Mortgage Loan Estimate: Things Need to Know Before Applying. A mortgage loan estimate is a crucial document that helps borrowers understand the costs associated with a mortgage. Whether you are a first-time homebuyer or refinancing an existing loan, understanding the details of your mortgage loan estimate can save you money and help you make an informed decision. This comprehensive guide …

Read More »Mortgage Meaning

Mortgage Process Explained: Guide to Home Financing

Mortgage Process Explained: Guide to Home Financing. Buying a home is an exciting journey, but the mortgage process can often seem complicated and overwhelming. Understanding each step of the mortgage process helps you make informed decisions, ensuring a smoother home-buying experience. In this guide, we will explain the mortgage process in detail, from application to closing, along with essential tips …

Read More »Mortgage Closing Procedure: Guide to a Smooth Home Purchase

Mortgage Closing Procedure: Guide to a Smooth Home Purchase. Buying a home is an exciting journey, but the mortgage closing procedure can be complex. Understanding the steps involved ensures a hassle-free experience. This guide will walk you through the mortgage closing process, helping you prepare and avoid common pitfalls. What Is Mortgage Closing? Mortgage closing, also known as settlement, is …

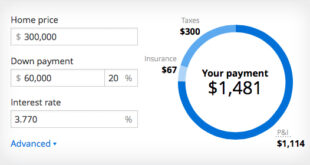

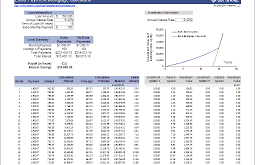

Read More »Mortgage Payment Calculator: Estimate Your Home Loan Costs

Mortgage Payment Calculator: Estimate Your Home Loan Costs. Buying a home is one of the biggest financial decisions you’ll make. Understanding your monthly mortgage payment is crucial for budgeting and financial planning. A mortgage payment calculator can help you estimate your costs, ensuring that you make informed decisions about your home loan. This article will explain how a mortgage payment …

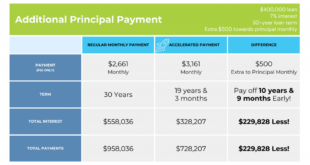

Read More »Mortgage Principal Payment: Guide to Paying Off Your Loan Faster

Mortgage Principal Payment: Guide to Paying Off Your Loan Faster. A mortgage principal payment refers to the portion of your monthly mortgage payment that goes directly toward reducing the original loan amount (the principal). The rest of your payment typically covers interest, property taxes, and insurance. Understanding how mortgage principal payments work can help you pay off your loan faster …

Read More »Mortgage Loan Prequalification: Get Prequalified for Home Loan

Mortgage Loan Prequalification: Get Prequalified for Home Loan. Buying a home is a significant financial commitment, and understanding the mortgage loan prequalification process is crucial for first-time and repeat buyers alike. Prequalification helps you estimate how much you can afford and demonstrates to sellers that you are a serious buyer. This comprehensive guide will cover everything you need to know …

Read More »Reverse Mortgage Calculator: How It Works and Learn It

Reverse Mortgage Calculator: How It Works and Learn It. A reverse mortgage calculator is a valuable tool that helps homeowners estimate how much they can borrow against their home equity. Whether you are planning for retirement, need extra cash flow, or want to eliminate monthly mortgage payments, understanding how a reverse mortgage works is essential. In this guide, we will …

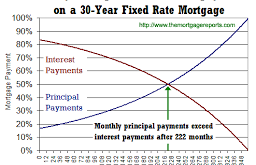

Read More »Mortgage Principal Payment: A Guide to Saving on Your Loan

Mortgage Principal Payment: A Guide to Saving on Your Loan. A mortgage principal payment refers to the portion of your monthly mortgage payment that goes directly toward reducing the original amount borrowed (the principal). This is different from interest payments, which are the fees charged by lenders for borrowing the money. Making extra principal payments can significantly reduce the overall …

Read More »Mortgage Term Rates: Learning Before Choosing a Loan

Mortgage Term Rates: Learning Before Choosing a Loan. Mortgage term rates play a critical role in determining the overall cost of your home loan. Whether you are a first-time homebuyer or refinancing an existing mortgage, understanding mortgage term rates can help you make informed financial decisions. This guide will explain how mortgage term rates work, factors that affect them, and …

Read More »Mortgage Loan Calculator: Estimate Home Loan Payments

Mortgage Loan Calculator: Estimate Home Loan Payments. A mortgage loan calculator is an essential tool for anyone looking to purchase a home or refinance an existing mortgage. It helps estimate monthly payments, total loan costs, and interest rates, allowing borrowers to make informed financial decisions. This guide will explain how a mortgage loan calculator works, its benefits, key factors that …

Read More » mortgage.kbk.news

mortgage.kbk.news