House Mortgage for Modular Homes: Prospective Buyers In recent years, modular homes have grown in popularity due to their affordability, flexibility, and shorter construction times. However, securing financing for a modular home can be a complex process, especially when it comes to house mortgages. A modular home, while similar to a traditional stick-built house, is constructed off-site in a factory …

Read More »House Mortgage

VA House Mortgage Funding Fee: Everything You Need

VA House Mortgage Funding Fee: Everything You Need to Know When applying for a VA home loan, veterans and active-duty service members benefit from various advantages, including no down payment and no private mortgage insurance (PMI). However, one common fee associated with VA loans is the VA house mortgage funding fee. This fee can catch some borrowers by surprise, but …

Read More »Private House Mortgage Lenders: Finding the Best Deals

Private House Mortgage Lenders: Finding the Best Deals Private house mortgage lenders offer an alternative to traditional banks and credit unions, providing flexible financing options to homebuyers who may not qualify for conventional loans. Whether you have unique financial circumstances or prefer a more personalized lending process, private mortgage lenders can be an attractive solution. However, working with private lenders …

Read More »House Mortgage Loan Estimate: Need to Know Before You Apply

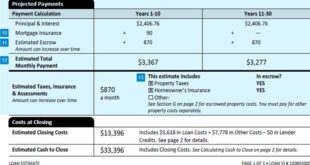

House Mortgage Loan Estimate: Need to Know Before You Apply When embarking on the journey to buy a home, one crucial step is obtaining a house mortgage loan estimate. This document provides a detailed projection of your potential mortgage, including monthly payments, interest rates, and associated costs. Understanding your mortgage estimate helps you make informed decisions, compare loan offers, and …

Read More »House Mortgage with PMI: Need to Know Before You Buy

House Mortgage with PMI: Need to Know Before You Buy Buying a house is one of the most significant financial decisions most people make. When purchasing a home with a mortgage, one factor to consider is Private Mortgage Insurance (PMI). PMI is an insurance policy that protects the lender in case you, the borrower, default on your loan. If you’re …

Read More »Reverse House Mortgage: Financial Freedom for Seniors

Reverse House Mortgage: Financial Freedom for Seniors A reverse house mortgage, commonly known as a reverse mortgage, is a financial product designed to help seniors access the equity in their homes while continuing to live in them. This type of mortgage can provide a significant source of income or financial flexibility, especially for retirees. Understanding how a reverse mortgage works, …

Read More »Green House Mortgage: Financing Eco-Friendly Homes

Green House Mortgage: Financing Eco-Friendly Homes As environmental consciousness rises, many people are shifting their focus toward sustainable living. One way to support this lifestyle is through eco-friendly homes, also known as “green homes.” These homes are designed with energy efficiency, sustainability, and minimal environmental impact in mind. However, financing a green home can be slightly different from traditional home …

Read More »House Mortgage for Second Home: Guide for Buyers

House Mortgage for Second Home: Guide for Buyers Buying a second home is a significant financial decision that often involves obtaining a mortgage. Whether you’re looking for a vacation retreat, an investment property, or a home for your family, understanding how to secure a house mortgage for a second home is crucial. This guide will provide an in-depth look at …

Read More »Balloon House Mortgage: How It Works and What to Consider

Balloon House Mortgage: How It Works and What to Consider A balloon house mortgage is a unique type of home loan that offers lower monthly payments initially but requires a large lump sum payment at the end of the loan term. This structure makes balloon mortgages attractive to buyers looking for low upfront costs, but the final payment can be …

Read More »Interest-Only House Mortgage: Pros and Cons of This Unique

Interest-Only House Mortgage: Pros and Cons of This Unique Loan Option An interest-only house mortgage is an unconventional type of home loan that allows borrowers to pay only the interest on their mortgage for a set period, typically ranging from 5 to 10 years. During this period, the principal balance remains unchanged, which can result in lower monthly payments compared …

Read More » mortgage.kbk.news

mortgage.kbk.news