Ramram Adminna

February 20, 2025 Mortgage Meaning

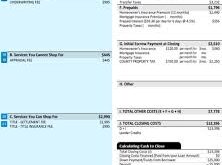

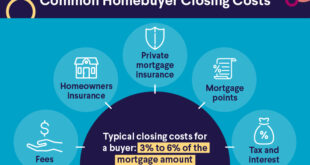

Mortgage Payment Structure: Works and Optimizing Payments. Buying a home is a significant financial commitment, and understanding the mortgage payment structure is crucial to making informed decisions. A mortgage payment consists of several components that impact how much you pay monthly and how quickly you can pay off your loan. This guide will explain the structure of mortgage payments, how …

Read More »

Ramram Adminna

February 20, 2025 Mortgage Meaning

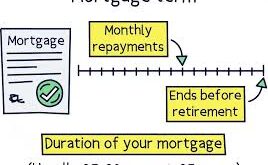

Mortgage Term Length: Best Option for Your Financial Goals. When it comes to buying a home, one of the most critical decisions you’ll face is selecting the right mortgage term length. This choice can significantly impact your monthly payments, total interest costs, and overall financial well-being. Understanding the different mortgage term lengths available and their implications will help you make …

Read More »

Ramram Adminna

February 20, 2025 Mortgage Meaning

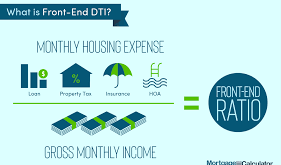

Mortgage Debt Ratio: Calculation and Best Practices. The mortgage debt ratio is a crucial financial metric used by lenders to determine a borrower’s ability to repay a home loan. It compares a borrower’s monthly housing expenses to their gross monthly income. Mortgage lenders use this ratio to assess financial risk and decide loan approval terms. There are two primary types …

Read More »

Ramram Adminna

February 19, 2025 Mortgage Meaning

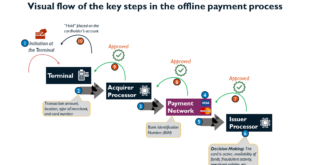

Mortgage Industry Definition: the Key Aspects of Home Financing. The mortgage industry refers to the network of financial institutions, lenders, brokers, and regulatory bodies involved in providing loans for home purchases and refinancing. It plays a crucial role in the real estate market by enabling individuals and businesses to secure funding for property acquisition. The industry comprises mortgage lenders, banks, …

Read More »

Ramram Adminna

February 19, 2025 Mortgage Meaning

Mortgage Documentation Meaning: Guide to Essential Paperwork. Mortgage documentation plays a crucial role in securing a home loan. Understanding the meaning of mortgage documentation and its importance helps borrowers prepare for a smooth mortgage approval process. Whether you are a first-time homebuyer or refinancing your property, knowing what documents are required and why they matter can save time and prevent …

Read More »

Ramram Adminna

February 19, 2025 Mortgage Meaning

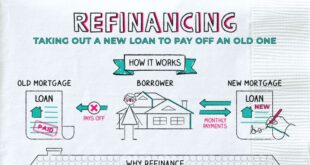

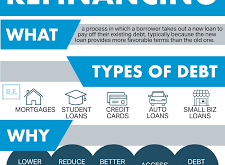

Mortgage Refinancing Options: Saving on Your Home Loan. Mortgage refinancing can be a great financial strategy for homeowners looking to lower their monthly payments, secure a better interest rate, or tap into home equity. Understanding the different mortgage refinancing options available will help you make the best choice for your financial situation. In this guide, we will explore various refinancing …

Read More »

Ramram Adminna

February 19, 2025 Mortgage Meaning

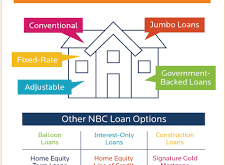

Mortgage Loan Options: Choosing the Best Option for You. When you’re in the market for a home loan, it’s essential to understand the variety of mortgage loan options available to you. Whether you’re a first-time homebuyer or looking to refinance, selecting the right mortgage can significantly impact your financial future. In this article, we’ll explore the different types of mortgage …

Read More »

Ramram Adminna

February 18, 2025 Mortgage Meaning

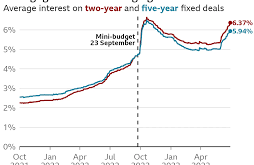

Current Mortgage Rates: What You Need to Know in 2025. In today’s world, staying informed about the current mortgage rates is essential for anyone considering buying a home, refinancing, or making long-term financial plans. The mortgage market is dynamic, with rates fluctuating based on several factors like inflation, the economy, and central bank policies. Understanding how mortgage rates work, and …

Read More »

Ramram Adminna

February 18, 2025 Mortgage Meaning

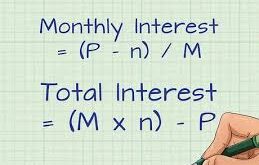

Mortgage Monthly Payments: Guide to Managing Your Payments. Understanding your mortgage monthly payments is a crucial aspect of homeownership. Whether you’re a first-time buyer or refinancing your current mortgage, knowing how your payments are structured can help you manage your finances better. This guide will take you through everything you need to know, from what makes up your mortgage payment …

Read More »

Ramram Adminna

February 18, 2025 Mortgage Meaning

Mortgage Interest Calculator: Save Money on Your Home Loan. When it comes to purchasing a home, one of the most important factors to consider is the mortgage interest rate. Whether you’re a first-time homebuyer or looking to refinance, understanding how much interest you’ll pay over the life of your loan can have a significant impact on your finances. A mortgage …

Read More »

Ramram Adminna

February 18, 2025 Mortgage Meaning

Mortgage Application Meaning: Mortgage Application Process. When you decide to purchase a home, one of the first steps is to understand the mortgage application process. This process is essential for securing financing from a lender, and it can be both exciting and overwhelming. Knowing the meaning of a mortgage application and how it works is crucial to ensuring that you …

Read More »

Ramram Adminna

February 17, 2025 Mortgage Meaning

Interest Rates Mortgage: Everything You Need to Know. Understanding mortgage interest rates is crucial for anyone looking to buy a home. These rates can significantly impact the total cost of a mortgage loan, and being informed can help you make better financial decisions. This article delves into everything you need to know about mortgage interest rates, from how they’re determined …

Read More »

Ramram Adminna

February 17, 2025 Mortgage Meaning

Mortgage for First-Time Buyers: Guide to First Home Purchase. Buying your first home is an exciting and rewarding milestone. However, it comes with its own set of challenges, especially when navigating the mortgage process. Whether you’re looking to settle down or invest in property, understanding how mortgages work can help make the journey smoother and less stressful. In this guide, …

Read More »

Ramram Adminna

February 17, 2025 Mortgage Meaning

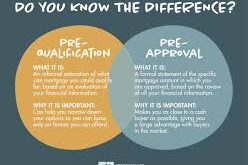

Mortgage Prequalification Meaning: Understanding the Process. The journey to homeownership begins with understanding the mortgage process. One key aspect that can greatly influence your ability to secure a home loan is mortgage prequalification. But what does mortgage prequalification mean, and why is it important? This guide breaks down the concept of mortgage prequalification, its significance, and how it differs from …

Read More »

Ramram Adminna

February 17, 2025 Mortgage Meaning

Mortgage Refinance Meaning: Guide Mortgage Refinancing. Mortgage refinance meaning refers to the process of replacing an existing mortgage with a new loan, often with better terms such as a lower interest rate, reduced monthly payments, or a shorter loan term. Refinancing can also allow homeowners to access equity in their homes for other financial needs. This comprehensive guide will explain …

Read More »

mortgage.kbk.news

mortgage.kbk.news