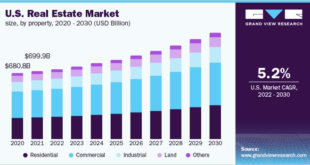

Real Estate Market Trends: Understanding the Housing Market. The real estate market is a dynamic and ever-evolving landscape. Whether you’re a potential homebuyer, investor, or real estate enthusiast, understanding market trends can significantly impact your decision-making. In this article, we’ll explore the key elements of real estate market trends, provide actionable tips, and address frequently asked questions to help you …

Read More »Mortgage Rates

Refinancing Cash-Out Options: Unlocking Your Home Equity

Refinancing Cash-Out Options: Unlocking Your Home Equity. Refinancing cash-out options allow homeowners to tap into their home’s equity and access funds for various purposes. Whether you’re looking to consolidate debt, renovate your property, or cover significant expenses, cash-out refinancing can be a powerful financial tool. This guide explores the process, benefits, considerations, and tips for maximizing its potential. What Is …

Read More »What Is a Mortgage Broker? A Comprehensive Guide

What Is a Mortgage Broker? A Comprehensive Guide. Navigating the world of home financing can be complex, and that’s where a mortgage broker steps in to simplify the process. Whether you’re a first-time homebuyer or refinancing your property, understanding what a mortgage broker does can save you time and money. What Is a Mortgage Broker? A mortgage broker is a …

Read More »Key Factors for Loan Approval: Guide to Securing Financing

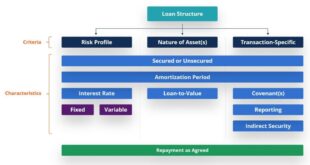

Key Factors for Loan Approval: Guide to Securing Financing. Securing a loan can be a transformative step toward achieving your financial goals. However, understanding the key factors for loan approval is crucial to ensuring a smooth application process. This comprehensive guide will walk you through the essential elements lenders evaluate and provide actionable tips to increase your chances of success. …

Read More »Pre-Approval vs. Pre-Qualified: Key Differences for Homebuyers

Pre-Approval vs. Pre-Qualified: Key Differences for Homebuyers. When buying a home, you often hear terms like “pre-approval” and “pre-qualified.” While these terms might seem interchangeable, they represent different steps in the mortgage process. Understanding their differences can give you an edge in securing your dream home. What is Pre-Qualification? Pre-qualification is the initial step in the mortgage process. It provides …

Read More »Rural Development Loan Rates: Your Comprehensive Guide

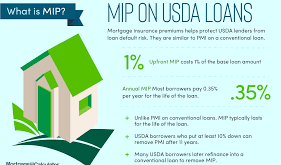

Rural Development Loan Rates: Your Comprehensive Guide. Rural development loans provide essential financial assistance for individuals looking to purchase homes in rural areas. These loans, often backed by government programs, make homeownership accessible by offering competitive interest rates and flexible terms. Understanding the rates, benefits, and application process is crucial for anyone considering this option. What Are Rural Development Loan …

Read More »Private Mortgage Insurance Rates: Everything You Need to Know

Private Mortgage Insurance Rates: Everything You Need to Know. Private Mortgage Insurance (PMI) rates can significantly impact the cost of homeownership. Whether you’re a first-time homebuyer or exploring refinancing options, understanding PMI is essential to making informed decisions. In this article, we’ll delve into PMI rates, factors affecting them, and strategies to manage or eliminate PMI costs effectively. What Is …

Read More »Closing Costs Breakdown: Understanding Homebuying Expenses

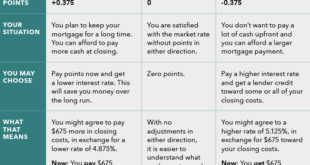

Closing Costs Breakdown: Understanding Homebuying Expenses. When purchasing a home, the term “closing costs” often appears in discussions and paperwork. These are essential fees that come into play when finalizing your home purchase. Knowing the breakdown of closing costs is critical for budgeting and negotiating effectively. This article provides a detailed overview, breaking down the costs, offering tips, and addressing …

Read More »Home Equity Loan Rates: Guide for Smart Borrowers

Home Equity Loan Rates: Guide for Smart Borrowers. Home equity loans are a popular financial tool for homeowners looking to leverage the equity in their property. Understanding home equity loan rates is essential to ensure you make informed decisions and secure the best deal for your financial needs. This article delves deep into the factors that influence these rates, how …

Read More »Lender Fees Comparison: Guide to Save Money on Loans

Lender Fees Comparison: Guide to Save Money on Loans. When applying for a loan, understanding lender fees is crucial. These fees can significantly impact the total cost of borrowing, and comparing them across different lenders ensures you get the best deal. This guide delves into lender fees, providing tips and answers to common questions, to help you make informed financial …

Read More » mortgage.kbk.news

mortgage.kbk.news