Mortgage Broker Services: How It Help You Secure the Best Loan. A mortgage broker is a licensed professional who acts as an intermediary between homebuyers and lenders. Instead of working for a single financial institution, mortgage brokers collaborate with various lenders to find the most suitable loan options for their clients. Their services can simplify the loan application process, potentially …

Read More »House Mortgage

Mortgage Loan Officers: Guide to Securing the Best Mortgage

Mortgage Loan Officers: Guide to Securing the Best Mortgage. Mortgage loan officers play a crucial role in the home buying process, helping borrowers secure the best financing options for their needs. Whether you are purchasing your first home or refinancing an existing mortgage, understanding the role of mortgage loan officers can make a significant difference in securing the best terms …

Read More »Mortgage Forbearance Options: Relief Programs and How It Work

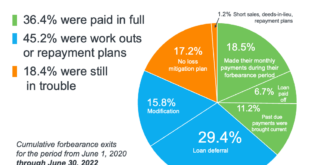

Mortgage Forbearance Options: Relief Programs and How It Work. Mortgage forbearance is a temporary relief option that allows homeowners to pause or reduce their mortgage payments during financial hardship. This assistance is designed to help borrowers avoid foreclosure while they recover from economic difficulties, such as job loss, medical emergencies, or natural disasters. How Does Mortgage Forbearance Work? When a …

Read More »Mortgage Escrow Accounts: Everything You Need to Know

Mortgage Escrow Accounts: Everything You Need to Know. A mortgage escrow account is a financial arrangement set up by lenders to manage property taxes, homeowners insurance, and sometimes other expenses on behalf of borrowers. It helps ensure these payments are made on time, protecting both the homeowner and lender. When you take out a mortgage, your lender may require an …

Read More »Mortgage Underwriting Process: A Complete Guide to Approval

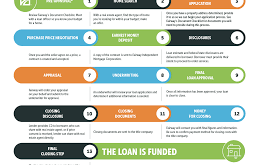

Mortgage Underwriting Process: A Complete Guide to Approval. The mortgage underwriting process is a critical step in obtaining a home loan. It involves evaluating a borrower’s financial history, creditworthiness, and ability to repay the loan. Lenders assess income, debt, credit score, and property details before approving a mortgage application. Understanding this process can help applicants navigate it smoothly and improve …

Read More »Mortgage Rate Locks: How They Work and Why They Matter

Mortgage Rate Locks: How They Work and Why They Matter. Securing a mortgage is one of the biggest financial decisions a person can make, and one key aspect to understand is the mortgage rate lock. A mortgage rate lock ensures that the interest rate offered to a borrower remains fixed for a specified period, protecting them from market fluctuations. This …

Read More »No-Closing-Cost Mortgages: Guide to Saving on Home Loans

No-Closing-Cost Mortgages: Guide to Saving on Home Loans. A no-closing-cost mortgage is a home loan where the borrower is not required to pay the typical closing costs upfront. Instead, these fees are either rolled into the loan balance or covered by the lender in exchange for a slightly higher interest rate. This option can be beneficial for homebuyers who want …

Read More »Mortgage Points Explained: Guide to Saving on Your Home Loan

Mortgage Points Explained: Guide to Saving on Your Home Loan. Mortgage points, also known as discount points, are fees paid directly to the lender at closing in exchange for a reduced interest rate on your home loan. By purchasing mortgage points, borrowers can lower their monthly payments and potentially save thousands over the life of the loan. Types of Mortgage …

Read More »Mortgage Amortization Schedule: Guide to Managing Your Loan

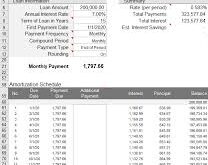

Mortgage Amortization Schedule: Guide to Managing Your Loan. A mortgage amortization schedule is a detailed table that outlines how each monthly mortgage payment is applied to the principal and interest over the loan term. Understanding this schedule helps borrowers plan their finances effectively, track their loan progress, and explore potential savings by making extra payments. How a Mortgage Amortization Schedule …

Read More »Bi-Weekly Mortgage Payments: Work fot Save on Home Loan

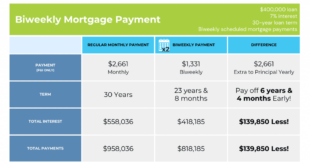

Bi-Weekly Mortgage Payments: Work fot Save on Home Loan. Bi-weekly mortgage payments are an alternative to the standard monthly mortgage payment plan. Instead of making one large payment per month, homeowners make half of their monthly mortgage payment every two weeks. This results in 26 half-payments per year, equivalent to 13 full payments, rather than the standard 12. This extra …

Read More » mortgage.kbk.news

mortgage.kbk.news