Banks Specializing in Home Equity: Boost Homeownership Benefits. Home equity is a powerful financial asset that many homeowners overlook. It can serve as a valuable resource for accessing capital, funding home improvements, or consolidating debt. Banks specializing in home equity offer various products, including home equity loans and lines of credit (HELOCs), which allow homeowners to leverage the value of …

Read More »Mortgage Banks

National Mortgage Banks for Teachers: Choose the Right One

National Mortgage Banks for Teachers: Choose the Right One. Teachers play a critical role in shaping the future of society. However, despite their significant contributions, many educators face financial challenges when it comes to purchasing a home. Fortunately, there are national mortgage banks that offer tailored solutions to meet the needs of teachers. These programs often provide favorable terms, lower …

Read More »Convenient Mortgage Banks Online: Best Mortgage Solutions

Convenient Mortgage Banks Online: Best Mortgage Solutions. In today’s fast-paced world, convenience is key, and when it comes to securing a mortgage, online mortgage banks offer some of the most convenient and efficient solutions available. Whether you’re a first-time homebuyer or looking to refinance, the right online mortgage bank can make the entire process quicker and more seamless. This article …

Read More »Mortgage Banks with Cashback Offers: Best Deals for Homebuyers

Mortgage Banks with Cashback Offers: Best Deals for Homebuyers. When it comes to securing a mortgage, most homebuyers focus on interest rates, loan terms, and repayment options. However, in recent years, a new incentive has been gaining popularity—cashback offers. Mortgage banks with cashback offers provide homebuyers with an opportunity to get some money back after securing a loan. These offers …

Read More »Affordable Interest Mortgage Banks: Securing the Best Loan

Affordable Interest Mortgage Banks: Securing the Best Loan. When it comes to securing a home loan, one of the most important factors to consider is the interest rate. With the growing variety of mortgage options available, it’s crucial to know which banks offer the best terms for affordable interest rates. This article delves deep into what makes an “affordable interest …

Read More »Best Local Mortgage Banks: Right Fit for Your Home Loan Needs

Best Local Mortgage Banks: Right Fit for Your Home Loan Needs. When it comes to securing a mortgage, finding the best local mortgage bank is essential. Local mortgage banks often provide more personalized service, better knowledge of the local real estate market, and tailored mortgage options. This article will guide you through understanding the benefits of choosing a local mortgage …

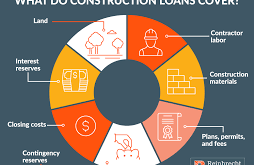

Read More »Home Construction Mortgage Banks: Financing Your Dream Home

Home Construction Mortgage Banks: Financing Your Dream Home. Home construction mortgages are a unique and powerful tool for those looking to build their dream home from the ground up. Unlike traditional mortgages, which are typically used to purchase an existing property, a home construction mortgage provides the necessary funds to cover the costs of building a new home. But how …

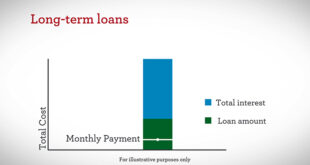

Read More »Long-Term Loan Mortgage Banks: Securing the Best Deals

Long-Term Loan Mortgage Banks: Securing the Best Deals. In today’s financial landscape, securing a long-term loan mortgage can be a key step toward homeownership or refinancing. For many, this process can feel overwhelming, especially when trying to navigate the various banks, mortgage rates, and loan terms available. This comprehensive guide will break down everything you need to know about long-term …

Read More »Mortgage Banks for Multi-Unit Properties: A Comprehensive Guide

Mortgage Banks for Multi-Unit Properties: A Comprehensive Guide. Investing in multi-unit properties can be a lucrative venture, but securing the right mortgage is crucial for success. Mortgage banks specializing in multi-unit properties offer tailored financing solutions that cater to investors, landlords, and real estate professionals. This guide provides an in-depth look at mortgage banks for multi-unit properties, their benefits, requirements, …

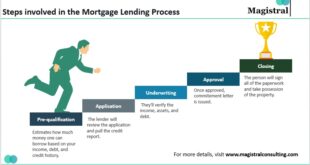

Read More »Streamlined Loan Mortgage Banks: Home Financing Process

Streamlined Loan Mortgage Banks: Home Financing Process. In today’s fast-paced world, homebuyers and homeowners alike are constantly looking for ways to simplify their mortgage process. A streamlined loan mortgage can make the entire experience smoother, faster, and more affordable. In this article, we will explore what streamlined loan mortgage banks are, how they work, and why they might be the …

Read More » mortgage.kbk.news

mortgage.kbk.news