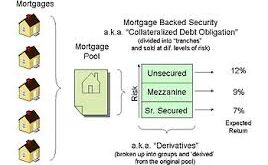

Subprime Mortgage Crisis: Causes, Effects, and Lessons Learned. The Subprime Mortgage Crisis was one of the most devastating financial disasters in modern history. It led to the Great Recession of 2008, impacting millions of homeowners, financial institutions, and the global economy. This article explores the causes, effects, and lessons learned from the crisis, providing a comprehensive understanding of its significance. …

Read More »Mortgage-Backed Securities: Investing and Understanding Risks

Mortgage-Backed Securities: Investing and Understanding Risks. Mortgage-backed securities (MBS) are a crucial part of the financial market, offering investors a way to earn returns from real estate-backed loans. They provide liquidity to the housing market and are widely used by institutions and individuals seeking steady income. In this guide, we will explore what mortgage-backed securities are, how they work, their …

Read More »Mortgage Servicing Rights: Everything You Need to Know

Mortgage Servicing Rights: Everything You Need to Know. Mortgage Servicing Rights (MSRs) refer to a contractual agreement where a financial institution, such as a mortgage servicer, manages loans on behalf of lenders or investors. These rights include collecting monthly payments, managing escrow accounts, and handling delinquencies. MSRs can be retained by the original lender or sold to third-party servicing companies, …

Read More » mortgage.kbk.news

mortgage.kbk.news