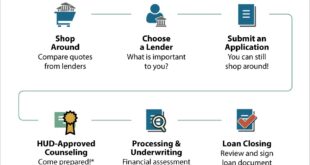

Down Payment Assistance: Buying House with Less Money. Buying a home is a significant financial commitment, and one of the biggest hurdles for many potential homeowners is the down payment. Fortunately, down payment assistance programs can help make homeownership more accessible by reducing or covering the initial costs. This comprehensive guide explores various down payment assistance options, eligibility criteria, application …

Read More »House Mortgage

Mortgage Payment Calculator: Estimate Your Monthly Payments

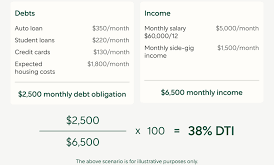

Mortgage Payment Calculator: Estimate Your Monthly Payments. A mortgage payment calculator is an essential tool for homebuyers and homeowners looking to estimate their monthly mortgage payments. It helps in budgeting and financial planning by considering principal, interest, taxes, and insurance (PITI). By using a reliable calculator, you can avoid surprises and ensure affordability before committing to a home loan. How …

Read More »Reverse Mortgage Information: Everything You Need to Know

Reverse Mortgage Information: Everything You Need to Know. A reverse mortgage is an increasingly popular financial tool for homeowners aged 62 and older. It allows them to convert a portion of their home equity into cash while still retaining ownership of their home. This article provides comprehensive reverse mortgage information, explaining how it works, its benefits, drawbacks, and essential considerations …

Read More »Home Equity Loans: Guide to Borrowing Against Your Home

Home Equity Loans: Guide to Borrowing Against Your Home. Home equity loans are a popular way for homeowners to tap into the value of their property to fund major expenses. Whether you need to renovate your home, pay off debts, or cover unexpected expenses, a home equity loan can provide the financial support you need. This guide will explore everything …

Read More »Private Mortgage Insurance: How It Works and Avoid It

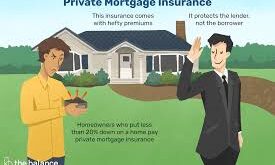

Private Mortgage Insurance: How It Works and Avoid It. Private Mortgage Insurance (PMI) is a type of insurance that protects lenders in case a borrower defaults on their mortgage. It is typically required for homebuyers who make a down payment of less than 20% of the home’s purchase price. While PMI does not benefit the borrower directly, it allows homebuyers …

Read More »Mortgage Refinancing Options: Payments and Saving Bank

Mortgage Refinancing Options: Payments and Saving Bank. Mortgage refinancing can be a powerful financial tool that helps homeowners reduce their monthly payments, secure lower interest rates, or tap into their home equity. However, choosing the right refinancing option requires a clear understanding of the available choices, costs, and benefits. In this article, we will explore various mortgage refinancing options, provide …

Read More »Jumbo Loan Limits: Everything You Need to Know in 2025

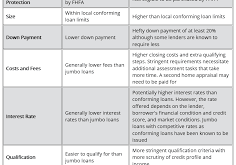

Jumbo Loan Limits: Everything You Need to Know in 2025. Jumbo loan limits refer to the maximum loan amount that a borrower can qualify for before a mortgage is considered a jumbo loan. Unlike conventional loans, which adhere to limits set by the Federal Housing Finance Agency (FHFA), jumbo loans exceed these limits and are not backed by Fannie Mae …

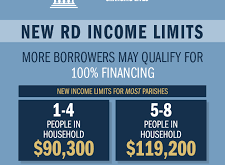

Read More »USDA Loan Eligibility: Qualifying for a USDA Home Loan

USDA Loan Eligibility: Qualifying for a USDA Home Loan. A USDA loan is a government-backed mortgage designed to help low- and moderate-income borrowers purchase homes in rural and suburban areas. Offered by the United States Department of Agriculture (USDA), this loan program provides an affordable path to homeownership with competitive interest rates and no down payment requirements. Benefits of a …

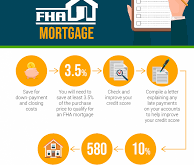

Read More »FHA Loan Requirements: Things Need to Know Before Applying

FHA Loan Requirements: Things Need to Know Before Applying. FHA loans are a popular option for homebuyers who may not qualify for conventional mortgages. Backed by the Federal Housing Administration, FHA loans provide flexible credit score requirements and lower down payments, making homeownership more accessible. This article explores the essential FHA loan requirements, eligibility criteria, benefits, and frequently asked questions …

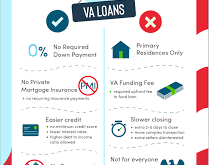

Read More »VA Loan Benefits: Unlocking Homeownership Perks for Veterans

VA Loan Benefits: Unlocking Homeownership Perks for Veterans VA loan benefits provide eligible veterans, active-duty service members, and select military spouses with an exceptional home financing option backed by the U.S. Department of Veterans Affairs. These benefits make homeownership more affordable by offering lower interest rates, no down payment, and no private mortgage insurance (PMI), among other advantages. Key Advantages …

Read More » mortgage.kbk.news

mortgage.kbk.news