Home Mortgage Application: A Guide to Get Approved Fast. Applying for a home mortgage is one of the most important financial steps in homeownership. Whether you are a first-time buyer or refinancing your current home, understanding the mortgage application process can make a big difference. This guide will walk you through everything you need to know about home mortgage applications, …

Read More »Mortgage Meaning

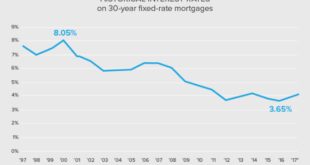

Mortgage Rate Comparison: The Best Rates for Your Home Loan

Mortgage Rate Comparison: The Best Rates for Your Home Loan. Comparing mortgage rates is an essential step in securing a home loan. Mortgage rates determine the interest you pay on your loan, significantly impacting your monthly payments and the overall cost of homeownership. By conducting a mortgage rate comparison, you can find the best possible deal that suits your financial …

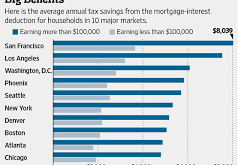

Read More »Mortgage Tax Benefits: Maximize Savings on Your Home Loan

Mortgage Tax Benefits: Maximize Savings on Your Home Loan. Owning a home comes with many financial responsibilities, but it also provides significant tax advantages. Mortgage tax benefits can help homeowners reduce their taxable income, saving them thousands of dollars each year. Understanding these benefits can make homeownership more affordable and financially rewarding. In this guide, we will explore the key …

Read More »Mortgage Insurance Premium: Everything You Need to Know

Mortgage Insurance Premium: Everything You Need to Know. Mortgage insurance premium (MIP) is an essential cost for many homeowners, particularly those obtaining government-backed loans. Understanding MIP is crucial for managing your homeownership expenses and making informed financial decisions. This guide provides an in-depth look at mortgage insurance premiums, including their costs, benefits, and ways to minimize them. What is a …

Read More »Mortgage Default Meaning: Causes, Consequences, and Solutions

Mortgage Default Meaning: Causes, Consequences, and Solutions. Mortgage default refers to the failure of a borrower to meet the repayment terms of their home loan agreement. This typically happens when the borrower misses multiple payments, leading to penalties, foreclosure risks, and a negative impact on credit scores. Understanding mortgage default is essential for homeowners, lenders, and potential buyers to navigate …

Read More »Mortgage Principal Balance: Everything You Need to Know

Mortgage Principal Balance: Everything You Need to Know. The mortgage principal balance is the amount of money you owe on your mortgage loan, excluding interest, taxes, and other fees. This balance decreases as you make payments toward your loan. The principal portion of your monthly payment goes directly toward reducing the total loan amount, while the interest portion compensates the …

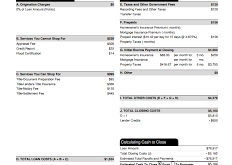

Read More »Mortgage Loan Estimates: Before Buying a Home

Mortgage Loan Estimates: Before Buying a Home. When buying a home, understanding mortgage loan estimates is crucial. A loan estimate provides a clear breakdown of the costs and terms of a mortgage, helping borrowers make informed decisions. In this guide, we will cover everything you need to know about mortgage loan estimates, how they work, and tips to ensure you …

Read More »Adjustable Rate Mortgage: Everything You Need to Know

Adjustable Rate Mortgage: Everything You Need to Know. An Adjustable Rate Mortgage (ARM) is a type of home loan where the interest rate fluctuates over time based on market conditions. Unlike a fixed-rate mortgage, which has a stable interest rate for the entire loan term, an ARM typically starts with a lower introductory rate for a set period before adjusting …

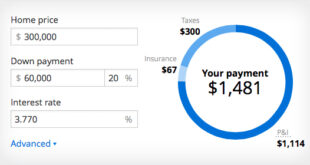

Read More »Mortgage Payment Breakdown: Your Monthly Costs

Mortgage Payment Breakdown: Your Monthly Costs. When buying a home, understanding the mortgage payment breakdown is crucial. Many homeowners assume their monthly payments only cover the loan principal and interest, but they often include additional costs like taxes, insurance, and other fees. This guide will explain how mortgage payments are structured, the components involved, and how you can manage these …

Read More »Mortgage Pre-Approval Letter: Guide to Getting Approved Fast

Mortgage Pre-Approval Letter: Guide to Getting Approved Fast. A mortgage pre-approval letter is a document from a lender stating that you are qualified for a home loan based on your financial information. It outlines how much you can borrow and reassures sellers that you are a serious buyer. Why is a Mortgage Pre-Approval Letter Important? A mortgage pre-approval letter provides …

Read More » mortgage.kbk.news

mortgage.kbk.news