Ramram Adminna

February 7, 2025 Mortgage Meaning

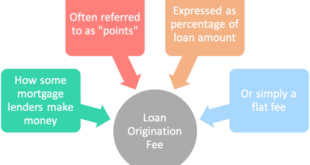

Mortgage Origination Fee: What It Is and How to Reduce It. When applying for a mortgage, borrowers encounter various fees, one of the most significant being the mortgage origination fee. This cost is charged by lenders to process and approve the loan, often calculated as a percentage of the total loan amount. Understanding this fee, how it works, and ways …

Read More »

Ramram Adminna

February 7, 2025 Mortgage Meaning

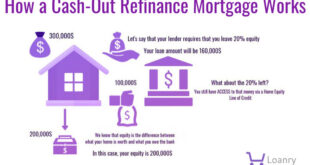

Mortgage Refinancing Explained: Lowering Your Loan Costs. Mortgage refinancing is a financial strategy that allows homeowners to replace their existing home loan with a new one, often with better terms. Whether you want to reduce your interest rate, shorten your loan term, or access home equity, refinancing can provide significant benefits. However, understanding the process, costs, and potential drawbacks is …

Read More »

Ramram Adminna

February 6, 2025 Mortgage Calculator

Mortgage Loan Process: Guide to Homeownership. Buying a home is an exciting milestone, but securing a mortgage loan can be complex. Understanding the mortgage loan process can help you navigate it smoothly and avoid common pitfalls. This guide will walk you through each step, ensuring you are well-prepared for homeownership. Understanding the Mortgage Loan Process The mortgage loan process consists …

Read More »

Ramram Adminna

February 6, 2025 Mortgage Meaning

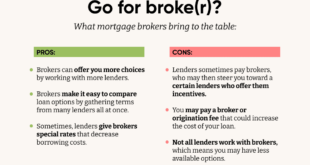

Mortgage Broker Meaning: Everything You Need to Know. A mortgage broker is an intermediary who connects borrowers with lenders to facilitate home loans. Instead of dealing directly with banks, homebuyers can work with mortgage brokers to find the best interest rates and loan options available. This article provides a comprehensive guide to understanding mortgage brokers, their roles, benefits, and how …

Read More »

Ramram Adminna

February 6, 2025 Mortgage Meaning

Mortgage Insurance Meaning: Understanding How It Works. Mortgage insurance is a financial safeguard that protects lenders in case borrowers default on their home loans. It is commonly required when a homebuyer makes a down payment of less than 20% of the home’s purchase price. Mortgage insurance can come in different forms, including private mortgage insurance (PMI) for conventional loans and …

Read More »

Ramram Adminna

February 6, 2025 Mortgage Meaning

Fixed Mortgage Rate: Learning Before Choosing One. A fixed mortgage rate is a popular home financing option that provides stability and predictability in monthly payments. Whether you’re a first-time homebuyer or refinancing, understanding the intricacies of a fixed mortgage rate can help you make an informed decision. This article will explore what a fixed mortgage rate is, how it compares …

Read More »

Ramram Adminna

February 5, 2025 Mortgage Meaning

Mortgage Loan Approval: A Guide to Getting Approved Fast. Obtaining mortgage loan approval is a critical step in purchasing a home. The process can be complex, with multiple factors influencing your chances of approval. Lenders evaluate credit scores, income, employment history, and debt-to-income ratio before making a decision. This guide will walk you through everything you need to know about …

Read More »

Ramram Adminna

February 5, 2025 Mortgage Meaning

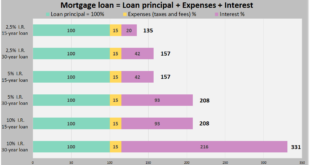

Mortgage Payment Terms: Everything You Need to Know. Understanding mortgage payment terms is essential for anyone looking to buy a home or refinance an existing loan. The terms of your mortgage determine how much you pay each month, the length of your loan, and the total cost over time. In this comprehensive guide, we will explore mortgage payment terms, their …

Read More »

Ramram Adminna

February 5, 2025 Mortgage Meaning

Adjustable Mortgage Rates: Things Before Choosing One. Adjustable mortgage rates (ARMs) are home loan interest rates that fluctuate over time based on a predetermined index. Unlike fixed-rate mortgages, where interest remains constant, ARMs start with a lower initial rate that adjusts periodically. How Adjustable Mortgage Rates Work ARMs typically begin with an introductory period with a fixed interest rate, often …

Read More »

Ramram Adminna

February 5, 2025 Mortgage Meaning

Mortgage Rates Explained: Mortgage Rates Explained: Home Loan Interest Rates. Mortgage rates play a crucial role in determining the overall cost of buying a home. Understanding how these rates work, what influences them, and how to secure the best rate can save homeowners thousands of dollars over the life of a loan. This guide explains everything you need to know …

Read More »

Ramram Adminna

February 4, 2025 Mortgage Meaning

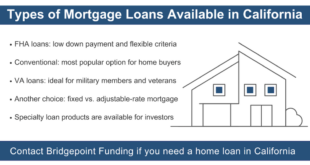

Mortgage Loan Types: Guide to Choosing the Right One. When purchasing a home, selecting the right mortgage loan is one of the most critical decisions you’ll make. Various mortgage loan types cater to different financial situations and preferences. Understanding each type can help you secure the best deal and save thousands over time. What Are Mortgage Loan Types? Mortgage loan …

Read More »

Ramram Adminna

February 4, 2025 Mortgage Meaning

Types of Mortgages: Guide to Choosing the Right Home Loan. When purchasing a home, selecting the right type of mortgage is crucial. Different mortgages offer varying benefits, interest rates, and repayment terms. Understanding these mortgage types can help borrowers make informed financial decisions. This article will explore various mortgage options, their advantages, and how to choose the best one for …

Read More »

Ramram Adminna

February 4, 2025 Mortgage Meaning

Mortgage Meaning in Finance: Definition, Types, and Benefits. A mortgage is a financial agreement where a borrower secures a loan using real estate property as collateral. This type of loan is commonly used to purchase homes, commercial properties, or refinance existing debt. The borrower agrees to repay the loan in installments over a specified period, typically ranging from 10 to …

Read More »

Ramram Adminna

February 4, 2025 Mortgage Meaning

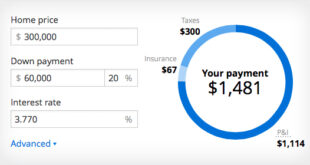

Mortgage Calculator Meaning: Why You Need One. A mortgage calculator is a valuable financial tool that helps individuals estimate their monthly mortgage payments based on loan amount, interest rate, loan term, and other associated costs. Understanding the meaning and functionality of a mortgage calculator is essential for anyone planning to buy a home or refinance an existing loan. In this …

Read More »

Ramram Adminna

February 3, 2025 Mortgage Meaning

Home Mortgage Meaning: Guide to Understanding Home Loans. A home mortgage is a loan that allows individuals to purchase a home by borrowing money from a lender. This loan is repaid over time with interest, and the property serves as collateral. Understanding home mortgages is essential for anyone looking to buy a home or refinance an existing loan. In this …

Read More »

mortgage.kbk.news

mortgage.kbk.news