Home Mortgage Meaning: Understanding the Basics and Beyond. A home mortgage is a crucial element in the real estate market, playing a pivotal role in home buying and ownership. This article will provide a comprehensive overview of what a home mortgage means, its components, and its significance. We’ll also delve into various aspects of home mortgages, including types, processes, and tips for potential borrowers. By the end, you’ll have a clear understanding of home mortgages and how they can impact your financial future.

What is a Home Mortgage?

A home mortgage is a loan taken out by an individual to purchase a property. This type of loan is secured by the property itself, meaning that if the borrower fails to repay the loan, the lender can take ownership of the property through a legal process known as foreclosure. Mortgages are typically used to finance the purchase of a home, but they can also be used to refinance an existing mortgage or to take out a home equity loan.

Components of a Home Mortgage

- Principal: This is the amount of money borrowed to purchase the property. It is the base amount that needs to be repaid over the life of the loan.

- Interest: This is the cost of borrowing money, calculated as a percentage of the principal. The interest rate can be fixed or variable.

- Term: This refers to the length of time over which the loan must be repaid. Common mortgage terms are 15, 20, or 30 years.

- Monthly Payments: These are payments made by the borrower to the lender on a regular basis, usually monthly. They cover both the principal and the interest.

- Down Payment: This is the amount of money the borrower pays upfront toward the purchase of the home. It is typically a percentage of the home’s purchase price.

- Escrow: This is a third-party account that holds funds for property taxes and insurance, ensuring that these obligations are met.

- Amortization: This is the process of paying off the mortgage over time through regular payments. Amortization schedules determine how much of each payment goes toward interest and how much goes toward the principal.

Types of Home Mortgages

- Fixed-Rate Mortgage: The interest rate remains the same throughout the life of the loan. This provides predictable monthly payments.

- Adjustable-Rate Mortgage (ARM): The interest rate can fluctuate based on market conditions. Initial rates are usually lower but can increase over time.

- Interest-Only Mortgage: Borrowers pay only the interest for a set period, after which they start paying both principal and interest.

- FHA Loan: A government-backed loan designed for low-to-moderate-income borrowers with lower down payment requirements.

- VA Loan: A loan backed by the Department of Veterans Affairs, available to veterans and active-duty service members.

- USDA Loan: A loan backed by the U.S. Department of Agriculture, intended for rural and suburban homebuyers with low to moderate incomes.

The Mortgage Application Process

- Pre-Approval: Before house hunting, it’s advisable to get pre-approved for a mortgage. This involves a lender reviewing your financial situation to determine how much you can borrow.

- House Hunting: Once pre-approved, you can start looking for a home within your budget.

- Application: After selecting a property, you’ll need to complete a formal mortgage application with your lender.

- Processing: The lender will process your application, which includes verifying your financial information and the details of the property.

- Underwriting: An underwriter will review the application and make a decision on whether to approve the loan.

- Closing: If approved, you’ll proceed to closing, where you’ll sign the final documents and take ownership of the property.

Benefits of a Home Mortgage

- Home Ownership: A mortgage allows individuals to buy a home without needing to pay the full purchase price upfront.

- Building Equity: As you repay your mortgage, you build equity in your home, which can be a valuable asset.

- Tax Deductions: Mortgage interest and property taxes may be deductible on your income tax return, providing potential savings.

- Predictable Payments: With a fixed-rate mortgage, you have predictable monthly payments, which can help with budgeting.

Common Challenges and How to Overcome Them

- High Interest Rates: Shop around for the best rates and consider refinancing if rates drop.

- Large Down Payments: Look into programs that offer low or no down payment options.

- Credit Score Issues: Work on improving your credit score before applying for a mortgage to get better terms.

- Debt-to-Income Ratio: Manage your debt-to-income ratio by reducing existing debts and avoiding new ones.

Tips for Getting a Home Mortgage

- Check Your Credit Score: Ensure it’s in good shape before applying for a mortgage.

- Save for a Down Payment: Aim for at least 20% of the home’s purchase price to avoid private mortgage insurance (PMI).

- Compare Lenders: Shop around to find the best mortgage rates and terms.

- Get Pre-Approved: Obtain a pre-approval letter to strengthen your position as a buyer.

- Understand the Terms: Know the difference between fixed-rate and adjustable-rate mortgages.

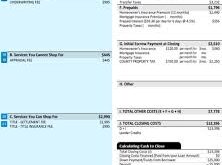

- Budget for Closing Costs: Set aside funds for closing costs, which can include fees for appraisal, inspection, and title insurance.

- Avoid Large Purchases: Refrain from making large purchases or taking on new debt before closing.

- Consider Loan Programs: Explore different loan programs that might be suitable for your financial situation.

- Review Your Mortgage Statement: Regularly check your statements to ensure payments are applied correctly.

- Plan for Future Payments: Consider how changes in your financial situation could affect your ability to make mortgage payments.

Frequently Asked Questions (FAQs)

- What is a home mortgage?

- A loan used to purchase a home, secured by the property itself.

- What is the difference between a fixed-rate and adjustable-rate mortgage?

- Fixed-rate mortgages have a constant interest rate, while adjustable-rate mortgages have a rate that can change periodically.

- How much should I save for a down payment?

- Ideally, 20% of the home’s purchase price, though some loans require less.

- What is PMI?

- Private Mortgage Insurance, required if you put down less than 20% of the home’s price.

- How does the mortgage application process work?

- It involves pre-approval, house hunting, applying, processing, underwriting, and closing.

- Can I refinance my mortgage?

- Yes, refinancing involves taking out a new mortgage to replace your existing one, often to get a better rate.

- What are closing costs?

- Fees associated with finalizing a mortgage, including appraisal, inspection, and legal fees.

- How does my credit score affect my mortgage?

- A higher credit score can help you qualify for better interest rates and terms.

- What is amortization?

- The process of gradually repaying a mortgage through regular payments.

- What happens if I can’t make my mortgage payments?

- The lender may foreclose on the property if payments are not made.

Conclusion

Understanding the meaning and mechanics of a home mortgage is essential for anyone looking to buy a home. A mortgage allows individuals to purchase property with a loan secured against the property itself. By knowing the different types of mortgages, the application process, and potential benefits and challenges, you can make informed decisions and manage your mortgage effectively.

Navigating the mortgage landscape can be complex, but with the right knowledge and preparation, you can secure a mortgage that fits your financial situation and home ownership goals. Make sure to do thorough research, consider all options, and seek professional advice if needed.

mortgage.kbk.news

mortgage.kbk.news