Ramram Adminna

January 29, 2025 Mortgage Banks

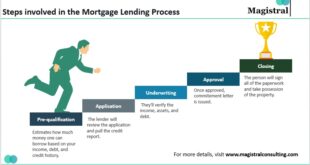

Streamlined Loan Mortgage Banks: Home Financing Process. In today’s fast-paced world, homebuyers and homeowners alike are constantly looking for ways to simplify their mortgage process. A streamlined loan mortgage can make the entire experience smoother, faster, and more affordable. In this article, we will explore what streamlined loan mortgage banks are, how they work, and why they might be the …

Read More »

Ramram Adminna

January 29, 2025 Mortgage Banks

Veteran-Friendly Mortgage Banks: Home Financing Options. In today’s housing market, veterans and active military personnel have unique opportunities when it comes to home financing. Veteran-friendly mortgage banks offer specialized services that cater to the needs of those who have served our country. These institutions not only provide favorable loan terms but also understand the complexities veterans face when purchasing a …

Read More »

Ramram Adminna

January 29, 2025 Mortgage Banks

Adjustable-Rate Loan Banks: Guide to Choosing the Right Bank. In the world of mortgage and financing, adjustable-rate loans have gained popularity among borrowers seeking flexibility in their interest rates. Choosing the right bank for an adjustable-rate loan is crucial in ensuring financial stability and long-term affordability. This guide will help you understand how adjustable-rate loan banks work, their benefits and …

Read More »

Ramram Adminna

January 29, 2025 Mortgage Banks

First-Time Buyer Friendly Banks: Guide to Finding the Best Deals. In today’s competitive market, first-time home buyers are often overwhelmed with the process of securing a mortgage. The landscape of home loans can be complicated, but knowing which banks offer favorable conditions for first-time buyers can make a huge difference. This guide will walk you through what to look for …

Read More »

Ramram Adminna

January 28, 2025 Mortgage Banks

Easiest Mortgage Banks for Approval: Securing Your Home Loan. Securing a mortgage is a significant milestone for anyone looking to purchase a home. However, the process can often feel overwhelming, especially for first-time buyers. One of the most important steps in this journey is choosing the right mortgage lender. Some banks and lending institutions are known for their easier approval …

Read More »

Ramram Adminna

January 28, 2025 Mortgage Banks

Top Mortgage Bank Offers USA: Best Deals for 2025 Homebuyers. When you’re looking to buy a home in the USA, the choice of a mortgage lender can make a big difference in your overall financial picture. With a range of mortgage products, interest rates, and terms to choose from, selecting the best mortgage bank is crucial. In this article, we …

Read More »

Ramram Adminna

January 28, 2025 Mortgage Banks

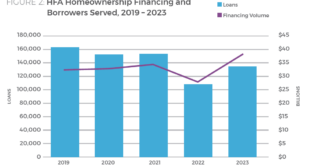

Mortgage Banks for Low-Income Families: Homeownership. For many low-income families, purchasing a home can seem like an unattainable dream. However, mortgage banks that specialize in assisting low-income individuals can provide crucial opportunities for homeownership. In this article, we’ll explore the best mortgage banks for low-income families, the types of loans they offer, and the steps you need to take to …

Read More »

Ramram Adminna

January 28, 2025 Mortgage Banks

Reverse Mortgage Banks Near Me: Choosing the Right Lender. Reverse mortgages can be a powerful financial tool for seniors looking to leverage the equity in their homes for retirement income. However, finding the right reverse mortgage bank near you is essential to ensure a smooth process and favorable terms. In this guide, we will delve into what reverse mortgages are, …

Read More »

Ramram Adminna

January 27, 2025 Mortgage Banks

Mortgage Banks for Small Businesses: Opportunities for Growth. In today’s dynamic economy, securing reliable financing is critical for small businesses aiming to expand, innovate, or simply sustain operations. Mortgage banks are increasingly becoming a vital resource for small businesses, offering tailored financial solutions to meet diverse needs. This article explores how mortgage banks can empower small businesses, detailing the processes, …

Read More »

Ramram Adminna

January 27, 2025 Mortgage Banks

Transparent Lending Mortgage Banks: Ethical Home Financing. In today’s dynamic financial market, finding a trustworthy mortgage bank is paramount. Transparent lending practices not only foster trust but also ensure borrowers make informed decisions. In this guide, we’ll explore how transparent lending mortgage banks operate, their benefits, and how to identify ethical lenders for your home financing needs. What Are Transparent …

Read More »

Ramram Adminna

January 27, 2025 Mortgage Banks

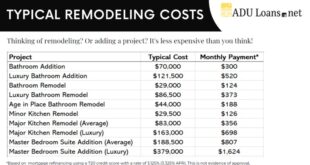

Mortgage Banks for Renovation Loans: Funding Home. Renovating your home can be both an exciting and challenging experience, especially when it comes to securing the right financing. Mortgage banks for renovation loans provide a streamlined way to fund your home improvement projects while keeping costs manageable. Whether you’re upgrading your kitchen, adding an extension, or enhancing energy efficiency, understanding your …

Read More »

Ramram Adminna

January 27, 2025 Mortgage Banks

Best Hybrid Mortgage Banks: Choosing the Right Lender. In the world of home loans, hybrid mortgages have gained traction due to their flexibility and unique advantages. But with numerous lenders available, choosing the best hybrid mortgage bank can be a daunting task. This article delves into the top hybrid mortgage banks, what makes them stand out, and how you can …

Read More »

Ramram Adminna

January 26, 2025 Mortgage Banks

Specialized Mortgage Banks USA: Best Lender for Your Needs. When it comes to securing a mortgage, choosing the right lender is crucial to ensuring you get the best deal for your financial situation. While traditional banks offer standard mortgage products, specialized mortgage banks in the USA can provide tailored solutions to meet specific needs. Whether you’re a first-time homebuyer, looking …

Read More »

Ramram Adminna

January 26, 2025 Mortgage Banks

Affordable Rural Mortgage Banks: Finding the Best Options. Affordable rural mortgage banks are a crucial resource for individuals looking to finance homes in rural areas. These banks cater specifically to the needs of rural homebuyers, offering unique loan programs and terms that make homeownership more accessible. In this article, we explore everything you need to know about affordable rural mortgage …

Read More »

Ramram Adminna

January 25, 2025 Mortgage Banks

Interest-Only Loan Mortgage Banks: Your Complete Guide. In the ever-evolving world of mortgages, interest-only loans have emerged as a unique and flexible option for specific borrowers. Interest-only loan mortgage banks offer products tailored to individuals seeking lower initial payments. But what exactly are interest-only loans, and how do they differ from traditional mortgages? This article dives deep into the workings …

Read More »

mortgage.kbk.news

mortgage.kbk.news