Mortgage Rate Negotiation: Guide to Securing the Best Deals. Securing a mortgage can be one of the most significant financial decisions in your life. Understanding the art of mortgage rate negotiation is essential for saving money and getting the best terms on your loan. This guide will provide you with insights into how mortgage rates work, strategies for effective negotiation, …

Read More »Mortgage Rates

Benefits of Refinancing Today: Unlocking Financial Freedom

Benefits of Refinancing Today: Unlocking Financial Freedom. Refinancing has become a powerful financial tool for homeowners and individuals seeking to optimize their finances. Whether it’s reducing monthly payments, shortening loan terms, or securing a lower interest rate, refinancing offers numerous benefits. Let’s dive into the advantages, essential tips, and frequently asked questions to help you make the most informed decision …

Read More »Lender Fees Comparison: Guide to Save on Loan Costs

Lender Fees Comparison: Guide to Save on Loan Costs. When applying for a loan, understanding lender fees is crucial to ensure you get the best deal possible. Comparing these fees can save you significant money over the life of your loan. This article explores everything you need to know about lender fees, how to compare them effectively, and tips to …

Read More »Mortgage Rate Negotiation: Guide to Lower Your Loan Costs

Mortgage Rate Negotiation: Guide to Lower Your Loan Costs. Mortgage rate negotiation is a critical step in securing a favorable home loan deal. With the right strategies, you can save thousands of dollars over the life of your mortgage. This article provides an in-depth guide to help you understand the process, optimize your negotiation tactics, and achieve the best possible …

Read More »Benefits of Refinancing Today: Savings and Financial Freedom

Benefits of Refinancing Today: Savings and Financial Freedom. Refinancing your mortgage or loan can be a strategic financial move, especially in today’s economic climate. By understanding the benefits of refinancing, you can take control of your finances, reduce costs, and achieve your long-term financial goals. This article explores the advantages of refinancing, offers practical tips, and answers common questions to …

Read More »Home Equity Loan Rates: Everything You Need to Know in 2024

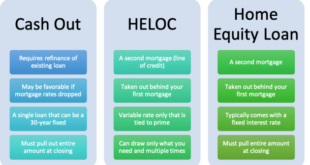

Home Equity Loan Rates: Everything You Need to Know in 2024. Home equity loans are a popular financial tool for homeowners who want to access the value of their property without selling it. However, understanding home equity loan rates is essential to making informed decisions. In this comprehensive guide, we will explore how these rates work, factors affecting them, tips …

Read More »Mortgage Points Explained: Saving Money on Your Home Loan

Mortgage Points Explained: Saving Money on Your Home Loan. Mortgage points can be a valuable tool for homeowners looking to save on their long-term mortgage costs. This guide breaks down what mortgage points are, how they work, and whether they’re a smart choice for your financial situation. Understanding these details will help you make an informed decision when negotiating your …

Read More »Long-Term Fixed Rates: Benefits and Key Considerations

Long-Term Fixed Rates: Benefits and Key Considerations. In today’s ever-changing financial landscape, securing stability is often a top priority for individuals and businesses alike. Long-term rigid rates offer a solution to the uncertainties of fluctuating interest rates. In this comprehensive guide, we’ll explore what long-term fixed rates are, their benefits, key considerations, and how to make the most of this …

Read More »Short-Term Loan Options: Making Smart Financial Choices

Short-Term Loan Options: Making Smart Financial Choices. Short-term loans provide a convenient financial solution for individuals who need quick access to funds. Whether you’re facing unexpected expenses, covering gaps in your budget, or planning for a specific short-term need, these loans can offer relief. This article explores various short-term loan options, their benefits, drawbacks, and tips for making informed decisions. …

Read More »15-Year Mortgage Savings: Benefits of Short-Term Home Loans

15-Year Mortgage Savings: Benefits of Short-Term Home Loans. Purchasing a home is one of the most significant financial commitments a person can make, and selecting the right mortgage plan is crucial. A 15-year mortgage, while demanding higher monthly payments than a 30-year loan, offers substantial financial benefits that can save homeowners thousands of dollars in the long term. Here, we …

Read More » mortgage.kbk.news

mortgage.kbk.news