Ramram Adminna

March 11, 2025 House Mortgage

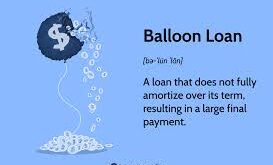

Balloon Payment Mortgages: The Risks and Benefits A balloon payment mortgage is a type of loan where the borrower makes relatively small monthly payments for a set period, followed by a large lump-sum payment at the end of the term. Unlike traditional mortgages, where payments are evenly spread over the life of the loan, a balloon mortgage requires borrowers to …

Read More »

Ramram Adminna

March 11, 2025 House Mortgage

Interest-Only Mortgage Loans: Guide to Using Them Wisely. Interest-only mortgage loans are a type of home loan where borrowers pay only the interest for a set period, usually between 5 and 10 years. During this time, the principal balance remains unchanged. After the interest-only period ends, borrowers must start paying both principal and interest, which results in significantly higher monthly …

Read More »

Ramram Adminna

March 11, 2025 House Mortgage

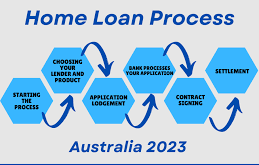

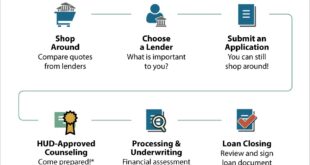

Mortgage Application Process: Guide to Getting Approved. Applying for a mortgage can be an overwhelming process, especially for first-time homebuyers. Understanding the mortgage application process is crucial to securing a loan with the best terms. This guide will walk you through the step-by-step process, requirements, tips, and common FAQs to help you navigate your mortgage journey smoothly. Step 1: Assess …

Read More »

Ramram Adminna

March 10, 2025 House Mortgage

Mortgage Approval Timeline: A Guide to Home Loan Success. Purchasing a home is a significant financial decision, and understanding the mortgage approval timeline is crucial to ensuring a smooth loan process. Mortgage approval involves several stages, from pre-qualification to final approval. Knowing what to expect can help you avoid delays and secure the best mortgage terms. Step 1: Pre-Qualification (1-3 …

Read More »

Ramram Adminna

March 10, 2025 House Mortgage

Mortgage Rate Trends: Market Fluctuations and Future Predictions. Mortgage rate trends are a crucial factor in home financing decisions, influencing the cost of borrowing and affordability. Understanding these trends helps homebuyers, investors, and homeowners make informed choices. In this article, we’ll explore mortgage rate trends, their influencing factors, predictions for the future, and actionable insights to navigate the mortgage market. …

Read More »

Ramram Adminna

March 10, 2025 House Mortgage

Best Mortgage Lenders: Top Choices for Homebuyers in 2025. Buying a home is one of the most significant financial decisions you’ll ever make, and choosing the best mortgage lender can make a huge difference in your homebuying experience. With so many lenders available, it’s essential to find the one that offers the best rates, terms, and services tailored to your …

Read More »

Ramram Adminna

March 10, 2025 House Mortgage

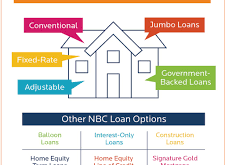

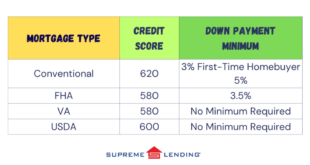

Mortgage Loan Types: Guide to Choosing the Right Home Loan. When purchasing a home, selecting the right mortgage loan is crucial to ensure financial stability and long-term affordability. Mortgage loans come in various types, each catering to different financial situations, goals, and borrower qualifications. This guide explores the most common mortgage loan types, their benefits, drawbacks, and essential factors to …

Read More »

Ramram Adminna

March 9, 2025 House Mortgage

Credit Score Requirements: Everything You Need to Know. Your credit score plays a crucial role in determining your financial opportunities, from loan approvals to credit card applications. Understanding credit score requirements is essential if you want to improve your financial standing. In this article, we will explore everything you need to know about credit score requirements, including their impact on …

Read More »

Ramram Adminna

March 9, 2025 House Mortgage

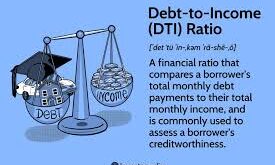

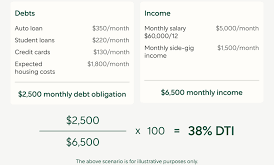

Debt-to-Income Ratio: Calculating and Improving Financial Health. Debt-to-Income Ratio (DTI) is a financial metric that lenders use to evaluate your ability to manage monthly debt payments compared to your gross income. It is an essential factor in determining your creditworthiness for loans, mortgages, and credit approvals. A lower DTI ratio indicates better financial stability and a higher likelihood of securing …

Read More »

Ramram Adminna

March 8, 2025 House Mortgage

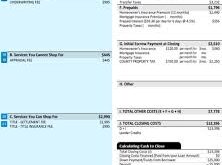

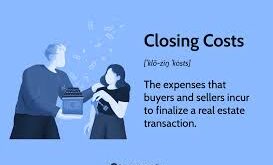

Mortgage Closing Costs: Guide to Fees and How to Save Money. Mortgage closing costs are the fees and expenses borrowers must pay when finalizing a home loan. These costs typically range from 2% to 5% of the loan amount and include various charges from lenders, third-party services, and government fees. Understanding these costs can help borrowers budget effectively and even …

Read More »

Ramram Adminna

March 7, 2025 House Mortgage

Down Payment Assistance: Buying House with Less Money. Buying a home is a significant financial commitment, and one of the biggest hurdles for many potential homeowners is the down payment. Fortunately, down payment assistance programs can help make homeownership more accessible by reducing or covering the initial costs. This comprehensive guide explores various down payment assistance options, eligibility criteria, application …

Read More »

Ramram Adminna

March 7, 2025 House Mortgage

Mortgage Payment Calculator: Estimate Your Monthly Payments. A mortgage payment calculator is an essential tool for homebuyers and homeowners looking to estimate their monthly mortgage payments. It helps in budgeting and financial planning by considering principal, interest, taxes, and insurance (PITI). By using a reliable calculator, you can avoid surprises and ensure affordability before committing to a home loan. How …

Read More »

Ramram Adminna

March 7, 2025 House Mortgage

Reverse Mortgage Information: Everything You Need to Know. A reverse mortgage is an increasingly popular financial tool for homeowners aged 62 and older. It allows them to convert a portion of their home equity into cash while still retaining ownership of their home. This article provides comprehensive reverse mortgage information, explaining how it works, its benefits, drawbacks, and essential considerations …

Read More »

Ramram Adminna

March 7, 2025 House Mortgage

Home Equity Loans: Guide to Borrowing Against Your Home. Home equity loans are a popular way for homeowners to tap into the value of their property to fund major expenses. Whether you need to renovate your home, pay off debts, or cover unexpected expenses, a home equity loan can provide the financial support you need. This guide will explore everything …

Read More »

Ramram Adminna

March 7, 2025 House Mortgage

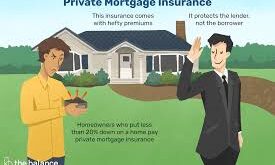

Private Mortgage Insurance: How It Works and Avoid It. Private Mortgage Insurance (PMI) is a type of insurance that protects lenders in case a borrower defaults on their mortgage. It is typically required for homebuyers who make a down payment of less than 20% of the home’s purchase price. While PMI does not benefit the borrower directly, it allows homebuyers …

Read More »

mortgage.kbk.news

mortgage.kbk.news