Cheapest FHA Lenders: Affordable Options for Your Home Loan. Purchasing a home can be one of the most significant financial decisions in your life. For many first-time buyers, FHA loans offer an affordable path to homeownership. However, finding the cheapest FHA lenders is essential to minimize costs and ensure you’re getting the best deal. This article explores top tips, frequently …

Read More »Mortgage Rates

Top Mortgage Apps 2024: Simplify Your Home Buying Journey

Top Mortgage Apps 2024: Simplify Your Home Buying Journey. The world of mortgage financing has been transformed by technology, offering a variety of apps that simplify the home-buying process. Whether you’re a first-time buyer or looking to refinance, top mortgage apps in 2024 can help you save time, money, and effort. Let’s dive into the best apps available and explore …

Read More »Fastest Mortgage Approvals: Guide to Speedy Home Financing

Fastest Mortgage Approvals: Guide to Speedy Home Financing. In today’s competitive housing market, obtaining the fastest mortgage approvals can make the difference between securing your dream home or losing it to another buyer. With proper preparation and the right approach, you can significantly accelerate the approval process. This comprehensive guide will walk you through actionable tips, common questions, and expert …

Read More »Refinance Without Equity: Unlocking Financial Opportunities

Refinance Without Equity: Unlocking Financial Opportunities. Refinancing your home has traditionally required a certain level of equity, but modern financial solutions now offer opportunities for homeowners to refinance without equity. This guide explores how to achieve this, the benefits, challenges, and steps involved, providing practical tips and answers to frequently asked questions. What Does It Mean to Refinance Without Equity? …

Read More »Tax Implications of Refinancing: What You Need to Know

Tax Implications of Refinancing: What You Need to Know. Refinancing a loan, especially a mortgage, can bring significant financial advantages, such as lower interest rates or reduced monthly payments. However, it’s crucial to understand the tax implications of refinancing to avoid unexpected financial surprises. This guide explores the key aspects of refinancing and its impact on your taxes, providing actionable …

Read More »Local vs. National Lenders: Which One is Right for You?

Local vs. National Lenders: Which One is Right for You? When it comes to securing a mortgage or a loan, one of the most important decisions is choosing between local and national lenders. The choice can significantly impact your financial future, with differences in customer service, rates, and loan products. Understanding the distinctions and the benefits of each option is …

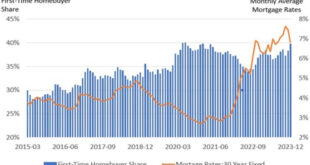

Read More »Mortgage Rate Analysis Tools: Homebuyers and Investors

Mortgage Rate Analysis Tools: Homebuyers and Investors. Understanding mortgage rates and how they fluctuate is critical for anyone considering a home loan or refinancing. In today’s market, there are a wide variety of mortgage rate analysis tools that can help borrowers make informed decisions. This article provides an in-depth exploration of these tools, explaining what they are, how they work, …

Read More »How to Improve Loan Approval: Essential Tips and Strategies

How to Improve Loan Approval: Essential Tips and Strategies. Obtaining a loan can be a daunting process, especially if you’re unsure about the steps to improve your chances of approval. Whether you’re applying for a personal loan, mortgage, or business loan, understanding what lenders look for can make all the difference. In this article, we’ll explore actionable strategies to enhance …

Read More »Benefits of Higher Down Payments: Financial Advantages

Benefits of Higher Down Payments: Financial Advantages. In the journey toward homeownership, a higher down payment can be a game-changer. It not only impacts the affordability of your mortgage but also influences your long-term financial well-being. Let’s explore the benefits of higher down payments, offering a clear roadmap for buyers looking to maximize their investment. The Financial Benefits of Higher …

Read More »Loan Comparison Calculators: Guide to Smarter Borrowing

Loan Comparison Calculators: Guide to Smarter Borrowing. Loan comparison calculators have become essential tools for anyone looking to secure the best possible loan terms. They provide clarity by comparing different loan options, helping borrowers make informed financial decisions. In this article, we will delve into the features, benefits, and usage of loan comparison calculators, along with actionable tips and frequently …

Read More » mortgage.kbk.news

mortgage.kbk.news