Ramram Adminna

January 13, 2025 Mortgage Banks

Leading Mortgage Banks in America: Guide for 2025. When it comes to securing a mortgage in the United States, choosing the right lender can make all the difference. Leading mortgage banks in America have built reputations for their reliability, customer service, and competitive rates. This guide will explore the top mortgage banks, their unique offerings, and how to choose the …

Read More »

Ramram Adminna

January 13, 2025 Mortgage Banks

Transparent Mortgage Bank Policies: Informed Financial Decisions. When it comes to securing a mortgage, understanding the terms and conditions can be daunting. Transparent mortgage bank policies not only build trust but also empower borrowers to make informed financial decisions. In this article, we’ll explore the significance of transparency, its benefits for borrowers, and practical tips for navigating the mortgage process …

Read More »

Ramram Adminna

January 13, 2025 Mortgage Banks

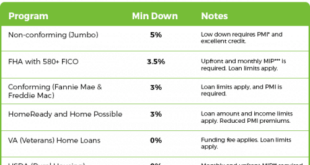

Mortgage Banks for Low Down Payments: Your Complete Guide. Buying a home is a major milestone, but one of the biggest hurdles for many potential homeowners is saving for a large down payment. Fortunately, numerous mortgage banks offer solutions tailored for low down payment options, making homeownership more accessible than ever. This article explores everything you need to know about …

Read More »

Ramram Adminna

January 13, 2025 Mortgage Banks

Top-Rated Mortgage Banks Online: Finding the Best Options. In today’s digital age, finding a reliable mortgage bank online is easier than ever. Whether you’re purchasing a home or refinancing, accessing the right financial institution can save you time, money, and stress. This article will guide you through the top-rated mortgage banks available online, tips for choosing the right one, and …

Read More »

Ramram Adminna

January 12, 2025 Mortgage Banks

Best Mortgage Banks for Investors: Top Options for Boost Returns. When investing in real estate, choosing the right mortgage bank can make or break your success. The ideal mortgage bank not only offers competitive rates but also provides investor-friendly loan products and excellent customer support. Here, we’ll explore the best mortgage banks for investors, their unique offerings, and how they …

Read More »

Ramram Adminna

January 12, 2025 Mortgage Banks

Mortgage Banks for Bad Credit: Guide to Finding the Right Loan. If you have bad credit, securing a mortgage might feel like an uphill battle. However, there are mortgage banks specifically designed to cater to individuals in your situation. In this guide, we’ll explore how these institutions work, provide tips to improve your chances, and answer frequently asked questions to …

Read More »

Ramram Adminna

January 11, 2025 Mortgage Banks

Adjustable-Rate Mortgage Banks: What You Need to Know. Adjustable-rate mortgages (ARMs) have long been a preferred choice for borrowers seeking flexibility and potentially lower initial payments. For those considering this option, understanding adjustable-rate mortgage banks is essential. In this comprehensive guide, we delve into the intricacies of ARMs, the role of banks offering these loans, and practical tips for borrowers. …

Read More »

Ramram Adminna

January 11, 2025 Mortgage Banks

Trusted Mortgage Banks USA: Guide to Choosing the Best Option. When it comes to securing a mortgage, finding a trusted mortgage bank is crucial. The USA offers a plethora of options, but identifying the right one can make all the difference in your home-buying journey. This comprehensive guide will walk you through everything you need to know about trusted mortgage …

Read More »

Ramram Adminna

January 10, 2025 Mortgage Banks

Mortgage Banks with Fixed Rates: A Comprehensive Guide. Fixed-rate mortgages are among the most popular home financing options for borrowers seeking stability and predictability. In this article, we’ll explore mortgage banks offering fixed rates, what they entail, their benefits, how to choose the right lender, and essential tips for securing the best deal. Whether you’re a first-time homebuyer or refinancing …

Read More »

Ramram Adminna

January 10, 2025 Mortgage Banks

Flexible Mortgage Banks USA: Guide to Finding the Best Options. In today’s fast-paced world, finding a mortgage solution that fits your lifestyle and financial needs is essential. Flexible mortgage banks in the USA offer a variety of products designed to cater to diverse preferences, making homeownership more accessible and manageable. This article delves into what flexible mortgages are, the benefits …

Read More »

Ramram Adminna

January 10, 2025 Mortgage Banks

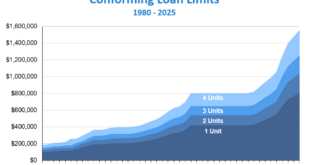

Banks Offering Jumbo Mortgages: Your Comprehensive Guide. Jumbo mortgages are a unique type of home loan designed for properties exceeding the conventional loan limits set by the Federal Housing Finance Agency (FHFA). These loans are ideal for borrowers purchasing high-value homes, but they come with distinct requirements and benefits. If you’re considering a jumbo mortgage, finding the right bank to …

Read More »

Ramram Adminna

January 10, 2025 Mortgage Banks

Local Mortgage Banks USA: Guide to Choosing the Best Option. When it comes to financing a home, local mortgage banks in the USA offer unparalleled advantages, including personalized service, community focus, and competitive rates. Choosing the right lender can make the home-buying process smoother and more enjoyable. In this article, we’ll explore everything you need to know about local mortgage …

Read More »

Ramram Adminna

January 9, 2025 Mortgage Banks

Nationwide Mortgage Banks 2024: A Comprehensive Guide. In 2024, the landscape of mortgage lending continues to evolve, with nationwide mortgage banks playing a pivotal role in helping individuals and families achieve homeownership. These institutions offer diverse loan options, competitive rates, and streamlined services to meet the demands of today’s borrowers. Whether you are a first-time homebuyer or looking to refinance, …

Read More »

Ramram Adminna

January 9, 2025 Mortgage Banks

Best Mortgage Banks for Veterans: Benefits of VA Home Loans. Veterans seeking to secure a home loan often face a unique set of financial needs and opportunities. Fortunately, many mortgage banks specialize in providing tailored solutions for veterans, offering exclusive benefits through VA home loans. This guide will help you navigate the best mortgage banks for veterans and understand how …

Read More »

Ramram Adminna

January 9, 2025 Mortgage Banks

Online Mortgage Banks 2024: Guide to Finding the Best Lenders. In recent years, the mortgage industry has undergone a significant transformation, especially with the rise of online mortgage banks. These institutions are gaining traction due to their convenience, accessibility, and competitive interest rates. As we head into 2024, understanding the landscape of online mortgage banks is crucial for anyone considering …

Read More »

mortgage.kbk.news

mortgage.kbk.news