Ramram Adminna

February 12, 2025 Mortgage Meaning

Mortgage Loan Terms: Need to Know Before Borrowing. When purchasing a home, one of the most important financial decisions you’ll make is securing a mortgage loan. However, understanding mortgage loan terms is crucial to ensuring you get the best deal and avoid costly mistakes. In this guide, we’ll break down essential mortgage loan terms, how they impact your loan, and …

Read More »

Ramram Adminna

February 11, 2025 Mortgage Meaning

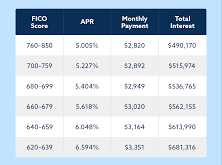

Mortgage Credit Score: How It Works and Ways to Improve It. A mortgage credit score is a numerical representation of a borrower’s creditworthiness, specifically in relation to obtaining a mortgage. Lenders use this score to determine the risk of lending money and to set interest rates. The score is derived from a person’s credit history, outstanding debts, payment history, and …

Read More »

Ramram Adminna

February 11, 2025 Mortgage Meaning

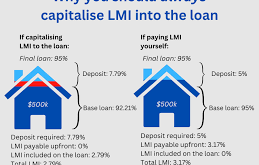

Mortgage Down Payment: Learning Before Buying a Home. Buying a home is one of the most significant financial decisions in life, and one of the key factors in the process is the mortgage down payment. Understanding how much to put down, the benefits of different payment amounts, and available assistance programs can help you make an informed decision. This article …

Read More »

Ramram Adminna

February 11, 2025 Mortgage Meaning

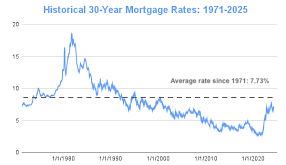

Mortgage Loan Rates: Things You Need to Know Before Applying. Mortgage loan rates play a crucial role in determining the overall cost of purchasing a home. Whether you’re a first-time buyer or refinancing your existing mortgage, understanding how these rates work can help you secure the best deal. In this comprehensive guide, we will cover everything you need to know …

Read More »

Ramram Adminna

February 11, 2025 Mortgage Meaning

Home Loan Mortgage: Guide to Securing Your Dream Home. Purchasing a home is one of the biggest financial decisions you will ever make. A home loan mortgage allows you to buy a home by borrowing funds from a lender and repaying the loan over time. Understanding the mortgage process, different types of loans, and key factors affecting your approval can …

Read More »

Ramram Adminna

February 10, 2025 Mortgage Meaning

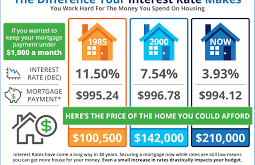

Mortgage Interest Rates: Everything You Need to Know. Mortgage interest rates play a crucial role in determining the affordability of home loans. Whether you are a first-time homebuyer or refinancing your mortgage, understanding interest rates is essential. This article explores mortgage interest rates in depth, including factors that influence them, how they impact borrowers, and tips for securing the best …

Read More »

Ramram Adminna

February 10, 2025 Mortgage Meaning

Mortgage Application Process: A Guide to Getting Approved. Applying for a mortgage can seem overwhelming, but understanding the mortgage application process can make the experience much smoother. Whether you are a first-time homebuyer or refinancing an existing mortgage, following the right steps can improve your chances of approval. This guide will walk you through each stage of the mortgage application …

Read More »

Ramram Adminna

February 10, 2025 Mortgage Meaning

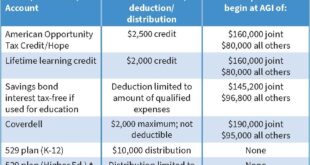

Mortgage Tax Deduction: How to Maximize Your Savings in 2024. Owning a home comes with many financial benefits, one of which is the mortgage tax deduction. This tax break allows homeowners to reduce their taxable income by deducting the interest paid on their mortgage. Understanding how mortgage tax deductions work can help homeowners maximize their savings and reduce their overall …

Read More »

Ramram Adminna

February 10, 2025 Mortgage Meaning

Mortgage Lender Meaning: Their Role in Home Financing. A mortgage lender is a financial institution or individual that provides loans to borrowers for purchasing real estate. These lenders evaluate applicants based on their creditworthiness, financial stability, and ability to repay the loan. Mortgage lenders can be banks, credit unions, mortgage companies, or private lenders. Types of Mortgage Lenders Retail Banks …

Read More »

Ramram Adminna

February 9, 2025 Mortgage Meaning

Mortgage Rate Comparison: Best Rates for Your Home Loan. Choosing the right mortgage rate can significantly impact your financial future. With various lenders offering different rates and terms, comparing mortgage rates is essential for securing the best deal. This guide will provide a comprehensive mortgage rate comparison, tips for finding the lowest rates, and answers to frequently asked questions. What …

Read More »

Ramram Adminna

February 9, 2025 Mortgage Meaning

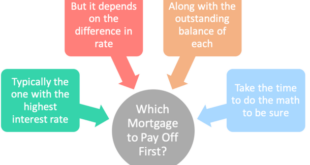

Second Mortgage Definition: How It Works and When to Use It. A second mortgage is an additional loan taken out on a property that already has a primary mortgage. This financial tool allows homeowners to access their home equity for various purposes, such as debt consolidation, home improvements, or emergency expenses. Understanding how second mortgages work, their benefits, risks, and …

Read More »

Ramram Adminna

February 8, 2025 Mortgage Meaning

First Mortgage Meaning: Guide to Your Primary Home Loan. When purchasing a home, one of the most common financing options is a first mortgage. But what exactly does it mean? Understanding the basics of a first mortgage can help homeowners make informed financial decisions. This article provides a detailed explanation of what a first mortgage is, how it works, its …

Read More »

Ramram Adminna

February 8, 2025 Mortgage Meaning

Mortgage Lenders Explained: Everything You Need to Know. Mortgage lenders play a crucial role in helping individuals and businesses secure financing for purchasing homes or properties. They provide the funds needed to buy real estate and structure repayment plans that borrowers must adhere to over a fixed period. Choosing the right mortgage lender is vital, as it can impact your …

Read More »

Ramram Adminna

February 7, 2025 Mortgage Meaning

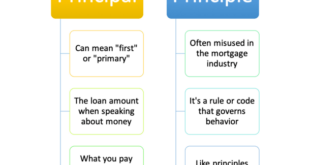

Mortgage Principal Definition: Everything You Need to Know. The mortgage principal is the original amount borrowed from a lender to purchase a home, excluding interest and other fees. It represents the core of your loan balance, which decreases as you make payments over time. Understanding how mortgage principal works can help homeowners manage their loans effectively and save money on …

Read More »

Ramram Adminna

February 7, 2025 Mortgage Meaning

Mortgage Underwriting Process: A Complete Guide to Approval. When applying for a mortgage, the mortgage underwriting process is a crucial step in determining whether your loan will be approved. Underwriting is the lender’s way of assessing risk and ensuring that borrowers can repay their loans. Understanding this process can help you navigate home financing more efficiently and improve your chances …

Read More »

mortgage.kbk.news

mortgage.kbk.news