Meaning of Mortgage Loan: Understanding How It Works. A mortgage loan is a fundamental concept in the world of finance, often used by individuals to purchase homes or properties. This type of loan provides buyers the necessary funds to purchase real estate while using the property itself as collateral. For anyone looking to own a home, understanding the intricacies of mortgage loans is crucial. It not only helps potential homeowners make informed decisions but also ensures that they navigate the financial aspects with clarity. This article delves deep into the meaning of mortgage loans, how they work, and the vital elements that come into play when considering one.

What is a Mortgage Loan?

A mortgage loan is a type of loan given by a lender, usually a bank or financial institution, that allows a borrower to purchase a home or property. The borrower agrees to repay the loan over a specific period, typically 15 to 30 years, with interest. If the borrower fails to repay the loan, the lender has the legal right to seize the property. This is what makes a mortgage loan a secured loan—the property acts as collateral.

The primary benefit of a mortgage loan is that it enables individuals to own property without having to pay the full price upfront. Instead, they can make payments over an extended period, making homeownership more accessible.

How Does a Mortgage Loan Work?

Mortgage loans are structured as long-term financial agreements between the lender and the borrower. Here’s how the process works:

- Application: The borrower first applies for the mortgage loan with a lender. This requires a detailed assessment of the borrower’s financial situation, credit history, income, and ability to repay the loan.

- Approval: If the borrower meets the lender’s requirements, the loan is approved. The lender provides the borrower with the amount needed to purchase the property, minus any down payment.

- Repayment: The borrower agrees to repay the loan in monthly installments over a predetermined period. These payments consist of both principal (the original loan amount) and interest.

- Interest Rates: Mortgage loans can either have fixed interest rates, where the interest remains the same throughout the loan term, or variable rates, where the interest can change based on market conditions.

- Loan Default: If the borrower is unable to meet the repayment obligations, the lender has the right to foreclose on the property, selling it to recover the outstanding loan balance.

Types of Mortgage Loans

- Fixed-Rate Mortgage (FRM): This is the most common type of mortgage loan, where the interest rate remains constant for the entire term of the loan. Borrowers prefer this option because it provides stability, knowing that the monthly payments won’t change.

- Adjustable-Rate Mortgage (ARM): In this type, the interest rate is initially fixed for a certain period (usually 3, 5, or 7 years) but then adjusts annually based on the market. While this can lead to lower payments in the initial period, the unpredictability of interest rate fluctuations later can be risky.

- FHA Loans: These are insured by the Federal Housing Administration and are designed for borrowers with lower credit scores or limited funds for a down payment. FHA loans make homeownership more accessible for first-time buyers.

- VA Loans: These are loans guaranteed by the Department of Veterans Affairs and are available to veterans, active-duty service members, and certain members of the National Guard and Reserves. VA loans often come with lower interest rates and don’t require a down payment.

- Jumbo Loans: These are loans that exceed the limits set by Fannie Mae and Freddie Mac. They are used for purchasing high-value properties and typically come with higher interest rates and stricter qualification requirements.

Key Elements of a Mortgage Loan

- Down Payment: Most mortgage loans require a down payment, which is a percentage of the property’s purchase price. The larger the down payment, the less the borrower needs to borrow, reducing overall loan costs.

- Loan Term: This refers to the length of time the borrower has to repay the loan. Common terms are 15 or 30 years. Shorter terms usually come with higher monthly payments but less interest paid overall.

- Interest Rate: The interest rate is the cost of borrowing money. It can be fixed or adjustable, depending on the loan type.

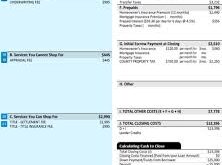

- Closing Costs: These are fees paid at the closing of a real estate transaction. They include appraisal fees, title insurance, and attorney fees, and can range from 2% to 5% of the loan amount.

- Amortization: This is the process of gradually paying off the mortgage loan through monthly payments. Over time, a larger portion of each payment goes toward the principal, while less goes toward interest.

How to Qualify for a Mortgage Loan

To qualify for a mortgage loan, lenders typically look at several factors:

- Credit Score: A good credit score demonstrates the borrower’s reliability and ability to repay the loan. Higher scores generally result in better loan terms and lower interest rates.

- Debt-to-Income Ratio: This measures how much of the borrower’s income goes toward paying off debt. Lenders prefer a lower ratio, typically below 36%.

- Employment History: Stable and consistent employment history assures lenders that the borrower has a steady income to make mortgage payments.

- Down Payment: A larger down payment increases the borrower’s chances of qualifying for a mortgage loan and may result in better loan terms.

- Income Verification: Lenders will verify the borrower’s income to ensure they can afford the monthly payments.

Benefits of Mortgage Loans

- Homeownership: Mortgage loans make it possible for people to own a home without having to pay the full price upfront.

- Building Equity: As borrowers make payments, they gradually build equity in their property, which can later be used for other financial needs.

- Tax Deductions: Mortgage interest payments may be tax-deductible, providing financial benefits to homeowners.

- Fixed Payments: With a fixed-rate mortgage, borrowers can enjoy consistent monthly payments, making budgeting easier.

10 Tips for Getting a Mortgage Loan

- Improve your credit score before applying.

- Save for a larger down payment to reduce loan costs.

- Research different lenders and compare interest rates.

- Understand the difference between fixed and adjustable rates.

- Get pre-approved to streamline the home-buying process.

- Keep your debt-to-income ratio low.

- Don’t make major financial changes before closing.

- Consider loan terms carefully—30 years versus 15 years.

- Budget for closing costs and other fees.

- Stay informed about mortgage interest rate trends.

10 FAQs About Mortgage Loans

- What is a mortgage loan? A mortgage loan is a type of loan used to purchase real estate, where the property serves as collateral.

- How long does a mortgage loan last? Most mortgage loans have terms of 15 or 30 years.

- What is the difference between a fixed-rate and an adjustable-rate mortgage? A fixed-rate mortgage has the same interest rate throughout the loan, while an adjustable-rate mortgage can change over time.

- Can I qualify for a mortgage with a low credit score? Yes, FHA loans are designed for borrowers with lower credit scores.

- What happens if I can’t make my mortgage payments? If you default, the lender may foreclose on your property.

- How much do I need for a down payment? The standard down payment is usually 20%, but some loans, like FHA loans, require less.

- Can I pay off my mortgage early? Yes, but check if there are any prepayment penalties with your lender.

- What are closing costs? Closing costs include fees associated with the home purchase, such as appraisal and attorney fees.

- Can I refinance my mortgage? Yes, refinancing allows you to replace your current loan with a new one, often with better terms.

- Is mortgage insurance required? Private mortgage insurance (PMI) is required if your down payment is less than 20%.

Conclusion

A mortgage loan is an essential financial tool for anyone looking to purchase real estate. It allows individuals to own property by borrowing the funds they need and repaying them over time. By understanding the basics of mortgage loans, their types, and the qualification process, potential homeowners can make informed decisions. Whether it’s choosing between a fixed or adjustable rate, or determining the right down payment amount, knowledge of mortgage loans empowers buyers to achieve their homeownership dreams confidently. Ultimately, the right mortgage loan can make homeownership not only achievable but also financially manageable.

Related Posts:

- Collateral Mortgage Meaning: A Comprehensive Guide

- Mortgage Meaning in Finance: A Comprehensive Guide

- Mortgage Meaning in Finance: Definition, Types, and Benefits

- First Mortgage Meaning: Understanding What It Means…

- Primary Mortgage Meaning: Understanding the Core Concepts

- Mortgage Lien Meaning: A Guide to Understanding Lien…

mortgage.kbk.news

mortgage.kbk.news