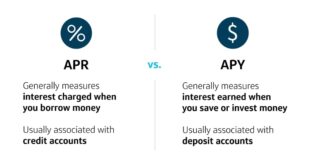

Comparing APR vs. Interest Rate: The Key Differences. When exploring financial products such as loans or mortgages, two terms you will often encounter are APR (Annual Percentage Rate) and interest rate. Both are critical in determining the cost of borrowing, but they represent different aspects of a loan. Understanding the distinction between APR and interest rate can help you make …

Read More »Mortgage Rates

Mortgage Insurance Explained: Everything You Need to Know

Mortgage Insurance Explained: Everything You Need to Know. Mortgage allowance is a crucial element for many homeowners, especially those entering the housing market with limited upfront capital. Understanding how it works, its costs, and its benefits can save you money and provide peace of mind. This comprehensive guide delves into mortgage allowance, explaining its significance, types, costs, and how to …

Read More »ARM vs. Fixed Rates: Which Mortgage Option is Right for You?

ARM vs. Fixed Rates: Which Mortgage Option is Right for You? When it comes to choosing a mortgage, one of the most critical decisions you’ll face is whether to opt for an Adjustable-Rate Mortgage (ARM) or a Fixed-Rate Mortgage. Both options have their advantages and drawbacks, making the choice highly dependent on your financial situation, goals, and tolerance for risk. …

Read More »Loan-to-Value Ratio Explained: Optimize Your Finances

Loan-to-Value Ratio Explained: Optimize Your Finances. The Loan-to-Value (LTV) ratio is a crucial metric in the financial world, especially when it comes to securing loans or mortgages. Understanding the LTV ratio can help borrowers make informed decisions and improve their chances of loan approval. In this article, we’ll break down the concept of the Loan-to-Value ratio, its significance, how to …

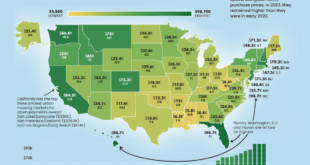

Read More »Best States for Mortgages: A Comprehensive Guide

Best States for Mortgages: A Comprehensive Guide. Finding the best state for securing a mortgage is essential for homebuyers looking to maximize their financial benefits and minimize costs. The mortgage landscape varies significantly from state to state, influenced by factors such as average home prices, interest rates, property taxes, and affordability. In this article, we’ll explore the best states for …

Read More »Bridge Loan Mortgages: Understanding and Utilizing Them

Bridge Loan Mortgages: Understanding and Utilizing Them. Bridge loan mortgages serve as a financial bridge for individuals and businesses needing temporary funding during transitional periods. This article provides an in-depth understanding of bridge loan mortgages, their benefits, drawbacks, and practical applications. What Are Bridge Loan Mortgages? Bridge loan mortgages are short-term loans that provide immediate cash flow to borrowers who …

Read More »Refinancing for Rental Properties: Financial Opportunities

Refinancing for Rental Properties: Financial Opportunities. Refinancing rental properties can be a strategic move for property investors seeking to optimize their financial portfolios. By lowering interest rates, accessing equity, or improving cash flow, refinancing can unlock numerous benefits. However, understanding the nuances of the process is key to making informed decisions. This comprehensive guide will explore refinancing strategies, benefits, challenges, …

Read More »Mortgage Trends 2024: Navigating the Changing Landscape

Mortgage Trends 2024: Navigating the Changing Landscape. The mortgage market is continuously evolving, and 2024 is set to bring significant changes. Staying ahead of these trends can help homeowners, buyers, and investors make informed decisions. This article explores the top mortgage trends in 2024, providing valuable tips, answers to common questions, and actionable insights. The Top Mortgage Trends to Watch …

Read More »Conventional Loan Benefits: Why It’s a Smart Choice for Borrowers

Conventional Loan Benefits: Why It’s a Smart Choice for Borrowers. Conventional loans have long been a popular choice for homebuyers. Their flexibility, competitive interest rates, and diverse options make them an attractive option for many borrowers. But what exactly are conventional loan benefits, and why should you consider them? In this comprehensive guide, we’ll break down everything you need to …

Read More »Biweekly Mortgage Payments: Why They Can Save You Money

Biweekly Mortgage Payments: Why They Can Save You Money. Biweekly mortgage payments have gained popularity as a smart strategy to save money and pay off your mortgage faster. This method, which involves making half of your monthly mortgage payment every two weeks, can lead to substantial savings on interest and shorten the life of your loan. In this article, we …

Read More » mortgage.kbk.news

mortgage.kbk.news