Economic Impact on Rates: Understanding the Factors and Trends. The economic impact on rates plays a crucial role in shaping financial markets, personal finances, and business operations. Understanding how economic conditions influence interest rates can help individuals and businesses make informed decisions. This article delves into the key factors that affect rates, their consequences, and actionable strategies for navigating these …

Read More »Mortgage Rates

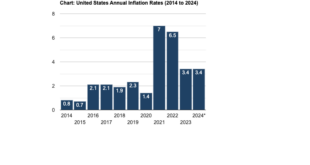

Impact of Inflation on Loans: How Rising Prices Affect Borrowers

Impact of Inflation on Loans: How Rising Prices Affect Borrowers. Inflation, the gradual increase in the prices of goods and services, has a profound impact on various aspects of the economy, including loans. Whether you’re a borrower or lender, understanding how inflation affects loan agreements, interest rates, and repayment capabilities is essential. This article explores the intricate relationship between inflation …

Read More »High Credit Score Benefits: Unlocking Financial Freedom

High Credit Score Benefits: Unlocking Financial Freedom. A high credit score can be a game-changer in personal finance, offering benefits that go beyond easier loan approvals. It impacts interest rates, insurance premiums, and even job opportunities. Let’s explore why maintaining a strong credit score is essential and how it can transform your financial life. What Is a High Credit Score? …

Read More »Mortgage for Investment Property: Opportunities in Real Estate

Mortgage for Investment Property: Opportunities in Real Estate. Investing in real estate is a time-tested strategy for building wealth. One of the most crucial aspects of venturing into this realm is understanding mortgages for investment properties. This comprehensive guide will walk you through everything you need to know, from the basics to advanced tips, ensuring you make informed decisions. Understanding …

Read More »Best Fixed-Rate Lenders: Guide to Secure Your Financial Future

Best Fixed-Rate Lenders: Guide to Secure Your Financial Future. When looking for stability in loan repayments, choosing the best fixed-rate lenders can make all the difference. Fixed-rate loans provide consistent payments, shielding borrowers from market fluctuations. In this article, we’ll explore top fixed-rate lenders, their benefits, and how to choose the right one for your needs. Let’s dive in. What …

Read More »Best Time to Refinance: Guide to Maximizing Savings

Best Time to Refinance: Guide to Maximizing Savings. Refinancing your mortgage can be a strategic move to reduce your monthly payments, shorten your loan term, or access your home equity. However, timing is crucial to make the most out of refinancing. This article explores the best time to refinance, tips for success, frequently asked questions, and a clear conclusion to …

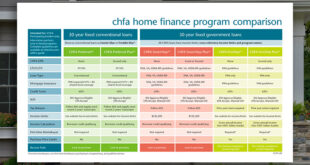

Read More »Comparing Local Mortgages: Guide to Finding the Best Deals

Comparing Local Mortgages: Guide to Finding the Best Deals. When it comes to securing a home loan, understanding the nuances of local mortgages can make all the difference. Choosing the right mortgage involves more than just picking the lowest interest rate. By comparing local mortgage options, you can find a deal tailored to your financial needs and future goals. This …

Read More »Affordable Loan Options: Your Guide to Smart Borrowing

Affordable Loan Options: Your Guide to Smart Borrowing. In today’s financial landscape, finding affordable loan options can make a significant difference in achieving your financial goals while maintaining stability. Whether you need funds for education, home improvement, or a personal emergency, choosing the right loan with manageable terms is crucial. This guide explores the best strategies, tips, and answers to …

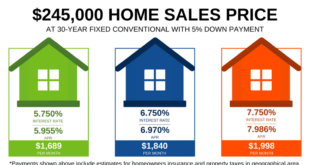

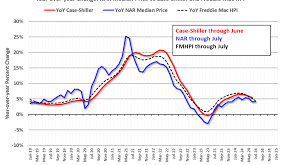

Read More »Current Housing Market Rates: Trends, Insights, and Expert Tips

Current Housing Market Rates: Trends, Insights, and Expert Tips. The current housing market rates play a crucial role in shaping the decisions of homebuyers, sellers, and investors. With fluctuating interest rates and dynamic economic conditions, staying informed is vital for navigating the real estate landscape effectively. This comprehensive guide explores current housing market trends, factors influencing rates, and actionable tips …

Read More »Quick Mortgage Pre-Approval: Securing Your Dream Home

Quick Mortgage Pre-Approval: Securing Your Dream Home. When embarking on the journey of homeownership, obtaining a quick mortgage pre-approval is a vital first step. This process not only helps you understand your budget but also positions you as a serious buyer in a competitive market. In this comprehensive guide, we’ll delve into what mortgage pre-approval entails, why it’s crucial, how …

Read More » mortgage.kbk.news

mortgage.kbk.news