Ramram Adminna

March 1, 2025 Mortgage Meaning

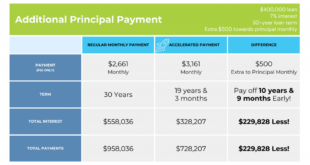

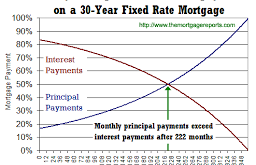

Mortgage Principal Payment: Guide to Paying Off Your Loan Faster. A mortgage principal payment refers to the portion of your monthly mortgage payment that goes directly toward reducing the original loan amount (the principal). The rest of your payment typically covers interest, property taxes, and insurance. Understanding how mortgage principal payments work can help you pay off your loan faster …

Read More »

Ramram Adminna

February 28, 2025 Mortgage Meaning

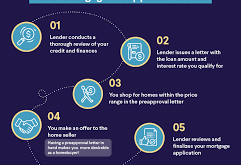

Mortgage Loan Prequalification: Get Prequalified for Home Loan. Buying a home is a significant financial commitment, and understanding the mortgage loan prequalification process is crucial for first-time and repeat buyers alike. Prequalification helps you estimate how much you can afford and demonstrates to sellers that you are a serious buyer. This comprehensive guide will cover everything you need to know …

Read More »

Ramram Adminna

February 28, 2025 Mortgage Meaning

Reverse Mortgage Calculator: How It Works and Learn It. A reverse mortgage calculator is a valuable tool that helps homeowners estimate how much they can borrow against their home equity. Whether you are planning for retirement, need extra cash flow, or want to eliminate monthly mortgage payments, understanding how a reverse mortgage works is essential. In this guide, we will …

Read More »

Ramram Adminna

February 28, 2025 Mortgage Meaning

Mortgage Principal Payment: A Guide to Saving on Your Loan. A mortgage principal payment refers to the portion of your monthly mortgage payment that goes directly toward reducing the original amount borrowed (the principal). This is different from interest payments, which are the fees charged by lenders for borrowing the money. Making extra principal payments can significantly reduce the overall …

Read More »

Ramram Adminna

February 28, 2025 Mortgage Meaning

Mortgage Term Rates: Learning Before Choosing a Loan. Mortgage term rates play a critical role in determining the overall cost of your home loan. Whether you are a first-time homebuyer or refinancing an existing mortgage, understanding mortgage term rates can help you make informed financial decisions. This guide will explain how mortgage term rates work, factors that affect them, and …

Read More »

Ramram Adminna

February 27, 2025 Mortgage Meaning

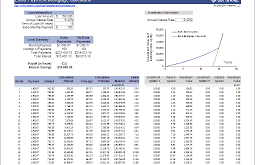

Mortgage Loan Calculator: Estimate Home Loan Payments. A mortgage loan calculator is an essential tool for anyone looking to purchase a home or refinance an existing mortgage. It helps estimate monthly payments, total loan costs, and interest rates, allowing borrowers to make informed financial decisions. This guide will explain how a mortgage loan calculator works, its benefits, key factors that …

Read More »

Ramram Adminna

February 27, 2025 Mortgage Meaning

Mortgage Loan Details: Everything You Need to Know. A mortgage loan is a significant financial commitment that helps individuals and families purchase homes or properties. Understanding the details of a mortgage loan is crucial for making informed decisions and securing the best deal possible. This guide will walk you through everything you need to know about mortgage loans, from types …

Read More »

Ramram Adminna

February 27, 2025 Mortgage Meaning

Home Equity Mortgage: A Guide to Accessing Your Home’s Value. A home equity mortgage allows homeowners to tap into the equity built up in their property, providing access to funds for various financial needs. Whether you’re considering a home renovation, debt consolidation, or an investment opportunity, understanding how a home equity mortgage works is essential. What Is a Home Equity …

Read More »

Ramram Adminna

February 27, 2025 Mortgage Meaning

Mortgage Loan Eligibility: Everything You Need to Know to Qualify. Mortgage loan eligibility refers to the set of criteria that lenders use to determine whether an applicant qualifies for a home loan. These factors include credit score, income level, debt-to-income ratio, employment history, and other financial indicators that demonstrate a borrower’s ability to repay the loan. Understanding these criteria can …

Read More »

Ramram Adminna

February 26, 2025 Mortgage Meaning

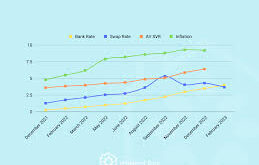

Mortgage Rates Analysis: Understanding Trends and Factors. Mortgage rates play a crucial role in home financing, affecting monthly payments and the overall cost of purchasing a home. Understanding mortgage rate trends, influencing factors, and strategies to secure the best rates can help borrowers make informed decisions. This article provides a detailed analysis of mortgage rates, key influencing factors, and expert …

Read More »

Ramram Adminna

February 26, 2025 Mortgage Meaning

Mortgage Prepayment Penalty: Learn Before Paying Off Loan Early. A mortgage prepayment penalty is a fee charged by lenders when a borrower pays off their home loan earlier than the agreed term. This penalty is designed to compensate lenders for the interest they lose when borrowers repay the loan ahead of schedule. Homeowners may encounter prepayment penalties when refinancing, selling …

Read More »

Ramram Adminna

February 26, 2025 Mortgage Meaning

Mortgage Credit Check: Improving Credit Score for Home Loans. A mortgage credit check is a crucial step in the home loan approval process. Lenders assess your credit history, score, and financial behavior to determine your eligibility for a mortgage. Understanding how credit checks work, their impact on your credit score, and ways to improve your credit standing can help you …

Read More »

Ramram Adminna

February 26, 2025 Mortgage Meaning

Mortgage Lending Meaning: A Guide to Home Financing. Mortgage lending refers to the process of providing loans to borrowers for purchasing real estate, typically homes. These loans, commonly known as mortgages, are secured by the property itself, meaning the lender has the right to seize the property if the borrower fails to make payments. Mortgage lending plays a critical role …

Read More »

Ramram Adminna

February 25, 2025 Mortgage Meaning

Mortgage Loan Officer Meaning: How to Choose the Right One. A mortgage loan officer (MLO) is a licensed professional who helps individuals and businesses obtain mortgage loans. They serve as a bridge between borrowers and lenders, assisting clients in securing the best loan options based on their financial status. Their role includes evaluating creditworthiness, explaining mortgage options, and ensuring compliance …

Read More »

Ramram Adminna

February 25, 2025 Mortgage Meaning

Mortgage Broker Explained: How They Work and Why You Need It. A mortgage broker is a financial professional who acts as an intermediary between borrowers and lenders. They help individuals and businesses find the best mortgage options based on their financial situation. Unlike banks or direct lenders, mortgage brokers work with multiple financial institutions, giving borrowers a broader range of …

Read More »

mortgage.kbk.news

mortgage.kbk.news