Ramram Adminna

January 21, 2025 Mortgage Banks

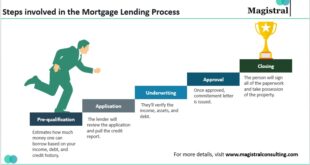

Banks with Streamlined Mortgage Process: Home Loans. Finding a mortgage lender that offers a streamlined process can be a game changer, especially for homebuyers looking for a hassle-free loan experience. Traditional mortgage processes can be lengthy and filled with paperwork, causing unnecessary stress. However, banks with streamlined mortgage processes aim to make securing a home loan as smooth and quick …

Read More »

Ramram Adminna

January 21, 2025 Mortgage Banks

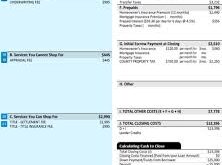

Mortgage Banks with Low Closing Costs: Home Financing. When looking for a mortgage, one of the crucial factors to consider is the closing cost. Closing costs can significantly impact the affordability of your home loan, but with the right mortgage bank, you can minimize these fees. This article will explore mortgage banks with low closing costs, how to find them, …

Read More »

Ramram Adminna

January 20, 2025 Mortgage Banks

Mortgage Banks Offering Discounts: Saving on Your Mortgage. When you’re looking to buy a home or refinance your mortgage, finding the best deal is crucial. One of the ways to get a better deal is by taking advantage of mortgage banks offering discounts. These discounts can range from reduced interest rates to waived fees, all designed to make homeownership more …

Read More »

Ramram Adminna

January 20, 2025 Mortgage Banks

Top Mortgage Banks for Teachers: Best Financing Options. Teachers play a vital role in shaping future generations, and their dedication often goes unnoticed, especially when it comes to financial matters. For many teachers, purchasing a home can be a challenging endeavor due to their unique financial circumstances. However, several mortgage banks offer specialized programs and benefits tailored to educators to …

Read More »

Ramram Adminna

January 20, 2025 Mortgage Banks

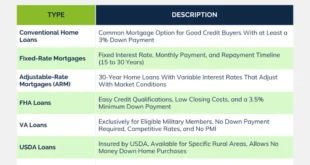

Adjustable Loan Mortgage Banks: Choosing the Right Lender. When considering a mortgage, one of the most critical decisions you’ll face is choosing between a fixed-rate mortgage and an adjustable-rate mortgage (ARM). Adjustable-rate mortgages, offered by various adjustable loan mortgage banks, provide a way to secure lower interest rates in the initial years, which can be appealing for many borrowers. However, …

Read More »

Ramram Adminna

January 20, 2025 Mortgage Banks

Mortgage Banks for High-Income Earners: A Comprehensive Guide. High-income earners often have unique financial needs when it comes to securing a mortgage. Mortgage banks tailored for this demographic offer specialized services, competitive rates, and exclusive benefits. Understanding how these banks operate and identifying the best options can significantly impact long-term financial goals. This guide explores everything high-income earners need to …

Read More »

Ramram Adminna

January 19, 2025 Mortgage Banks

Home Equity Loan Mortgage Banks: A Comprehensive Guide. Home equity loans have become a popular choice for homeowners seeking financial solutions. Mortgage banks play a crucial role in facilitating these loans, offering tailored options for borrowers. In this article, we delve deep into the world of home equity loans, focusing on mortgage banks’ role, benefits, processes, and key considerations. Whether …

Read More »

Ramram Adminna

January 19, 2025 Mortgage Banks

Nationwide Mortgage Bank Reviews:Best Mortgage Provider. Nationwide Mortgage Bank is a prominent player in the mortgage industry, offering a range of financial solutions to meet the diverse needs of homebuyers and homeowners. In this article, we will provide an in-depth review of Nationwide Mortgage Bank, explore its key features, and offer insights to help you decide whether it’s the right …

Read More »

Ramram Adminna

January 19, 2025 Mortgage Banks

Highly Rated Mortgage Banks: Best Lender for Home Loan. When it comes to securing a mortgage, one of the most important steps is finding a reputable lender. Highly rated mortgage banks can make the difference between a smooth, stress-free home-buying experience and a complicated, frustrating one. Choosing the right lender not only ensures competitive rates and favorable terms, but it …

Read More »

Ramram Adminna

January 19, 2025 Mortgage Banks

Banks Specializing in Refinancing: Guide to Better Loan Options. Refinancing your loans can be a powerful way to lower monthly payments, reduce interest rates, or adjust the term of your loan. Banks specializing in refinancing cater to customers seeking these benefits by offering tailored solutions to meet specific financial goals. In this article, we’ll explore what refinancing entails, the advantages …

Read More »

Ramram Adminna

January 18, 2025 Mortgage Banks

Green Energy Mortgage Banks: Sustain Path to Homeownership. Green energy mortgage banks are becoming increasingly popular as homeowners seek eco-friendly options for financing their properties. These specialized banks offer loans that promote energy-efficient home improvements and sustainable living, making it easier for individuals to contribute to environmental preservation while enjoying the benefits of a modern home. Section 1: What Are …

Read More »

Ramram Adminna

January 18, 2025 Mortgage Banks

Best Small Mortgage Banks: Choose the Right One for Home Loan. When it comes to securing a mortgage, choosing the right bank is crucial for your financial future. While large, national banks often dominate the scene, smaller mortgage banks can provide highly competitive rates and personalized service that may better suit your unique needs. In this article, we’ll explore the …

Read More »

Ramram Adminna

January 18, 2025 Mortgage Banks

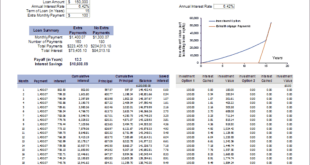

Mortgage Bank Loan Calculators: Making Financial Decisions. When it comes to buying a home, understanding your financing options is crucial. One of the most valuable tools available today is the mortgage bank loan calculator, a tool that helps potential homeowners determine how much they can afford to borrow and how much their monthly payments will be. By using a mortgage …

Read More »

Ramram Adminna

January 18, 2025 Mortgage Banks

Top-Performing Mortgage Banks in the USA: Lender for Home Loan. When searching for a mortgage to purchase a home or refinance, choosing the right mortgage bank is one of the most important decisions you will make. The landscape of mortgage lenders in the USA is vast, but top-performing banks offer competitive rates, strong customer service, and a variety of loan …

Read More »

Ramram Adminna

January 17, 2025 Mortgage Banks

Mortgage Banks for Rural Properties: Financing Your Rural Dream. When it comes to purchasing rural properties, finding the right financing option can be a challenge. Traditional mortgage lenders often focus on urban and suburban areas, leaving those interested in rural properties to navigate a more complicated landscape. However, mortgage banks for rural properties specialize in providing tailored solutions for buyers …

Read More »

mortgage.kbk.news

mortgage.kbk.news