Ramram Adminna

December 18, 2024 Mortgage Rates

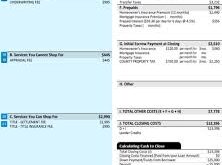

Home Equity Loan Rates: Guide for Smart Borrowers. Home equity loans are a popular financial tool for homeowners looking to leverage the equity in their property. Understanding home equity loan rates is essential to ensure you make informed decisions and secure the best deal for your financial needs. This article delves deep into the factors that influence these rates, how …

Read More »

Ramram Adminna

December 17, 2024 Mortgage Rates

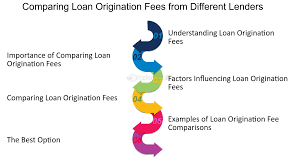

Lender Fees Comparison: Guide to Save Money on Loans. When applying for a loan, understanding lender fees is crucial. These fees can significantly impact the total cost of borrowing, and comparing them across different lenders ensures you get the best deal. This guide delves into lender fees, providing tips and answers to common questions, to help you make informed financial …

Read More »

Ramram Adminna

December 17, 2024 Mortgage Rates

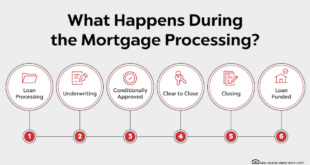

Mortgage Rate Negotiation: Guide to Securing the Best Deals. Securing a mortgage can be one of the most significant financial decisions in your life. Understanding the art of mortgage rate negotiation is essential for saving money and getting the best terms on your loan. This guide will provide you with insights into how mortgage rates work, strategies for effective negotiation, …

Read More »

Ramram Adminna

December 17, 2024 Mortgage Rates

Benefits of Refinancing Today: Unlocking Financial Freedom. Refinancing has become a powerful financial tool for homeowners and individuals seeking to optimize their finances. Whether it’s reducing monthly payments, shortening loan terms, or securing a lower interest rate, refinancing offers numerous benefits. Let’s dive into the advantages, essential tips, and frequently asked questions to help you make the most informed decision …

Read More »

Ramram Adminna

December 17, 2024 Mortgage Rates

Lender Fees Comparison: Guide to Save on Loan Costs. When applying for a loan, understanding lender fees is crucial to ensure you get the best deal possible. Comparing these fees can save you significant money over the life of your loan. This article explores everything you need to know about lender fees, how to compare them effectively, and tips to …

Read More »

Ramram Adminna

December 16, 2024 Mortgage Rates

Mortgage Rate Negotiation: Guide to Lower Your Loan Costs. Mortgage rate negotiation is a critical step in securing a favorable home loan deal. With the right strategies, you can save thousands of dollars over the life of your mortgage. This article provides an in-depth guide to help you understand the process, optimize your negotiation tactics, and achieve the best possible …

Read More »

Ramram Adminna

December 16, 2024 Mortgage Rates

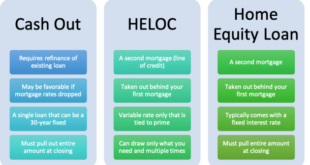

Benefits of Refinancing Today: Savings and Financial Freedom. Refinancing your mortgage or loan can be a strategic financial move, especially in today’s economic climate. By understanding the benefits of refinancing, you can take control of your finances, reduce costs, and achieve your long-term financial goals. This article explores the advantages of refinancing, offers practical tips, and answers common questions to …

Read More »

Ramram Adminna

December 16, 2024 Mortgage Rates

Home Equity Loan Rates: Everything You Need to Know in 2024. Home equity loans are a popular financial tool for homeowners who want to access the value of their property without selling it. However, understanding home equity loan rates is essential to making informed decisions. In this comprehensive guide, we will explore how these rates work, factors affecting them, tips …

Read More »

Ramram Adminna

December 16, 2024 Mortgage Rates

Mortgage Points Explained: Saving Money on Your Home Loan. Mortgage points can be a valuable tool for homeowners looking to save on their long-term mortgage costs. This guide breaks down what mortgage points are, how they work, and whether they’re a smart choice for your financial situation. Understanding these details will help you make an informed decision when negotiating your …

Read More »

Ramram Adminna

December 15, 2024 Mortgage Rates

Long-Term Fixed Rates: Benefits and Key Considerations. In today’s ever-changing financial landscape, securing stability is often a top priority for individuals and businesses alike. Long-term rigid rates offer a solution to the uncertainties of fluctuating interest rates. In this comprehensive guide, we’ll explore what long-term fixed rates are, their benefits, key considerations, and how to make the most of this …

Read More »

Ramram Adminna

December 15, 2024 Mortgage Rates

Short-Term Loan Options: Making Smart Financial Choices. Short-term loans provide a convenient financial solution for individuals who need quick access to funds. Whether you’re facing unexpected expenses, covering gaps in your budget, or planning for a specific short-term need, these loans can offer relief. This article explores various short-term loan options, their benefits, drawbacks, and tips for making informed decisions. …

Read More »

Ramram Adminna

December 14, 2024 Mortgage Rates

15-Year Mortgage Savings: Benefits of Short-Term Home Loans. Purchasing a home is one of the most significant financial commitments a person can make, and selecting the right mortgage plan is crucial. A 15-year mortgage, while demanding higher monthly payments than a 30-year loan, offers substantial financial benefits that can save homeowners thousands of dollars in the long term. Here, we …

Read More »

Ramram Adminna

December 14, 2024 Mortgage Rates

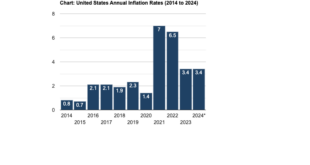

Economic Impact on Rates: Understanding the Factors and Trends. The economic impact on rates plays a crucial role in shaping financial markets, personal finances, and business operations. Understanding how economic conditions influence interest rates can help individuals and businesses make informed decisions. This article delves into the key factors that affect rates, their consequences, and actionable strategies for navigating these …

Read More »

Ramram Adminna

December 13, 2024 Mortgage Rates

Impact of Inflation on Loans: How Rising Prices Affect Borrowers. Inflation, the gradual increase in the prices of goods and services, has a profound impact on various aspects of the economy, including loans. Whether you’re a borrower or lender, understanding how inflation affects loan agreements, interest rates, and repayment capabilities is essential. This article explores the intricate relationship between inflation …

Read More »

Ramram Adminna

December 13, 2024 Mortgage Rates

High Credit Score Benefits: Unlocking Financial Freedom. A high credit score can be a game-changer in personal finance, offering benefits that go beyond easier loan approvals. It impacts interest rates, insurance premiums, and even job opportunities. Let’s explore why maintaining a strong credit score is essential and how it can transform your financial life. What Is a High Credit Score? …

Read More »

mortgage.kbk.news

mortgage.kbk.news