Ramram Adminna

January 17, 2025 Mortgage Banks

Competitive Mortgage Bank Offers: Best Deals for Your Home Loan. When it comes to buying a home or refinancing an existing mortgage, one of the most important factors to consider is finding a competitive mortgage bank offer. With so many options available, choosing the right one can be overwhelming. However, understanding the competitive offers in the mortgage market and how …

Read More »

Ramram Adminna

January 17, 2025 Mortgage Banks

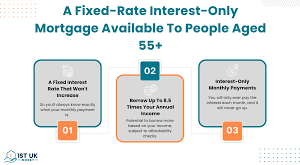

Mortgage Banks for Retirees: Right Bank for Your Financial Future. When you retire, managing your finances becomes more important than ever, and one of the key considerations is your mortgage. For many retirees, finding the right mortgage bank that offers favorable terms and services tailored to their unique needs is crucial. This article will explore what retirees should look for …

Read More »

Ramram Adminna

January 17, 2025 Mortgage Banks

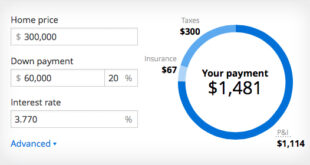

Affordable Fixed Mortgage Banks: Find the Best Rates and Deals. When you’re ready to purchase a home, securing a mortgage loan with affordable rates is crucial for long-term financial stability. Among the different types of mortgages available, fixed-rate mortgages are popular due to their predictable monthly payments. But how do you find the most affordable fixed-rate mortgage from the right …

Read More »

Ramram Adminna

January 16, 2025 Mortgage Banks

Mortgage Banks with No Fees: Fee-Free Mortgage Solutions. For many homebuyers and those refinancing their mortgages, the fees associated with a mortgage loan can be one of the most frustrating aspects of the process. From application fees to closing costs, these additional charges can significantly increase the total cost of homeownership. Fortunately, there are mortgage banks with no fees that …

Read More »

Ramram Adminna

January 16, 2025 Mortgage Banks

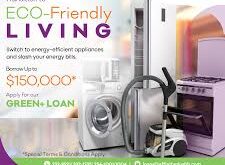

Eco-Friendly Mortgage Banks USA: Sustainable Financing. In recent years, environmental concerns have been at the forefront of many industries, and the mortgage industry is no exception. Eco-friendly mortgage banks in the USA are gaining popularity as more people prioritize sustainability. These financial institutions offer a variety of green mortgage products designed to promote energy efficiency, reduce carbon footprints, and encourage …

Read More »

Ramram Adminna

January 16, 2025 Mortgage Banks

VA Loan Mortgage Banks: Guide to Choosing the Right Lender. For veterans, active-duty service members, and eligible surviving spouses, the VA loan program offers an invaluable opportunity to secure home financing with favorable terms. VA loan mortgage banks play a crucial role in facilitating access to these loans, helping applicants navigate the process and make informed decisions. In this guide, …

Read More »

Ramram Adminna

January 16, 2025 Mortgage Banks

Mortgage Banks for Self-Employed: Guide to Securing a Loan. For self-employed individuals, securing a mortgage can be a daunting process due to fluctuating incomes and additional documentation requirements. However, understanding how mortgage banks cater to the self-employed can help you navigate the process with confidence. This article offers a complete guide to finding and securing the best mortgage options tailored …

Read More »

Ramram Adminna

January 15, 2025 Mortgage Banks

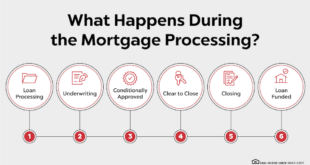

Online Application Mortgage Banks: Your Home Loan Journey. Applying for a mortgage online has revolutionized the way people secure home loans. With the advent of online application mortgage banks, the process has become faster, more transparent, and less cumbersome. Whether you are a first-time homebuyer or looking to refinance your existing mortgage, understanding how online mortgage applications work can save …

Read More »

Ramram Adminna

January 15, 2025 Mortgage Banks

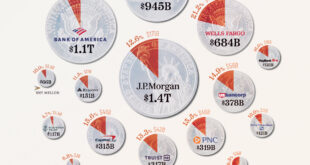

Banks Specializing in Mortgages: A Comprehensive Guide. When it comes to securing a mortgage, choosing the right bank can make a significant difference. Banks specializing in mortgages are equipped with tailored loan options, competitive rates, and expert advisors to guide you through the process. This article will provide an in-depth overview of such banks, their benefits, and how to choose …

Read More »

Ramram Adminna

January 15, 2025 Mortgage Banks

Top 10 Mortgage Banks 2024: Your Comprehensive Guide. The mortgage industry continues to evolve, and finding the right lender is crucial for securing a favorable home loan. Here, we present the Top 10 Mortgage Banks 2024, helping you navigate the best options for your financial needs. Whether you’re a first-time homebuyer or looking to refinance, these banks stand out for …

Read More »

Ramram Adminna

January 15, 2025 Mortgage Banks

Efficient Mortgage Banks USA: Finding the Best Mortgage Lender. Finding the right mortgage lender is a crucial step when buying a home. Among the numerous options available, efficient mortgage banks in the USA stand out for their streamlined processes, competitive rates, and customer service. This guide will help you understand what makes a mortgage bank efficient, how to identify them, …

Read More »

Ramram Adminna

January 14, 2025 Mortgage Banks

High-Value Mortgage Bank Deals: Offers for Your Dream Home. Securing the right mortgage is one of the most significant steps toward homeownership. High-value mortgage bank deals can provide favorable terms, low-interest rates, and flexible repayment options, making them an excellent choice for homebuyers seeking substantial loans. In this guide, we will explore everything you need to know about these deals, …

Read More »

Ramram Adminna

January 14, 2025 Mortgage Banks

First-Time Buyer Mortgage Banks: Mortgage Lender for Home. Buying a home for the first time is a significant milestone. However, for many first-time buyers, navigating the world of mortgages can be overwhelming. The process involves understanding various loan types, interest rates, down payments, and finding the right lender. One of the most crucial decisions you’ll make is choosing the right …

Read More »

Ramram Adminna

January 14, 2025 Mortgage Banks

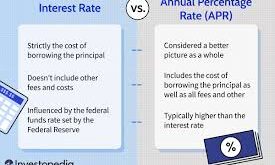

Mortgage Banks with Lowest APR: Best Rates for Your Home Loan. When looking to finance your dream home, the interest rate can make a significant difference in your monthly payments and overall financial stability. Mortgage banks with the lowest APR (Annual Percentage Rate) offer homeowners a chance to save substantially over the life of their loan. In this article, we …

Read More »

Ramram Adminna

January 14, 2025 Mortgage Banks

Quick Mortgage Bank Approval: Guide to Fast Home Financing. Obtaining a mortgage can be a daunting task, but with the right strategies, you can secure quick mortgage bank approval. This comprehensive guide will help you understand the process, avoid common pitfalls, and fast-track your way to homeownership. Let’s dive into how you can achieve your dream of owning a home …

Read More »

mortgage.kbk.news

mortgage.kbk.news