Conventional Mortgage Meaning: A Comprehensive Guide. A conventional mortgage is one of the most common types of home loans available today. Unlike government-backed loans, such as FHA or VA loans, conventional mortgages are not insured or guaranteed by a government agency. Instead, they are offered by private lenders and adhere to guidelines set by Fannie Mae and Freddie Mac. Understanding what a conventional mortgage is and how it works can help potential homebuyers make informed decisions about their financing options.

What is a Conventional Mortgage?

A conventional mortgage is a home loan that is not insured or guaranteed by the federal government. These loans are typically offered by private lenders such as banks, credit unions, and mortgage companies. They come with specific criteria and terms that can vary depending on the lender, but they generally follow the guidelines set by Fannie Mae and Freddie Mac, which are government-sponsored enterprises that buy and guarantee mortgages.

Types of Conventional Mortgages

- Fixed-Rate Mortgage

- Definition: A mortgage where the interest rate remains the same throughout the loan term.

- Pros: Predictable monthly payments, stable interest rates.

- Cons: Higher initial interest rates compared to adjustable-rate mortgages.

- Adjustable-Rate Mortgage (ARM)

- Definition: A mortgage with an interest rate that can change periodically based on market conditions.

- Pros: Lower initial interest rates, potential for lower payments.

- Cons: Payments can increase if interest rates rise.

- Interest-Only Mortgage

- Definition: A mortgage where the borrower only pays interest for a set period.

- Pros: Lower initial monthly payments.

- Cons: Higher payments later, no equity build-up during interest-only period.

- Conventional 97 Loan

- Definition: A type of conventional mortgage that requires only a 3% down payment.

- Pros: Low down payment option.

- Cons: Private Mortgage Insurance (PMI) is typically required.

Advantages of Conventional Mortgages

- Flexibility: Conventional mortgages offer a variety of terms and conditions, allowing borrowers to choose a loan that best fits their needs.

- Lower Costs: They often have fewer fees compared to government-backed loans.

- No PMI for Larger Down Payments: If you make a down payment of 20% or more, you can avoid paying Private Mortgage Insurance (PMI).

- Higher Loan Limits: Conventional loans often have higher loan limits compared to some government-backed loans.

- Simpler Approval Process: They usually have less stringent approval requirements compared to government-backed loans.

Disadvantages of Conventional Mortgages

- Higher Down Payments: Conventional mortgages often require a higher down payment compared to some government-backed loans.

- Stricter Credit Requirements: Borrowers typically need a higher credit score to qualify.

- Private Mortgage Insurance (PMI): If you make a down payment of less than 20%, you’ll usually need to pay PMI.

- Potentially Higher Interest Rates: Depending on your credit profile, you might face higher interest rates.

How to Qualify for a Conventional Mortgage

- Credit Score: A good credit score is essential for qualifying and obtaining favorable terms.

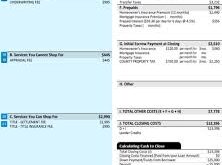

- Down Payment: A typical down payment is between 5% and 20% of the home’s purchase price.

- Debt-to-Income Ratio: Lenders will evaluate your debt-to-income ratio to ensure you can manage your mortgage payments.

- Income Verification: Proof of stable income is necessary to demonstrate your ability to repay the loan.

- Employment History: Lenders prefer borrowers with a steady employment history.

Steps to Apply for a Conventional Mortgage

- Assess Your Financial Situation: Review your credit score, savings, and debt-to-income ratio.

- Determine Your Budget: Calculate how much you can afford to borrow and make a down payment.

- Shop for Lenders: Compare rates and terms from various lenders.

- Gather Documentation: Prepare necessary documents such as tax returns, bank statements, and proof of income.

- Complete the Application: Fill out the mortgage application and provide all required information.

- Get Pre-Approved: Obtain pre-approval to know how much you can borrow.

- Submit Your Application: Once pre-approved, formally submit your mortgage application.

- Undergo the Appraisal: The property will be appraised to determine its value.

- Close the Loan: Review and sign closing documents, and finalize the loan.

Common Questions About Conventional Mortgages

- What is the difference between a conventional mortgage and an FHA loan?

- FHA loans are backed by the government and have more flexible credit requirements. Conventional mortgages are not government-backed and typically require a higher credit score.

- Can I get a conventional mortgage with a low credit score?

- It is possible, but you may face higher interest rates and stricter terms.

- How much down payment is required for a conventional mortgage?

- Typically, a down payment of 5% to 20% is required, though some programs offer lower down payments.

- What is Private Mortgage Insurance (PMI)?

- PMI is insurance that protects the lender if the borrower defaults on the loan. It is usually required if the down payment is less than 20%.

- How can I avoid PMI?

- Making a down payment of 20% or more can help you avoid PMI.

- Are there any benefits to a conventional mortgage over an FHA loan?

- Conventional mortgages often have fewer fees and do not require mortgage insurance if a 20% down payment is made.

- What is an adjustable-rate mortgage (ARM)?

- An ARM is a loan with an interest rate that changes periodically based on market conditions.

- What happens if I miss a mortgage payment?

- Missing a payment can result in late fees and affect your credit score. Repeated missed payments can lead to foreclosure.

- Can I refinance a conventional mortgage?

- Yes, refinancing a conventional mortgage is possible if you meet the lender’s requirements.

- What are the typical terms for a conventional mortgage?

- Conventional mortgages commonly have terms of 15, 20, or 30 years.

Tips for Getting the Best Conventional Mortgage

- Check Your Credit Score: Ensure your credit score is in good shape before applying.

- Save for a Larger Down Payment: A larger down payment can help you avoid PMI and secure better terms.

- Compare Lenders: Shop around to find the best rates and terms.

- Get Pre-Approved: Obtain pre-approval to understand your borrowing limits.

- Understand Your Terms: Know the details of your mortgage, including interest rates and fees.

- Consider Loan Term Length: Choose a loan term that fits your financial goals.

- Maintain a Budget: Keep track of your finances to manage mortgage payments effectively.

- Avoid Large Purchases: Refrain from making large purchases before closing on your mortgage.

- Review Closing Costs: Understand all costs associated with closing the loan.

- Consult a Mortgage Advisor: Seek professional advice to make informed decisions.

Conclusion

In summary, a conventional mortgage offers a range of options and benefits for homebuyers, including flexibility and potentially lower costs compared to government-backed loans. However, it also comes with requirements such as higher down payments and stricter credit standards. Understanding these aspects can help you choose the right mortgage for your needs and financial situation.

By thoroughly researching and comparing different mortgage options, you can make an informed decision that aligns with your long-term financial goals. Remember to consider all factors, including down payments, interest rates, and loan terms, to find the best conventional mortgage for your circumstances.

mortgage.kbk.news

mortgage.kbk.news